MasterCard 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

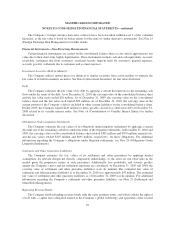

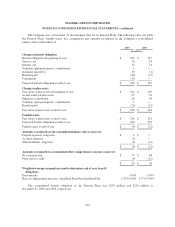

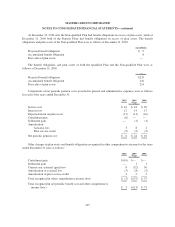

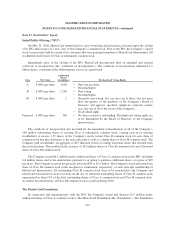

The Company uses a December 31 measurement date for its Pension Plans. The following table sets forth

the Pension Plans’ funded status, key assumptions and amounts recognized in the Company’s consolidated

balance sheet at December 31:

2010 2009

(in millions)

Change in benefit obligation

Benefit obligation at beginning of year $ 235 $ 217

Service cost 16 18

Interest cost 12 14

Voluntary plan participants’ contributions 1 —

Actuarial (gain)/loss 19 (1)

Benefits paid (26) (13)

Curtailment (17) —

Projected benefit obligation at end of year $ 240 $ 235

Change in plan assets

Fair value of plan assets at beginning of year $ 214 $ 149

Actual return on plan assets 27 44

Employer contribution 20 34

Voluntary plan participants’ contributions 1 —

Benefits paid (26) (13)

Fair value of plan assets at end of year $ 236 $ 214

Funded status

Fair value of plan assets at end of year $ 236 $ 214

Projected benefit obligation at end of year 240 235

Funded status at end of year $ (4) $ (21)

Amounts recognized on the consolidated balance sheet consist of:

Prepaid expenses, long term $ 4 $ —

Accrued expenses (5) —

Other liabilities, long term (3) (21)

$ (4) $ (21)

Amounts recognized in accumulated other comprehensive income consist of:

Net actuarial loss $ 37 $ 48

Prior service credit (4) (12)

$33$36

Weighted-average assumptions used to determine end of year benefit

obligations

Discount rate 5.00% 5.50%

Rate of compensation increase—Qualified Plan/Non-Qualified Plan 5.37%/5.00% 5.37%/5.00%

The accumulated benefit obligation of the Pension Plans was $239 million and $216 million at

December 31, 2010 and 2009, respectively.

104