MasterCard 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On August 19, 2010, MasterCard entered into an agreement to acquire all the outstanding shares of

DataCash Group plc, a European payment service provider. Pursuant to the terms of the acquisition agreement,

the Company acquired DataCash on October 22, 2010 at a purchase price of 334 million U.K. pound sterling, or

$534 million.

On December 9, 2010, MasterCard entered into an agreement to acquire Travelex CPM. Pursuant to the

terms of the acquisition agreement, the Company is expected to acquire Travelex CPM at a purchase price of

approximately 290 million U.K. pound sterling, or approximately $458 million, with contingent consideration

(an “earn-out”) of up to an additional 35 million U.K. pound sterling, or approximately $55 million, if certain

performance targets are met. The acquisition is expected to be consummated in the first half of 2011.

In September 2010, the Company’s Board of Directors authorized a plan for the Company to repurchase up

to $1 billion of its Class A common stock in open market transactions. The Company did not repurchase any

shares under this plan during 2010. As of February 16, 2011, the Company had completed the repurchase of

approximately 0.3 million shares of its Class A common stock at a cost of approximately $75 million. The timing

and actual number of shares repurchased will depend on a variety of factors, including legal requirements, price

and economic and market conditions.

We believe that the cash generated from operations, our borrowing capacity and our access to capital

resources are sufficient to meet our future operating capital needs and litigation settlement obligations. Our

liquidity and access to capital could be negatively impacted by the adverse outcome of any of the legal or

regulatory proceedings to which we are still a party. See “Risk Factors-Legal and Regulatory Risks” in Part I,

Item 1A; Note 20 (Obligations Under Litigation Settlements) and Note 22 (Legal and Regulatory Proceedings) to

the consolidated financial statements included in Part II, Item 8; and “—Business Environment” in Part II, Item 7

for additional discussion of these and other risks facing our business.

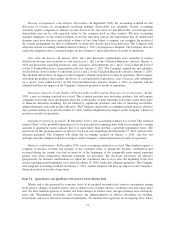

Cash Flow

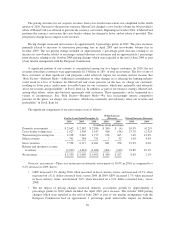

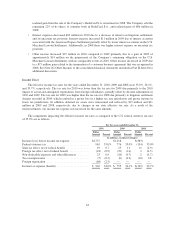

The table below shows a summary of the cash flows from operating, investing and financing activities:

Percent Increase (Decrease)

2010 2009 2008 2010 2009

(in millions, except percentages)

Cash Flow Data:

Net cash provided by operating activities .............. $1,697 $1,378 $ 413 23.1% 233.5%

Net cash (used in) provided by investing activities ....... (641) (664) 202 (3.5)% (429.4)%

Net cash provided by (used in) financing activities ....... 19 (185) (751) 110.9% (75.4)%

Balance Sheet Data:

Current assets .................................... $6,454 $5,003 $4,312 29.0% 16.0%

Current liabilities ................................. 3,143 3,167 2,990 (0.7)% 5.9%

Long-term liabilities ............................... 478 791 1,553 (39.8)% (49.1)%

Equity .......................................... 5,216 3,512 1,932 48.6% 81.8%

Net cash provided by operating activities for the year ended December 31, 2010 was $1.7 billion, compared

to $1.4 billion and $413 million in 2009 and 2008, respectively. In 2010, cash from operations was primarily due

to operating income, an increase in settlements due to customers, and an increase in accrued expenses, partially

offset by litigation settlement payments, an increase in accounts receivable and income taxes receivable and the

effect of stock units withheld for taxes. In 2009, cash from operations was primarily due to operating income,

collections of accounts receivable and income taxes receivable and increases in accrued expenses for personnel

and advertising costs, partially offset by approximately $946 million in litigation settlement payments. In 2008,

cash from operations resulted from an increase of $2.5 billion in litigation settlement obligations, partially offset

by $1.3 billion in payments for litigation settlements and increases in accounts receivable and income taxes

receivable.

65