LensCrafters 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

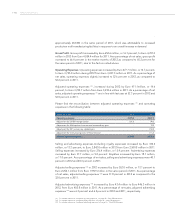

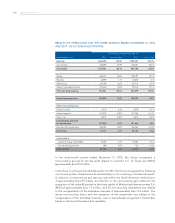

| 7 >MANAGEMENT REPORT

2011. In 2012, adjusted EPS (6) was Euro1.22 and EPS expressed in USD was 1.57 (at an

average exchange rate of Euro/USD of 1.2848).

By carefully controlling working capital, the Group generated positive free cash flow(7) of

Euro720.0 million in 2012 and Euro232.2 million in the fourth quarter of 2012. Net debt as

of December 31, 2012 was Euro1,662 million (Euro2,032 million at the end of 2011), with

the ratio of net debt to adjusted EBITDA (8) of 1.2x, (1.8x as of December 31, 2011).

January

On January 20, 2012, the Group successfully completed the acquisition of share capital

of the Brazilian entity Tecnol - Tecnica Nacional de Oculos Ltda (“Tecnol”). The total

consideration paid was approximately BRL 181.8 million (approximately Euro72.5 million),

of which BRL 143.4 million (approximately Euro57.2 million) was paid in January 2012 and

BRL 38.4 million (approximately Euro15.3 million) was paid in October 2012. Additionally

the Group assumed Tecnol’s net debt amounting to approximately Euro30.3 million.

On January 24, 2012, the Board of Directors of Luxottica Group S.p.A. (hereinafter, also the

“Company”) approved the reorganization of the retail business in Australia. As a result of

the reorganization, the Group closed approximately 10 percent of its Australian and New

Zealand stores, redirecting resources into its market leading OPSM brand.

March

On March 19, 2012, the Company closed an offering in Europe to institutional investors

of Euro500 million of senior unsecured guaranteed notes due on March 19, 2019. The

notes are listed on the Luxembourg Stock Exchange under ISIN XS0758640279. Interest

on the Notes accrues at 3.625 percent per annum. The Notes are guaranteed on a senior

unsecured basis by Luxottica U.S. Holdings Corp. (“US Holdings”) and Luxottica S.r.l., both

of which are wholly owned subsidiaries. On March 19, 2012, the notes were assigned a

BBB+ credit rating by Standard & Poor’s.

April

At the Stockholders’ Meeting on April 27, 2012, the stockholders approved the Statutory Financial

Statements as of December 31, 2011, as proposed by the Board of Directors and the distribution

of a cash dividend of Euro0.49 per ordinary share, reflecting a year-over-year increase of 11.4

percent. The aggregate dividend of Euro227.0 million was fully paid in May 2012.

May

On May 17, 2012, the Company entered into an agreement pursuant to which it acquired

over 125 Sun Planet stores in Spain and Portugal. In 2011 Luxottica Group acquired

from the same seller Sun Planet stores in South America, that were part of Multiopticas

International. In 2011, net sales of the Spanish and Portuguese chain totaled approximately

Euro22.0 million. The acquisition was completed on July 31, 2012. The consideration paid

was approximately Euro23.8 million.

(6) For a further discussion of adjusted EPS, see page 43 - “Non-IFRS Measures”.

(7) For a further discussion of free cash ow, see page 43 - “Non-IFRS Measures”.

(8) For a further discussion of net debt to adjusted EBITDA, see page 43 - “Non-IFRS Measures”.

2. SIGNIFICANT

EVENTS DURING

2012