LensCrafters 2012 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

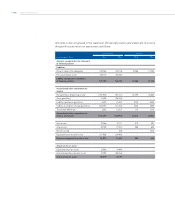

| 151 >CONSOLIDATED FINANCIAL STATEMENTS - NOTES

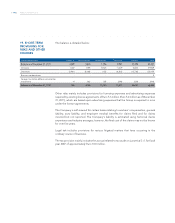

The table below summarizes the main terms of the Group’s long-term debt.

Type

(thousands of Euro) Series Issuer/Borrower Issue date CCY Amount

Outstanding

amount at

the reporting

date

Coupon/

Pricing

Interest rate as

of December

31, 2012 Maturity

Multicurrency Euro/USD

Revolving Credit Facility Tranche C Luxottica Group S.p.A./

Luxottica US Holdings

03.06.2004 Euro 725,000,000 - Euribor

+ 0.20%/0.40%

- 17.04.2012

Oakley Term Loan 2007 Tranche E Luxottica Group S.p.A. 14.11.2007 USD 500,000,000 - Libor

+ 0.20%/0.40%

- 15.10.2012

USD Term loan 2004 Tranche B Luxottica US Holdings 03.06.2004 USD 325,000,000 60,411,904 Libor

+ 0.20%/0.40%

0.410% 03.03.2013

Revolving Credit Facility Intesa 250 Luxottica Group S.p.A. 29.05.2008 Euro 250,000,000 70,000,000 Euribor

+ 0.40%/0.60%

0.589% 29.05.2013

Private Placement A Luxottica US Holdings 01.07.2008 USD 20,000,000 20,000,000 5.960% 5.960% 01.07.2013

Oakley Term Loan 2007 Tranche D Luxottica US Holdings 14.11.2007 USD 1,000,000,000 230,919,721 Libor

+ 0.20%/0.40%

0.457% 12.10.2013

Term Luxottica Group S.p.A. 11.11.2009 Euro 300,000,000 300,000,000 Euribor

+ 1.00%/2.75%

1.110% 30.11.2014

Private Placement B Luxottica US Holdings 01.07.2008 USD 127,000,000 127,000,000 6.420% 6.420% 01.07.2015

Bond (Listed on Luxembourg

Stock Exchange/no covenants)

Luxottica Group S.p.A. 10.11.2010 Euro 500,000,000 500,000,000 4.000% 4.000% 10.11.2015

Private Placement D Luxottica US Holdings 29.01.2010 USD 50,000,000 50,000,000 5.190% 5.190% 29.01.2017

Revolving Credit Facility 2012 Luxottica Group S.p.A. 17.04.2012 Euro 500,000,000 - Euribor

+ 1.30%/2.25%

- 10.04.2017

Private Placement G Luxottica Group S.p.A. 30.09.2010 Euro 50,000,000 50,000,000 3.750% 3.750% 15.09.2017

Private Placement C Luxottica US Holdings 01.07.2008 USD 128,000,000 128,000,000 6.770% 6.770% 01.07.2018

Private Placement F Luxottica US Holdings 29.01.2010 USD 75,000,000 75,000,000 5.390% 5.390% 29.01.2019

Bond (Listed on Luxembourg

Stock Exchange/no covenants) Luxottica Group S.p.A. 19.03.2012 Euro 500,000,000 500,000,000 3.625% 3.625% 19.03.2019

Private Placement E Luxottica US Holdings 29.01.2010 USD 50,000,000 50,000,000 5.750% 5.750% 29.01.2020

Private Placement H Luxottica Group S.p.A. 30.09.2010 Euro 50,000,000 50,000,000 4.250% 4.250% 15.09.2020

Private Placement I Luxottica US Holdings 15.12.2011 USD 350,000,000 350,000,000 4.350% 4.350% 15.12.2021

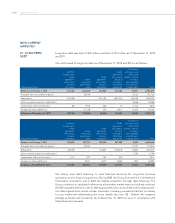

The floating rate measures under “Coupon/Pricing” are based on the corresponding

EURIBOR (LIBOR for USD) plus a margin in the range, indicated in the table, based on the

“Net Debt/EBITDA” ratio, as defined in the applicable debt agreement.

The USD Term Loan 2004 - Tranche B, Oakley Term Loan 2007 Tranche D and Tranche E

and Revolving Credit Facility Intesa 250 were hedged by interest rate swap agreements

with various banks. The Tranche B swaps expired on March 10, 2012 and the Tranche D

and E swaps expired on October 12, 2012.

As of December 31, 2012 there are still eight interest rate swap transactions with an

aggregate initial notional amount of Euro250 million with various banks “Intesa Swaps”.

The “Intesa Swaps” will decrease in notional amount on a quarterly basis, following the

amortization schedule of the underlying facility. The Intesa Swaps will expire on May 29,

2013. The “Intesa Swaps” were entered as a cash flow hedge on the Intesa Sanpaolo S.p.A.