LensCrafters 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

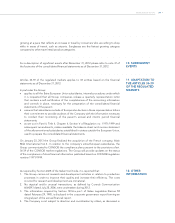

| 47 >MANAGEMENT REPORT - APPENDIX

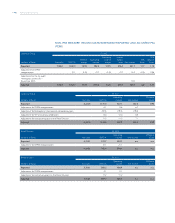

NON-IFRS MEASURE: EBITDA AND EBITDA MARGIN

(millions of Euro) 4Q 2011 4Q 2012 FY 2011 FY 2012

Net income/(loss) (+) 64.4 76.8 452.3 541.7

Net income attributable to non-controlling interest (+) 0.7 0.5 6.0 4.2

Provision for income taxes (+) 36.8 56.0 237.0 310.5

Other (income)/expense (+) 26.5 30.7 111.9 125.7

Depreciation & amortization (+) 94.4 94.4 323.9 358.3

EBITDA (=) 222.8 258.4 1,131.0 1,340.3

Net sales (/) 1,509.0 1,632.3 6,222.5 7,086.1

EBITDA margin (=) 14.8% 15.8% 18.2% 18.9%

NON-IFRS MEASURE: ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

(millions of Euro) 4Q 2011 (1) 4Q 2012 (2) FY 2011 (3) FY 2012 (2) (4)

Adjusted net income/(loss) (+) 72.7 86.8 455.6 566.9

Net income attributable to non-controlling interest (+) 0.7 0.5 6.0 4.2

Adjusted provision for income taxes (+) 39.3 46.0 247.4 307.0

Other (income)/expense (+) 26.5 30.7 111.9 125.7

Adjusted depreciation & amortization (+) 85.5 94.4 315.0 358.3

Adjusted EBITDA (=) 224.7 258.4 1,135.9 1,362.0

Net sales (/) 1,509.0 1,632.3 6,222.5 7,086.1

Adjusted EBITDA margin (=) 14.9% 15.8% 18.3% 19.2%

(1) The adjusted gures exclude the following:

(a) an extraordinary gain of approximately Euro1.9 million related to the acquisition of the initial 40 percent stake in Multiopticas Internacional;

(b) non-recurring restructuring and start-up costs of approximately Euro0.9 million in the Retail distribution segment; and

(c) non-recurring impairment loss related to the reorganization of the Australian business of approximately Euro9.6 million.

(2) A non-recurring accrual for tax audit relating to Luxottica S.r.l. (scal Year 2007) of approximately Euro10 million.

(3) The adjusted gures exclude the following measures:

(a) an extraordinary gain of approximately Euro19 million related to the acquisition, in 2009, of a 40 percent stake in Multiopticas Internacional;

(b) non-recurring costs related to Luxottica’s 50th anniversary celebrations of approximately Euro12 million, including the adjustment relating

to the grant of treasury shares to Group employees;

(c) non-recurring restructuring and start-up costs in the Retail Division of approximately Euro11 million; and

(d) non-recurring OPSM reorganization costs of approximately Euro9.6 million.

(4) Non-recurring OPSM reorganization costs with approximately Euro21.7 million impact on operating income and an approximately Euro15.2

million adjustment on net income.

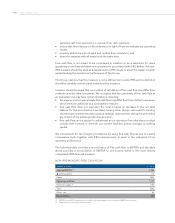

FREE CASH FLOW

Free cash flow represents net income before non controlling interests, taxes, other income/

expense, depreciation and amortization (i.e., EBITDA) plus or minus the decrease/(increase)

in working capital over the prior period, less capital expenditures, plus or minus interest

income/(expense) and extraordinary items, minus taxes paid. We believe that free cash

flow is useful to both management and investors in evaluating our operating performance

compared with other companies in our industry. In particular, our calculation of free cash

flow provides a clearer picture of our ability to generate net cash from operations, which

is used for mandatory debt service requirements, to fund discretionary investments, pay

dividends or pursue other strategic opportunities.

Free cash flow is not a measure of performance under IFRS. We include it in this

Management Report in order to:

• improve transparency for investors;

• assist investors in their assessment of our operating performance and our ability to