LensCrafters 2012 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

ANNUAL REPORT 2012> 152 |

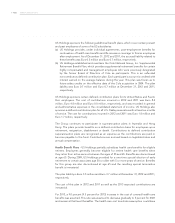

credit facility discussed above. The Intesa Swaps exchange the floating rate of EURIBOR

(as defined in the agreement) for an average fixed rate of 2.25 percent per annum. The

ineffectiveness of cash flow hedges is tested at the inception date and at least every three

months. The results of the Company’s ineffectiveness testing indicated that these the cash

flow hedges are highly effective. As a consequence, approximately Euro(0.5) million, net

of taxes, is included in other comprehensive income as of December 31, 2012. On May 29,

2013 the Intesa Swaps will expire.

On March 19, 2012, the Group closed an offering in Europe to institutional investors of

Euro500 million of senior unsecured guaranteed notes due March 19, 2019. The Notes

are listed on the Luxembourg Stock Exchange under ISIN XS0758640279 with a BBB+

credit rating by Standard & Poor’s. Interest on the Notes accrues at 3.625 percent per

annum. The Notes are guaranteed on a senior unsecured basis by US Holdings and

Luxottica S.r.l.

On April 17, 2012, the Group and US Holdings, entered into a multicurrency (Euro/USD)

revolving credit facility with a group of a banks providing for loans in the aggregate

principal amount of Euro500 million (or the equivalent in USD) guaranteed by Luxottica

Group, Luxottica S.r.l. and US Holdings with UniCredit AG Milan Branch as agent, with

Bank of America Securities Limited, Citigroup Global Markets Limited, Crédit Agricole

Corporate and Investment Bank - Milan Branch, Banco Santander S.A., The Royal Bank of

Scotland PLC and UniCredit S.p.A. as lenders. The facility, whose maturity date is April 10,

2017, was not used as of December 31, 2012.

During 2012, in addition to scheduled repayments, the Group repaid in advance Euro500

million of Tranche E, USD 225 million of Tranche B and USD 169 million of Tranche D.

The fair value of long-term debt as of December 31, 2012 was equal to Euro2,483.5 million

(Euro2,804.7 as of December 31, 2011). The fair value of the debt equals the present value

of future cash flows, calculated by utilizing the market rate currently available for similar

debt and adjusted in order to take into account the Group’s current credit rating.

On December 31, 2012 the Group has unused uncommitted lines (revolving) of Euro 500

million.

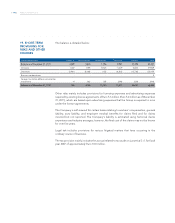

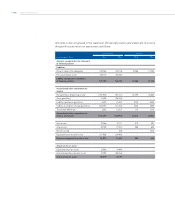

Long-term debt, including capital lease obligations, as of December 31, 2012 matures as

follows:

Years ended December 31 (thousands of Euro)

2013 316,538

2014 300,000

2015 637,456

2016 -

2017 and subsequent years 1,098,230

Effect deriving from the adoption of the amortized cost method 9,954

Total 2,362,178