LensCrafters 2012 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

| 127 >CONSOLIDATED FINANCIAL STATEMENTS - NOTES

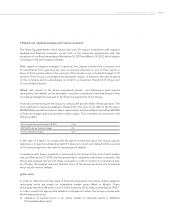

f) Default risk: negative pledges and financial covenants

The financing agreements of the Group (see note 21) require compliance with negative

pledges and financial covenants, as set forth in the respective agreements, with the

exception of our Bond issues dated November 10, 2010 and March 19, 2012, which require

compliance only with negative pledges.

With regard to negative pledges, in general, the clauses prohibit the Company and

its subsidiaries from granting any liens or security interests on any of their assets in

favor of third parties without the consent of the lenders over a threshold equal to 30

percent of the Group consolidated stockholders’ equity. In addition, the sale of assets

of the Company and its subsidiaries is limited to a maximum threshold of 30 percent

of consolidated assets.

Default with respect to the above mentioned clauses - and following a grace period

during which the default can be remedied - would be considered a material breach of the

contractual obligations pursuant to the financing agreement of the Group.

Financial covenants require the Group to comply with specific levels of financial ratios. The

most significant covenants establish a threshold for the ratio of net debt of the Group to

EBITDA (Earnings before interest, taxes, depreciation and amortization) as well as EBITDA

to financial charges and priority debt to share equity. The covenants are reported in the

following table:

Net Financial Position/Pro forma EBITDA <3.5 x

EBITDA/Pro forma financial charges >5 x

Priority Debt/Share Equity <20 x

In the case of a failure to comply with the above mentioned ratios, the Group may be

called upon to pay the outstanding debt if it does not correct such default within a period

of 15 business days from the date of reporting such default.

Compliance with these covenants is monitored by the Group at the end of each quarter

and, as of December 31, 2012, the Group was fully in compliance with these covenants. The

Group also analyzes the trend of these covenants in order to monitor its compliance and,

as of today, the analysis indicates that the ratios of the Group are below the thresholds

which would result in default.

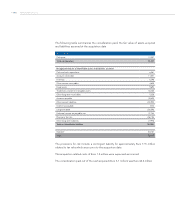

g) Fair value

In order to determine the fair value of financial instruments, the Group utilizes valuation

techniques which are based on observable market prices (Mark to Model). These

techniques therefore fall within Level 2 of the hierarchy of Fair Values identified by IFRS 7.

In order to select the appropriate valuation techniques to utilize, the Group complies with

the following hierarchy:

a) utilization of quoted prices in an active market for identical assets or liabilities

(Comparable Approach);