LensCrafters 2012 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

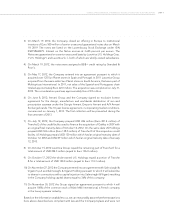

| 187 >CONSOLIDATED FINANCIAL STATEMENTS - BOARD OF STATUTORY AUDITORS REPORT

3) On March 19, 2012, the Company closed an offering in Europe to institutional

investors of Euro 500 million of senior unsecured guaranteed notes due on March

19, 2019. The notes are listed on the Luxembourg Stock Exchange under ISIN

XS0758640279. Interest on the Notes accrues at 3.625 percent per annum. The

Notes are guaranteed on a senior unsecured basis by Luxottica U.S. Holdings Corp.

(“U.S. Holdings”) and Luxottica S.r.l., both of which are wholly owned subsidiaries.

4) On March 19, 2012, the notes were assigned a BBB+ credit rating by Standard &

Poor’s.

5) On May 17, 2012, the Company entered into an agreement pursuant to which it

acquired over 125 Sun Planet stores in Spain and Portugal. In 2011 Luxottica Group

acquired from the same seller Sun Planet stores in South America, that were part of

Multiopticas International. In 2011, net sales of the Spanish and Portuguese chain

totaled approximately Euro 22.0 million. The acquisition was completed on July 31,

2012. The consideration paid was approximately Euro 23.8 million.

6) On June 8, 2012, Armani Group and the Company signed an exclusive license

agreement for the design, manufacture and worldwide distribution of sun and

prescription eyewear under the Giorgio Armani, Emporio Armani and A/X Armani

Exchange brands. The 10-year license agreement, incorporating market conditions,

commenced on January 1, 2013. The first collection will be presented during the

first semester of 2013.

7) On July 12, 2012, the Company prepaid USD 246 million (Euro 201.4 million) of

Tranche E of the credit facility used to finance the acquisition of Oakley in 2007 with

an original final maturity date of October 12, 2012. On the same date US Holdings

prepaid USD 169 million (Euro 138.5 million) of Tranche D of this acquisition credit

facility. US Holdings prepaid USD 130 million which had an original maturity date of

October 12, 2012 and USD 39 million which had an original maturity date of January

12, 2013.

8) On October 15, 2012 Luxottica Group repaid the remaining part of Tranche E for a

total amount of USD 254.3 million (equal to Euro 196.0 million).

9) On October 17, 2012 the whole-owned U.S. Holdings repaid a portion of Tranche

B for a total amount of USD 150.0 million (equal to Euro 114.3 million).

10) On November 27, 2012 the Company entered into an agreement with Salmoiraghi &

Viganò S.p.A and Salmoiraghi & Viganò Holding pursuant to which it will subscribe

to shares in connections with a capital injection into Salmoiraghi & Viganò resulting

in the Company holding capital shares equal to 36% of this company.

11) On November 30, 2012 the Group signed an agreement pursuant to which it will

acquire 100% of the common stock of Alain Mikli International, a French company

in the luxury eyewear industry.

Based on the information available to us, we can reasonably assure that the transactions

here above described are compliant with law and the Company bylaws and were not