LensCrafters 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

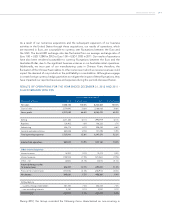

| 17 >MANAGEMENT REPORT

The income from operations, EBITDA and net income attributable to the Luxottica Group

stockholders adjusted to exclude the above non-recurring items would be as follow:

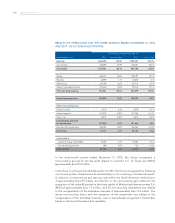

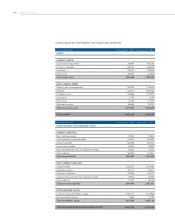

ADJUSTED MEASURES (19)

(thousands of Euro) 4Q 2012 % of net sales 4Q 2011 % of net sales % change

Adjusted income from operations 164,020 10.0% 139,259 9.2% 17.8%

Adjusted EBITDA 258,445 15.8% 224,747 14.9% 15.0%

Adjusted net income attributable to Luxottica Group

Stockholders 86,762 5.3% 72,701 4.8% 19.3%

Net Sales. Net sales increased by 8.2 percent, to Euro1,632.3 million in the three-month

period ended December 31, 2012 from Euro1,509.0 million in the same period of 2011.

Euro 55.1 million of the Euro 123.3 increase was attributable to the increased sales in

the manufacturing and wholesale distribution segment in the three-month period ended

December 31, 2012 as compared to the same period in 2011 and to the increased sales in

the retail distribution segment of Euro68.1 million for the same period.

Net sales for the retail distribution segment increased by Euro68.1 million, or 7.2 percent,

to Euro 1,021.0 million in the three-month period ended December 31, 2012 from

Euro952.9 million in the same period in 2011. The segment experienced a 4.5 percent

improvement in comparable store sales (20). In particular, there was a 3.9 percent increase in

comparable store sales for the North American retail operations, and 7.2 percent increase

for the Australian/New Zealand retail operations. In addition, there was a positive net

sales impact of Euro42.0 million due to effects from currency fluctuations between the

Euro(which is our reporting currency) and other currencies in which we conduct business,

in particular the strengthening of the U.S. Dollar and Australian Dollar.

Net sales to third parties in the manufacturing and wholesale distribution segment

increased by Euro55.1 million, or 9.9 percent, to Euro611.3 million in the three-month

period ended December 31, 2012 from Euro 556.2 million in the same period in 2011.

This increase was mainly attributable to increased sales of most of our house brands, in

particular Ray-Ban and Oakley, led by the increase in optical sales, Persol and of some

designer brands such as Prada, Tiffany, Burberry, Ralph Lauren and the Coach line

launched in January 2012. Such increase was recorded in most of the Group’s markets. In

addition, there was a positive net sales impact of Euro5.0 million due to positive currency

fluctuations, in particular a strengthening of the U.S. Dollar and other minor currencies,

including but not limited to the Australian Dollar and the Turkish Lira, partially offset by

weakening of Brazilian Real.

During the three-month period ended December 31, 2012, net sales in the retail distribution

segment accounted for approximately 62.5 percent of total net sales, as compared to

approximately 63.1 percent of total net sales for the same period in 2011.

(19) Adjusted measures are not in accordance with IFRS. For a further discussion of adjusted measures, see page 43 - “Non-IFRS Measures”.

(20) Comparable store sales reects the change in sales from one period to another that, for comparison purposes, includes in the calculation only

stores open in the more recent period that also were open during the comparable prior period in the same geographic area, and applies to

both periods the average exchange rate for the prior period.