LensCrafters 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

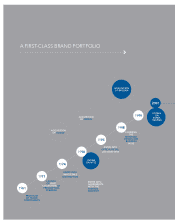

20 ANNUAL REVIEW 2012

chains. As a result, Luxottica became the world’s first significant eyewear manufacturer to

enter the retail market, thereby maximizing synergies with its production and wholesale

distribution and increasing penetration of its products through LensCrafters stores.

Since 2000, Luxottica has strengthened its retail business by acquiring a number of chains,

including Sunglass Hut (2001), a leading retailer of premium sunglasses, OPSM Group

(2003), a leading optical retailer in Australia and New Zealand and Cole National (2004),

which brought with it another important optical retail chain in North America, Pearle

Vision, and an extensive retail licensed brands store business (Target Optical and Sears

Optical). In 2005, the Company began its retail expansion into China, where LensCrafters

has become a leading brand in the country’s high-end market. In the same year, the Group

also started to expand Sunglass Hut globally in high-potential markets like the Middle East,

South Africa, Thailand, India, the Philippines, Mexico, Brazil and Mediterranean Europe.

In 2011, Luxottica started its optical retail expansion in Latin America by completing the

acquisition of Multiopticas Internacional, a leading retailer in Chile, Peru, Ecuador and

Colombia operating under the Opticas GMO, Econópticas and Sun Planet retail brands.

Building strong brands that create enduring relationships with consumers is key to how

Luxottica plans to sustain its business in the future. The Company has an existing strong and

well-balanced brand portfolio that includes a number of proprietary and licensed brands

and that is continually evolving. Its composition is gradually modified by the acquisition of

new brands, the addition of new licensing agreements and the renewal of existing ones

along with the withdrawal of brands no longer deemed strategic. These actions are taken

in order to continually attract a wide range of consumers with different tastes and lifestyles.

Furthermore, Luxottica’s long-term objectives remain consistent:

Luxottica is committed to staying current with changing lifestyles and emerging fashion

trends, which it interprets in the design and style of products to address the needs and

tastes of consumers. Emphasis on product design and the continuous development of

new styles is the Group’s distinctive feature.

The Company differentiates its products not only through innovation in style and design

but also through a commitment to technological innovation.

BRAND PORTFOLIO

MANAGEMENT

to focus on leading brands, balance proprietary

and licensed brands, avoid brand dilution, lengthen

the average term of licensing agreements

and fuel Asian friendly styles.

DESIGN AND

TECHNOLOGICAL

INNOVATION