LensCrafters 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual

Review

2012

Table of contents

-

Page 1

Annual Review 2012 -

Page 2

-

Page 3

A N N UA L R EV I EW 2 012 -

Page 4

-

Page 5

3 -

Page 6

All pictures in this Annual Review are from OneSight and are portraits of some of the thousands of people worldwide who received free eyecare from the nonprofit organization in 2012. Further information on OneSight can be found on www.onesight.org. -

Page 7

Index LETTER TO SHAREHOLDERS 1 2 FINANCIAL HIGHLIGHTS LUXOTTICA GROUP 2.1 Proï¬le 2.2 Mission and strategy 2.3 History 2.4 From design to logistics 2.5 Brand portfolio 2.6 Distribution 2.7 OneSight A LONG WAY TO GROW GROUP TRENDS IN 2012 HUMAN RESOURCES OTHER INFORMATION 7 8 11 13 17 23 27 35 43 ... -

Page 8

-

Page 9

... an excellent position to make the most of these opportunities, utilizing our vertically integrated business model and sound profitability. In 2012, we continued our investments in further expanding our retail division, enriching our portfolio with new brands, increasing our production capacity and... -

Page 10

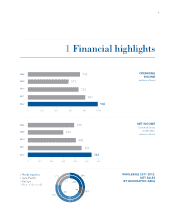

...000 3,000 4,000 5,000 6,000 7,000 8,000 2010 2011 2012 GRoSS pRofiT (millions of Euro) 2008 2009 3,453 3,332 3,808 4,054 4,707 0 1,000 2,000 3,000 4,000 5,000 2010 2011 2012 3% 4% RETAiL 2011-2012: NET SALES by GEoGRAphic AREA > North America > Asia-Paciï¬c > Europe > Rest of the world... -

Page 11

9 1 Financial highlights 2008 2009 732 571 712 807 982 0 200 400 600 800 1,000 opERATiNG iNcoME (millions of Euro) 2010 2011 2012 2008 2009 390 299 402 452 542 0 100 200 300 400 500 600 NET iNcoME (Luxottica Group stockholders, millions of Euro) 2010 2011 2012 > North America > Asia-... -

Page 12

-

Page 13

11 2 Luxottica Group 2.1 2.2 2.3 2.4 2.5 2.6 2.7 Proï¬le Mission and strategy History From design to logistics Brand portfolio Distribution OneSight 13 17 23 27 35 43 55 -

Page 14

-

Page 15

... in India serving the local market. In 2012, the Group's worldwide production reached approximately 75 million units. The design and quality of Luxottica's products and strong and well-balanced brand portfolio are known around the world. Proprietary brands include Ray-Ban, one of the world's best... -

Page 16

-

Page 17

... the GMO brand. In North America, Luxottica operates points of sale for its retail licensed brands under the Sears Optical and Target Optical brands. In addition, Luxottica is one of the largest managed vision care operators in the United States, through EyeMed, and the second largest lens finisher... -

Page 18

-

Page 19

... and strategy VERTICAL INTEGRATION BRAND PORTFOLIO MANAGEMENT DESIGN AND TECHNOLOGICAL INNOVATION MARKET EXPANSION FINANCIAL DISCIPLINE LUXOTTICANS Being a global leader in the design, manufacture and distribution of sun and prescription eyewear of high technical and stylistic quality, Luxottica... -

Page 20

18 ANNUAL REVIEW 2012 but not standardized, being specially tailored to specific local needs and fashion tastes. The Company's long-term strategy is to continue to expand in the eyewear and eyecare sector by growing its various businesses, whether through acquisitions or organically, primarily by ... -

Page 21

...2006), Polo Ralph Lauren (2007), Tiffany (2008), Stella McCartney (2009), Tory Burch (2009), Coach (2012) and Armani (2013). In addition, Luxottica acquired Ray-Ban in 1999, one of the world's best-known sunglasses brands. Through this acquisition, the Company obtained crystal sun lens technology as... -

Page 22

... of its products through LensCrafters stores. Since 2000, Luxottica has strengthened its retail business by acquiring a number of chains, including Sunglass Hut (2001), a leading retailer of premium sunglasses, OPSM Group (2003), a leading optical retailer in Australia and New Zealand and Cole... -

Page 23

...term growth strategy. Market expansion is also sought through increasing retail distribution while consolidating Luxottica's wholesale network. The Company has a strong focus on operating profitability and cash generation to deliver sustainable growth. Close monitoring of working capital management... -

Page 24

-

Page 25

23 2.3 History OVER yEARS OF ExCELLENCE 50 -

Page 26

... pERSoL 1999 AcQuiSiTioN of VoGuE 1998 ENTERiNG ThE MANAGEd ViSioN cARE buSiNESS iN uS 1995 1990 LiSTiNG oN NySE ENTRy iNTo opTicAL RETAiL: LENScRAfTERS 1974 ENTRy iNTo WhoLESALE diSTRibuTioN 1971 1961 pRoducER of fRAME coMpoNENTS LAuNch of fiRST coLLEcTioN of pREScRipTioN EyEWEAR ENTER iNTo... -

Page 27

... 2003 2001 ENTRy iNTo SuN RETAiL: SuNGLASS huT opSM LEAdiNG RETAiLER iN AuSTRALiA ANd NEW ZEALANd STARTiNG RETAiL ExpANSioN iN chiNA fiRST STEp iNTo RETAiL iN LATiN AMERicA STRENGThENiNG LATiN AMERicA RETAiL coLE NATioNAL STRoNGER pRESENcE iN uS RETAiL MARkET VERTICALLy INTEGRATED BUSINESS MODEL -

Page 28

-

Page 29

... the demand for current models, as well as general style trends in eyewear. The information obtained from the marketing and sales departments is used by designers to refine existing product designs and by marketing and sales departments to develop market positioning strategies in order to react to... -

Page 30

-

Page 31

... designs and assembles the equipment needed to make the components for the new model. The first specimens obtained are assembled and undergo a series of tests required by internal quality control procedures. The next steps in the process involve the production and quality certification of sales... -

Page 32

... Vogue prescription collection for this market. In 2013, the Company plans to add the production of select Ray-Ban, Arnette and Oakley collections. Luxottica also operates a small plant in India serving the local market. In 2012, the Group's manufacturing facilities produced a combined total of... -

Page 33

... quality improvement, Luxottica has three main labs, one in each of Italy, China and the United States. Each lab is responsible for establishing and maintaining the quality standards in the region where it is located and supports activities in engineering, production and market feedback management... -

Page 34

32 ANNUAL REVIEW 2012 introduces new requirements. As a result of the effectiveness of the quality control program, the return rate for defective merchandise manufactured by Luxottica has remained stable at approximately 1% in 2012. LoGiSTicS The Group's distribution system is globally ... -

Page 35

... internet, and works actively to remove counterfeit eyewear from certain popular on-line auction platforms and shut down the websites that violate its intellectual property rights, through the sale of counterfeit products or the unauthorized use of Luxottica's trademarks. ANTi-couNTERfEiTiNG poLicy -

Page 36

-

Page 37

... and A/x Armani Exchange brands. The first Armani collections were launched during the first quarter of 2013 and are distributed through Armani stores worldwide, independent optical locations, select department stores as well as through select travel retail locations and Luxottica's retail chains. -

Page 38

...ANNUAL REVIEW 2012 pRopRiETARy bRANdS In 2012, proprietary brands accounted for approximately 70% of total sales of frames. Ray-Ban and Oakley, the two biggest eyewear brands in Luxottica's portfolio, accounted for approximately 23.1% and 11.7%, respectively, of the Group's 2012 net sales. RAy-bAN... -

Page 39

...to a culture of excellence and craftsmanship, a perfect alchemy of aesthetics and technology. The irresistible appeal of timeless design and high quality makes the brand a favorite among celebrities. oLiVER pEopLES Acquired by Luxottica in 2007, Oliver Peoples began in 1987 with the introduction of... -

Page 40

... related collection and a mandatory marketing contribution of between 5% and 10% of sales. bRookS bRoThERS Prada and Dolce & Gabbana are two significant licenses in Luxottica's portfolio as measured by total sales. In 2012, sales realized through the Prada, Prada Linea Rossa and Miu Miu brand names... -

Page 41

... of fine accessories and gifts for women and men. Under license since 2012, the Coach eyewear collection perfectly expresses the signature look and distinctive identity of the Coach brand. REEd kRAkoff In 2010, Coach launched the Reed Krakoff brand, with stores opened in New york, Tokyo and Las... -

Page 42

... fashion designers. Ralph Lauren Group Under license since 2007, the Ralph Lauren Group includes the following collections. RALph LAuREN puRpLE LAbEL The Ralph Lauren Purple Label eyewear collection is the ultimate expression of modern elegance, reflecting an impeccable sense of high quality... -

Page 43

...style and has a dedicated advertising campaign. Miu Miu The eyewear collection was launched with brand new luxury positioning in 2011 to align it with the brand's other product categories. Miu Miu is Miuccia Prada's other soul: a brand with a very strong and autonomous identity, characterized by an... -

Page 44

-

Page 45

... strengthen its distribution platform going forward. Luxottica's efficient distribution network makes it possible to maintain close contact with customers while maximizing the visibility of the Group's brand portfolio. In addition, the Group's experience in the retail business has given it a unique... -

Page 46

... United Kingdom 39% 61% RETAiL 6,960 stores (of which 543 in franchising) NoRTh AMERicA prescription Lenscrafters pearle Vision (of which 356 are franchises) Sears Optical Target Optical prescription/Sun Oliver peoples (of which 1 is franchise) The Optical Shop of Aspen ILORI Sun Sunglass Hut... -

Page 47

iNdiA EuRopE NoRTh AMERicA ASiA-pAcific SouTh AfRicA cENTRAL AMERicA AfRicA MiddLE EAST SouTh AMERicA 2.6 DISTRIBUTION 45 -

Page 48

... lens options, advanced eyecare, everyday value and high-quality vision care health benefits. As of December 31, 2012, Luxottica's retail business consisted of 6,417 stores and 543 franchised or licensed locations. Luxottica's retail stores sell not only prescription frames and sunglasses that... -

Page 49

... demand for Luxottica's products and services in the region. As of December 31, 2012, the Group operated a retail network of 1,178 LensCrafters stores, of which 968 are in North America and the other 210 stores are in China and Hong Kong. opTicAL RETAiL pEARLE ViSioN Acquired by Luxottica in 2004... -

Page 50

-

Page 51

-

Page 52

...a department store. Each of these brands has a precise market positioning that Luxottica has reinforced by improving service levels while strengthening their fashion reputation with brands such as Ray-Ban and Vogue. As of December 31, 2012, Luxottica operated 775 Sears Optical and 331 Target Optical... -

Page 53

... stores, the retail licensed brand stores, LensCrafters and a number of franchises. In addition, the Group operates Oakley optical lens laboratories in the United States, Ireland and Japan. These labs provide Oakley prescription lenses to the North and South American, European and Asian markets... -

Page 54

... 1970s, The Optical Shop of Aspen is known in the optical industry for its luxury brands for both prescription and sunglasses and its first class customer service. As of December 31, 2012, Luxottica operated 18 stores in some of the most upscale and exclusive locations throughout the United States. -

Page 55

... customers. In addition to operating optical stores, David Clulow operates a number of designer sunglass concessions in upmarket department stores, further reinforcing its position as a premium brand in the United Kingdom. As of December 31, 2012, David Clulow operated 39 corporate owned locations... -

Page 56

-

Page 57

... and 90% of this cost is affecting developing countries. But there is good news. For 563 million people, a pair of glasses can restore their sight. OneSight is a public nonprofit organization providing sustainable access to quality vision care and eyewear in underserved communities worldwide... -

Page 58

... in need. Students will be studied for two years to understand the impact their glasses make on their school performance. Based on the results of the study, REAP will advocate for the inclusion of expanded quality vision care in rural China. SCHOOL-BASED MODEL Students who see better, learn better... -

Page 59

-

Page 60

... locations, OneSight hosted 27 Vision Van Clinics in the U.S. in 2012. OneSight's 40-foot Vision Van, EyeLeen, is a complete optical lab on wheels, equipped with everything needed to provide eye exams and new eyewear. More than 20,000 students who visited the van last year received new prescription... -

Page 61

... of giving the gift of sight! 2013 GoALS Since 1988, we have helped hand-deliver vision care to more than 8 million people in 40 countries. OneSight is grateful to the thousands of volunteers and partners who have made this work possible. But in the midst of such great need - 733 million globally... -

Page 62

-

Page 63

61 3 A long way to grow In 2013 Luxottica will target continued international growth and the development of new markets and new sales channels. The Group looks to the future by pursuing long-term profitable and sustainable growth backed by a solid balance sheet. -

Page 64

... is positioned to capitalize on these trends, with its vertically integrated business model and geographic diversification, and it will continue to invest by expanding its specialty store chains internationally in both the optical (LensCrafters and OPSM, in particular) and sun segments (Sunglass Hut... -

Page 65

... division includes brands such as Oliver Peoples, Paul Smith and Starck Eyes - with the objective of becoming a leader in an eyewear segment that is becoming increasingly important. ThE pREMiuM SEGMENT New sales channels are growing at a faster rate than traditional retail. Department stores, in... -

Page 66

-

Page 67

65 4 Group trends in 2012 -

Page 68

66 ANNUAL REVIEW 2012 Net sales in 2012 exceeded Euro 7 billion, the highest net sales results recorded in Luxottica's history: Euro 7,086 million (+13.9% at current exchange rates; +7.5% at constant exchange rates3) as compared with the previous record in 2011 of Euro 6,222 billion). (millions ... -

Page 69

... per Share (EPS)2 of Euro 1.22. In 2012, strict control over working capital enabled Luxottica to accumulate record free cash flow2 in excess of Euro 700 million. As a result, net debt2 as of December 31, 2012 decreased further, falling to Euro 1,662 million (Euro 2,032 million at the end of 2011... -

Page 70

-

Page 71

69 5 Human resources GROUP HEADCOUNT ORGANIZATIONAL DEVELOPMENT WHOLESALE RETAIL OPERATIONS CORPORATE SERVICES ORGANIZATIONAL WELLBEING SURVEY -

Page 72

....8% are in Europe and 20.8% are in the Asia-Pacific area. As a result of the Tecnol and Multiopticas acquisitions, Latin America increased to 6.3% of the Group's total workforce. 2012 employees by business area Retail Wholesale Operations Corporate Total 45,036 7,344 17,588 339 70,307 -

Page 73

... into the organization and in retail sun in Latin America, Luxottica completed the integration of a chain of stores operating in Mexico acquired in 2011 and pushed for an acceleration of Sunglass Hut entry plans in the region. Lastly, Europe saw the important acquisition in the Iberia region of... -

Page 74

-

Page 75

5 HUMAN RESOURcES 73 In 2012 the entire Luxottica organization participated in the first global employee engagement survey. With the active participation of more than 55,000 employees, Luxottica created an opportunity for employee feedback and internal communication aimed at collecting ... -

Page 76

-

Page 77

75 Other information 2000-2012 EVOLUTION OF NUMBER OF STORES SHARE CAPITAL AND DIVIDEND PER SHARE NOTES 1990-2012 LUXOTTICA SHARE PERFORMANCE -

Page 78

...2012 EVoLuTioN of NuMbER of SToRES At December 31, LensCrafters Pearle Vision Licensed brands Sears Optical Target Optical BJ's Optical The Optical Shop of Aspen Oliver Peoples Sun North America (of which Ilori) Oakley Stores and Vaults NORTH AMERICA Prescription Australia & New Zealand Sunglass Hut... -

Page 79

... 2012 with record results" dated February 28, 2013 available on www.luxottica.com. The adjusted data for 2012 does not include the following items: (i) non-recurring costs relating to reorganization of the Australian retail business amounting to a Euro 22 million adjustment to Group operating... -

Page 80

78 ANNUAL REVIEW 2012 1990-2012 LuxoTTicA ShARE pERfoRMANcE LUxOTTIcA NYSE (USD) year 1990 (a) 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Low 0.794 0.988 2.250 2.025 2.787 3.175 5.212 5.125 3.875 5.000 7.969 12.150 11.820 10.230 15... -

Page 81

...INFORMATION 79 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 23-year high USD 41.73 on December 19, 2012... 2004 2005 2006 2007 2008 2009 2010 2011 2012 35 30 25 20 15 10 5 0 Ordinary share MTA (Euro) FTSE MIB (rebased) ... -

Page 82

..., credit and insurance risks, changes to tax regimes as well as other political, economic and technological factors and other risks and uncertainties referred to in Luxottica Group's filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made as of the date... -

Page 83

-

Page 84

WWW.LUXOTTICA.COM -

Page 85

Annual Report 2012 -

Page 86

-

Page 87

ANNUAL REPORT 2012 FISCAL yEAR ENDED DECEMBER 31, 2012 -

Page 88

-

Page 89

... |3> Summary Management report Appendix Report on Corporate Governance and ownership structure Consolidated Financial Statements Consolidated statements of financial position Consolidated statements of income Consolidated statements of comprehensive income Consolidated statements of stockholders... -

Page 90

-

Page 91

MANAGEMENT REPORT |5> Management report -

Page 92

>6| ANNUAL REPORT 2012 1. opERATiNG pERfoRMANcE foR ThE ThREE MoNThS ANd ThE yEAR ENdEd dEcEMbER 31, 2012 During the course of the fourth quarter of 2012, the Group's growth trend continued. In a more challenging macroeconomic environment, the Group achieved positive results in all the geographic... -

Page 93

...board of directors of Luxottica Group s.p.A. (hereinafter, also the "company") approved the reorganization of the retail business in Australia. As a result of the reorganization, the Group closed approximately 10 percent of its Australian and New Zealand stores, redirecting resources into its market... -

Page 94

... frames and sunglasses. We operate our retail distribution segment principally through our retail brands, which include, among others, Lenscrafters, sunglass Hut, OPsm, Laubman & Pank, bright Eyes, Oakley "O" stores and Vaults, david clulow, GmO and our stores located within host department stores... -

Page 95

... activities in the United States through these acquisitions, our results of operations, which are reported in Euro, are susceptible to currency rate fluctuations between the Euro and the Usd. The Euro/Usd exchange rate has fluctuated from an average exchange rate of Euro 1.00 = Usd 1.2848 in 2012... -

Page 96

> 10 | ANNUAL REPORT 2012 its financial results: (i) non-recurring expenses related to the restructuring of the Australian retail business of Euro 21.7 million (Euro 15,2 million net of the fiscal effect), (ii) non-recurring cost related to the tax audit of one of Luxottica's subsidiaries of ... -

Page 97

....2 million, or 20.1 percent of total retail net sales for the same period in 2011, mainly due to a general increase in consumer demand and to the contribution to sales for the whole 2012 by multiopticas, our newly acquired retail chain in south America. during 2012, net sales to third parties in our... -

Page 98

... anniversary celebrations Adjustment for restructuring costs in Retail division Adjusted operating expenses 2012 3,725.0 (20.3) 3,704.7 (11) and operating 2011 3,247.3 (9.6) 19.0 (12.0) (11.2) 3,233.6 selling and advertising expenses (including royalty expenses) increased by Euro 332.2 million... -

Page 99

... Adjustment for 50th anniversary celebrations Adjustment for restructuring costs in Retail division Adjusted selling and advertising expenses 2012 2,842.0 (17.3) 2,824.6 2011 2,509.8 (5.7) (2.9) 2,501.2 General and administrative expenses, including intangible asset amortization increased by Euro... -

Page 100

... same period of 2011. Net interest expense was Euro 119.2 million in 2012 as compared to Euro 108.6 million in the same period of 2011. The increase was mainly due to the acquisition of Tecnol and to the issuing of a new long-term loan during 2012. Net Income. income before taxes increased by Euro... -

Page 101

... for restructuring costs in the Retail division Adjustment for tax audit related to Luxottica s.r.l. for fiscal year 2007 Adjusted net income attributable to Luxottica Group stockholders 2012 541.7 15.2 10.0 566.9 2011 452.3 6.7 (19.0) 8.5 7.1 455.6 in 2012 basic and diluted earnings per share were... -

Page 102

... 31, (thousands of Euro) Net sales Cost of sales Gross profit 2012 1,632,298 553,896 1,078,401 % of net sales 100.0% 33.9% 66.1% 2011 1,509,030 546,281 962,748 % of net sales 100.0% 36.2% 63.8% Selling Royalties Advertising General and administrative Total operating expenses 565,057 26,949 100,745... -

Page 103

... brands, in particular Ray-ban and Oakley, led by the increase in optical sales, Persol and of some designer brands such as Prada, Tiffany, burberry, Ralph Lauren and the coach line launched in January 2012. such increase was recorded in most of the Group's markets. in addition, there was a positive... -

Page 104

... | ANNUAL REPORT 2012 During the three-month period ended December 31, 2012, net sales in our retail distribution segment in the United States and Canada comprised 76.1 percent of our total net sales in this segment as compared to 76.6 percent of our total net sales in the same period of 2011. In... -

Page 105

MANAGEMENT REPORT | 19 > Operating Expenses. Total operating expenses increased by Euro 80.0 million, or 9.6 percent, to Euro 914.4 million in the three-month period ended december 31, 2012 from Euro 834.4 million in the same period of 2011. As a percentage of net sales, operating expenses ... -

Page 106

... extraordinary gain Adjustment for restructuring costs in the Retail division Adjusted general and administrative expenses 4Q 2012 221.6 221.6 4Q 2011 197.3 (9.6) (1.9) (3.5) 182.3 Income from Operations. For the reasons described above, income from operations increased by Euro 35.7 million... -

Page 107

... compared to Euro 0.7 million in the same period of 2011. Our effective tax rate was 42.0 percent in the three-month period ended december 31, 2012 as compared to 36.1 percent for the same period of 2011. Net income attributable to Luxottica Group stockholders increased by Euro 12.4 million, or 19... -

Page 108

...Internacional extraordinary gain Adjustment for restructuring costs in the Retail Division Adjustment for tax audit related to Luxottica S.r.l. for fiscal year 2007 Adjusted net income 2012 76.8 10.0 86.8 2011 64.4 6.7 1.9 (0.3) 72.7 Basic and diluted earnings per share were Euro 0.16 in the three... -

Page 109

... North America retail division (Euro 18.4 million) for the timing of salary payment to store personnel. income taxes paid were Euro 265.7 million in 2012 as compared to Euro 228.2 million in the same period of 2011. This change was mainly due to the timing of tax payments made by the Group in the... -

Page 110

...borrowings Current portion of long-term debt Accounts payable Income taxes payable Short-term provisions for risks and other charges Other liabilities Total current liabilities NON-CURRENT LIABILITIES: Long-term debt Employee benefits Deferred tax liabilities Long-term provisions for risks and other... -

Page 111

... 11.6 million); • accounts payable increased by Euro 74.3 million. This increase is mainly due to better payment conditions, which were negotiated by the Group in 2011; • current taxes payable increased by Euro 26.5 million mainly due to the timing of tax payments made by the Group in various... -

Page 112

...ANNUAL REPORT 2012 Our net financial position as of December 31, 2012 and December 31, 2011 was as follows: December 31, (thousands of Euro) Cash and cash equivalents Bank overdrafts Current portion of long-term debt Long-term debt Total 2012 790,093 (90,284) (310,072) (2,052,107) (1,662,369) 2011... -

Page 113

... and multiopticas acquisitions, Latin America increased to 6.3 percent of Group's total workforce. business area Retail Wholesale manufacturing and Logistics (Operations) corporate Total Headcount 45,036 7,344 17,588 339 70,307 5. huMAN RESouRcES Geographic area Europe North America Asia-Pacific... -

Page 114

... was completed. As for the Retail sun, again in Latin America, Luxottica completed the integration of a chain of stores operating in Mexico acquired in 2011 and pushed for an acceleration of Sunglass Hut entry plans in the region. Lastly, Europe saw the important acquisition in the Iberia region of... -

Page 115

... organization to reach levels of further excellence in quality, speed and production flexibility. Lastly, in 2012 the "zero accidents" program produced satisfactory results in all manufacturing and logistics sites. cORpORATE SERVIcES In 2012 important professional investments have been made in the... -

Page 116

... that contribute to business success LUxOTTIcA ENGAGEMENT INDEx 75% 6. coRpoRATE GoVERNANcE Information about ownership structure and corporate governance is contained in the corporate governance report which is an integral part of the annual financial report. 7. RELATEd pARTy TRANSAcTioNS Our... -

Page 117

... our products and services. Discretionary spending is affected by many factors, including general business conditions, inflation, interest rates, consumer debt levels, unemployment rates, availability of consumer credit, conditions in the real estate and mortgage markets, currency exchange rates and... -

Page 118

... use of vision correction alternatives could result in decreased use of our prescription eyewear products, including a reduction of sales of lenses and accessories sold in our retail outlets, which could have a material adverse impact on our business, results of operations, financial condition... -

Page 119

MANAGEMENT REPORT | 33 > RISKS RELATING TO OUR BUSINESS AND OpERATIONS e) If we are unable to successfully introduce new products and develop our brands, our future sales and operating performance may suffer The mid- and premium price categories of the prescription frame and sunglasses markets in ... -

Page 120

... ANNUAL REPORT 2012 maintaining strict quality control and the ability to deliver products to our customers in a timely and efficient manner. We must also continuously develop new product designs and features, expand our information systems and operations, and train and manage an increasing number... -

Page 121

MANAGEMENT REPORT | 35 > 31, 2012 and 2011, sales realized through the Prada and Miu Miu brand names together represented approximately 3.9 percent and 4.0 percent of total sales, respectively. For the years ended December 31, 2012 and 2011, sales realized through the Dolce & Gabbana and D&G brand... -

Page 122

... competitive markets, our business, results of operations and financial condition could suffer The mid- and premium price categories of the prescription frame and sunglasses markets in which we operate are highly competitive. We believe that, in addition to successfully introducing new products... -

Page 123

... business, results of operations, financial condition and prospects. p) If there is any material failure, inadequacy, interruption or security failure of our information technology systems, whether owned by us or outsourced or managed by third parties, this may result in remediation costs, reduced... -

Page 124

> 38 | ANNUAL REPORT 2012 cause delays in product supply and sales, reduced efficiency of our operations, unintentional disclosure of customer or other confidential information of the Company, or damage to our reputation, and potentially significant capital investments could be required to ... -

Page 125

... result in increased costs due to additional reserves for doubtful accounts and a reduction in sales to customers experiencing credit-related issues A substantial majority of our outstanding trade receivables are not covered by collateral or credit insurance. While we have procedures to monitor and... -

Page 126

... some form of vision correction aid. Luxottica is positioned to capitalize on these trends, with its vertically integrated business model and geographic diversification, and will continue to invest by expanding its specialty store chains internationally in both the optical (LensCrafters and OPSM in... -

Page 127

...regulation number 11971/1999. 11. AdApTATioN To ThE ARTicLES 36-39 of ThE REGuLATEd MARkETS As required by Section 2428 of the Italian Civil Code, it is reported that: 1. The Group carries out research and development activities in relation to production processes in order to improve their quality... -

Page 128

... ANNUAL REPORT 2012 more detail in the corporate governance report. 5. The Company has made a world-wide and national group tax election (sections 117-129 of the Italian Tax Code). Under this election, Luxottica Group S.p.A., as the head of the tax group for the Group's principal Italian companies... -

Page 129

... net of tax benefit , and a non-recurring accrual for the tax audit relating to Luxottica s.r.l. (Fiscal year 2007) of approximately Euro 10.0 million. The Group believes that these adjusted measures are useful to both management and investors in evaluating the Group's operating performance compared... -

Page 130

> 44 | ANNUAL REPORT 2012 NON-IFRS MEASURE: REcONcILIATION BETWEEN REpORTED AND ADJUSTED p&L ITEMS Luxottica Group EBITDA margin 18.9% 0.3% Operating income 982.0 21.7 Fy 2012 Operating Income margin 13.9% 0.3% Income before taxes Net income 856.4 21.7 541.7 15.2 EPS base 1.17 0.05 EPS dilutive (... -

Page 131

...to Luxottica Group stockholders, before noncontrolling interest, provision for income taxes, other income/expense, depreciation and amortization. EBITDA margin means EBITDA divided by net sales. We believe that EBITDA is useful to both management and investors in evaluating our operating performance... -

Page 132

> 46 | ANNUAL REPORT 2012 EBITDA and EBITDA margin are not measures of performance under IFRS. We include them in this Management Report in order to: • improve transparency for investors; • assist investors in their assessment of the Group's operating performance and its ability to refinance... -

Page 133

...) in working capital over the prior period, less capital expenditures, plus or minus interest income/(expense) and extraordinary items, minus taxes paid. We believe that free cash flow is useful to both management and investors in evaluating our operating performance compared with other companies in... -

Page 134

... on our financial statements prepared in accordance with IFRS. Rather, this nonIFRS measure should be used as a supplement to IFRS results to assist the reader in better understanding the operational performance of the Group. The Group cautions that this measure is not a defined term under IFRS... -

Page 135

... to financing, income taxes and the accounting effects of capital spending, which items may vary for different companies for reasons unrelated to the overall operating performance of a company's business. The ratio of net debt to EBITDA is a measure used by management to assess the Group's level of... -

Page 136

... ANNUAL REPORT 2012 The Group recognizes that the usefulness of EBITDA and the ratio of net debt to EBITDA as evaluative tools may have certain limitations, including: • EBITDA does not include interest expense. Because we have borrowed money in order to finance our operations, interest expense... -

Page 137

... to the grant of treasury shares to Group employees; (c) non-recurring restructuring and start-up costs in the Retail division of approximately Euro 11.2 million; and (d) non-recurring OPsm reorganization costs for approximately Euro 9.6 million. Throughout this report, management has made certain... -

Page 138

... in exchange rates, changes in local conditions, our ability to protect our proprietary rights, our ability to maintain our relationships with host stores, any failure of our information technology, inventory and other asset risk, credit risk on our accounts, insurance risks, changes in tax laws... -

Page 139

REPORT ON CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE | 53 > Report on Corporate Governance and ownership structure pursuant to article 123-bis of the Italian consolidated financial law Year 2012 Approved by the Board of Directors on February 28, 2013 Traditional administration and control system -

Page 140

... Middle East. Its operations are particularly significant in terms of product turnover and personnel in Europe, North America, Australia and China. Luxottica Group S.p.A. is listed on the New york Stock Exchange and on the telematic stock exchange ("MTA") organized and managed by Borsa Italiana and... -

Page 141

... and the New york Stock Exchange ("NySE"), according to the highest standards of corporate governance. The values established in the Code of Ethics of Luxottica Group bind all employees to ensure that the activities of the Group are performed in compliance with applicable law, in the context of fair... -

Page 142

... Code. The Board of Directors made its last assessment in this respect on February 14, 2013, as it deemed that the presumption indicated in article 2497-sexies was overcome, as Delfin S.Ã r.l. acts as Group parent company and from an operational and business perspective there is no common managing... -

Page 143

... CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE | 57 > Information on the stock option plans, the share capital increases approved by stockholders and reserved to stock option plans, and the performance share plan assigned to employees is available in the notes to the separate consolidated financial... -

Page 144

... family gains control of the company and at the same time the majority of lenders believe, reasonably and in good faith, that this party cannot repay the debt. On march 19, 2012 the company issued a bond listed on the Luxembourg stock Exchange (code isiN Xs0758640279) for a total amount of Euro 500... -

Page 145

... article 123-ter of the Italian Consolidated Financial Law. The appointment and the removal of directors and auditors are respectively governed by article 17 and by article 27 of the Company's by-laws, which are available for review on the company website www.luxottica.com in the Governance/By-laws... -

Page 146

... 2012 On the approval date of this Report Luxottica directly holds 4,681,025 treasury shares acquired through two buyback programs which were authorized by the Company's stockholders' meeting in 2008 and 2009. Please note that the information concerning the characteristics of the risk management... -

Page 147

REPORT ON CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE | 61 > I. BOARD OF DIREcTORS Role and duties The Board of Directors (hereinafter also the "Board") plays a central role in Luxottica's corporate governance. It has the power and responsibility to direct and manage the Company, with the ... -

Page 148

... regard to the organizational structure of the Company and of the Group, the general development and investment plans, the financial plans and provisional financial statements as well as any other matter submitted to him/her by the Board itself. The Directors report to the other directors and to the... -

Page 149

...day for the Group's senior management, the Company Directors and the auditors was organized in July 2012 in order to promote a more in-depth knowledge of the business operations and dynamics of the Company. In January 2013, the Company issued the calendar of corporate events for the 2013 fiscal year... -

Page 150

... related information please refer to the Corporate Governance Report for the previous fiscal year. Set out below is a brief profile of each member of the Board in office, listing the most significant other offices held by such directors in listed companies as well as in financial, banking, insurance... -

Page 151

... his long career in the Group he was Group's Product & Design Director, Group's Chief Quality Officer and Technical General Manager. He is the Chairman of Luxottica S.r.l., one of the major subsidiary companies of the Group. In April 2000, he was awarded an honorary business administration degree... -

Page 152

... a member of the Board of Directors since 2003 and General Manager of Central Corporate Functions since 2011. He held the position as Chief Financial Officer since he joined Luxottica Group in 1999 until March 2011. Before joining Luxottica Group, he was Planning and Control Officer for the Piaggio... -

Page 153

... working for the ENI Group and also worked for the Barclays Group in Italy and for the Nuovo Banco Ambrosiano Group. At Eni, he held positions of increasing responsibility and was appointed Financial Director and ultimately Chief Financial Officer between 1993 and 2008. From August 2008 to May 2011... -

Page 154

... of the Board of Statutory Auditors of Indesit Company S.p.A. To assess the maximum number of positions a Director of the Group may hold as a director or an auditor in other companies listed on regulated markets, in financial companies, banks, insurance companies or other companies of a significant... -

Page 155

...credit lines in general, to issue financial debt under any form, for an amount exceeding Euro 15 million per transaction; d) to issue debt (other than intra-group transactions and those transactions for payment of tax and employees' wages) on current accounts of the Company in banks and post offices... -

Page 156

... Chief Executive Officer is authorized by the Board of Directors to supervise all the business units. He also makes proposals to be submitted to the Board of Directors regarding the organization of the Company and of the Group, the general development and investment programs, the financial programs... -

Page 157

... for more information). The board of directors has so far deemed it unnecessary to establish a committee for the appointment of directors due to the company's ownership structure. Remuneration Report The information on the remuneration paid to directors, Auditors and other managers with strategic... -

Page 158

... in 2012. The Committee examines succession plans annually and reports on them to the Board of Directors. The Committee did not identify a succession plan for executive directors. There are succession plans for approximately three hundred managers that hold important positions within the Group. II... -

Page 159

... processes, procedures and, more generally, the conduct and corporate activities within the applicable legal framework and Code of Ethics adopted by the Group. To fulfill these tasks the CR&CO makes use of a Corporate Risk Manager, a Corporate Compliance Manager and similar relocated structures, in... -

Page 160

... by the Board of Directors in October 2011, and is applicable to all the companies of the Luxottica Group. The policy sets forth the principles and rules for the management and monitoring of financial risk and pays particular attention to the activities carried out by the Luxottica Group to minimize... -

Page 161

REPORT ON CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE | 75 > This policy defines the rules and responsibilities for the management and collection of credit in order to prevent financial risks, optimize revolving credit and reduce losses on such credits. In particular, this policy sets the ... -

Page 162

.... The Board of Directors approved the allocation of funds totaling Euro 50,000 to the Committee for the 2012 fiscal year in order to provide it with the adequate financial resources to perform its tasks independently. The Internal Audit Manager The Manager of the Internal Audit department is... -

Page 163

... fiscal year, the Internal Audit Manager performed his role through the implementation of an activities and verification plan which is related to the Company and its main subsidiaries. Such actions, which the Chairman, the Chief Executive Officer and the Board were informed of, through the Control... -

Page 164

... on the activities performed. The board of directors allocated specific funds, totaling Euro 50,000, in order to provide the supervisory board with adequate financial resources to perform its duties for the 2012 fiscal year. On the basis of the guidelines provided by the Parent company and of... -

Page 165

REPORT ON CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE | 79 > The disclosure controls and procedures are designed to ensure that the financial information is adequately collected and communicated to the Chief Executive Officer (CEO) and to the Chief Financial Officer (CFO), so that they may make ... -

Page 166

...the correct reporting of the management-related issues, and verifies the procedures for the implementation of the corporate governance rules provided for by the Code of Conduct, and, in accordance with the provisions of Italian Legislative Decree 39/2010, supervises the financial information process... -

Page 167

... Controls over financial reporting"); • examines the reports by the Chief Executive Officer and Chief Financial Officer on any fraud involving management or related officers in the context of the internal control system; • evaluates the proposals of the auditing companies for the appointment... -

Page 168

> 82 | ANNUAL REPORT 2012 In 2012 the Board met ten times. All the Auditors comply with the legal requirements of such office and in particular with the requirements set forth in article no. 148, paragraph 3, of the Italian Consolidated Financial Law. Below is some background information on the ... -

Page 169

... of April 28, 2011. Manager responsible for the preparation of the company's financial reports On April 27, 2012, the Board of Directors confirmed Enrico Cavatorta as the manager responsible for the preparation of the Company's financial reports. The appointed manager will remain in office until... -

Page 170

> 84 | ANNUAL REPORT 2012 The Board of Directors, as authorized by article 23 of the by-laws, amended articles 17 and 27. The text of the by-laws is available on the website www.luxottica.com in the Governance/ By-laws section. code of Ethics and procedure for Handling Reports and complaints ... -

Page 171

... of the Company and seven managers with strategic functions (pursuant to article 152-sexies letter c2 of the Regulations for Issuers) - inform the Company, CONSOB and the public about any transactions involving the purchase, sale, subscription or exchange of Luxottica shares or financial instruments... -

Page 172

... Luxottica Group. The limitations on the appointment contained in this policy derive from current regulations in italy and in the United states, by virtue of the fact that the company's shares are listed both on the mTA, organized and managed by borsa italiana, and on the New york stock Exchange... -

Page 173

REPORT ON CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE | 87 > IV. STOcKHOLDERS' MEETINGS The Board of Directors determines the venue, date and time of the stockholders' meeting in order to facilitate the participation of stockholders. The Luxottica Directors and Auditors endeavor to attend the ... -

Page 174

... investor relations team, directly reporting to the chief Executive Officer, is dedicated to relations with the national and international financial community, with investors and analysts, and with the market. The company set up a specific investors section on its website to provide information that... -

Page 175

... have already been described in the paragraphs above. After closing the 2012 fiscal year, the Board of Directors: (a) approved the annual report concerning the organizational and accounting corporate structure of Luxottica Group, identifying strategically important subsidiaries; (b) on the basis of... -

Page 176

...Human Resources Committee: 6 NOTES (*) Indicates the percentage of participation of the Directors in the meetings of the Board of Directors and of the Committees. (**) Lists the number of offices as director or auditor performed by the directors in office in other listed companies, banks, financial... -

Page 177

... the Fiscal Year 2012: 10 (*) Indicates the number of offices as director or auditor performed by the interested party in other listed companies indicated in book V, title V, paragraphs V, Vi and Vii of the italian civil code, with the number of offices held in listed companies. Pursuant to article... -

Page 178

...92 | ANNUAL REPORT 2012 3. oThER pRoViSioNS of ThE codE of coNducT Summary of the grounds for possible divergence from the Code's recommendations yES Granting of authorities and transactions with related parties The Board of Directors granted authorities defining their: a) limits b) conditions of... -

Page 179

CONSOLIDATED FINANCIAL STATEMENTS | 93 > Consolidated Financial Statements -

Page 180

> 94 | ANNUAL REPORT 2012 Consolidated statements of financial position At December 31, (thousands of Euro) ASSETS CURRENT ASSETS Cash and cash equivalents Accounts receivable Inventories Other assets Total current assets 6 7 8 9 790,093 698,755 728,767 209,250 2,426,866 1,248 13 1,261 905,100 668... -

Page 181

...18,004 2,568 20,572 Note reference 2012 Related parties (note 29) 2011 Related parties (note 29) NON-CURRENT LIABILITIES Long-term debt Employee benefits Deferred tax liabilities Long-term provisions for risks and other charges Other non-current liabilities Total non-current liabilities 21 22 14 23... -

Page 182

> 96 | ANNUAL REPORT 2012 Consolidated statements of income (thousands of Euro) Net sales Cost of sales of which non-recurring Gross profit Selling of which non-recurring Royalties Advertising of which non-recurring General and administrative of which non-recurring Total operating expenses Income ... -

Page 183

... Actuarial (loss)/gain on defined benefit plans - net of tax of Euro 13.6 million and Euro 22.9 million as of december 31, 2012 and 2011 Total other comprehensive income - net of tax Total comprehensive income for the period Attributable to: - Luxottica Group stockholders' equity - non-controlling... -

Page 184

... 26) 13,029 Capital stock (thousands of Euro) Balance as of January 1, 2011 Total comprehensive income as of December 31, 2011 Exercise of stock options Non-cash stock based compensation Excess tax benefit on stock options Investments in treasury shares Gifting of shares to employees Change in the... -

Page 185

... > Consolidated statements of cash flows (thousands of Euro) Income before provision for income taxes Note December 31, 2012 856,357 December 31, 2011 695,272 Stock based compensation Depreciation, amortization and impairment Net loss on disposals of fixed assets and other Financial expenses Other... -

Page 186

... | ANNUAL REPORT 2012 (thousands of Euro) Long-term debt: - Proceeds - Repayments Short-term debt: - Increase in short-term lines of credit - (Decrease) in short-term lines of credit Exercise of stock options (Purchase)/Sale of treasury shares Dividends Cash used in financing activities Increase... -

Page 187

... distribution and marketing of house brand and designer lines of mid to premium priced prescription frames and sunglasses, as well as of performance optics products. Through its retail operations, as of December 31, 2012, the Company owned and operated 6,417 retail locations worldwide and franchised... -

Page 188

...Other Liabilities", against accounts receivables. The company has determined that the revisions are immaterial to the previously reported financial statements. in addition provisions for risks and other charges and employee benefits that were presented in other liabilities in 2011 are now separately... -

Page 189

...arrangement. Acquisition-related costs are expensed as incurred. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. On an acquisition-by-acquisition basis, the Group recognizes... -

Page 190

...ANNUAL REPORT 2012 Intercompany transactions, balances and unrealized gains and losses on transactions between Group companies are eliminated. Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies adopted by the Group. The individual financial... -

Page 191

... at the closing rate. The exchange rates used in translating the results of foreign operations are reported in the Exchange Rates Attachment to the Notes to the Consolidated Financial Statements. cOMpOSITION OF THE GROUp The composition of the Group has changed during 2012 due to the acquisition of... -

Page 192

... within selling expenses. Subsequent collections of previously written-off receivables are recorded in the consolidated statement of income as a reduction of selling expenses. Inventories Inventories are stated at the lower of the cost determined by using the average annual cost method by product... -

Page 193

... shorter of the useful life of the asset and the lease term. Intangible assets (a) Goodwill Goodwill represents the excess of the cost of an acquisition over the fair value of the Group's share of the net identifiable assets of the acquired subsidiary at the date of acquisition. Goodwill is tested... -

Page 194

... relationships acquired in a business combination are recognized at fair value at the acquisition date. The contractual customer relations have a finite useful life and are carried at cost less accumulated amortization and accumulated impairment losses. Amortization is recognized over the expected... -

Page 195

... income from financial assets held for sale is recognized in the consolidated statement of income as part of other income when the Group's right to receive payments is established. A regular way purchase or sale of financial assets is recognized using the settlement date. Financial assets are... -

Page 196

> 110 | ANNUAL REPORT 2012 market. If the market for a financial asset is not active (or if it refers to non-listed securities), the Group defines the fair value by utilizing valuation techniques. These techniques include using recent arms-length market transactions between knowledgeable willing ... -

Page 197

...liabilities if payment is due within one year or less from the reporting date. If not, they are presented as non-current liabilities. Accounts payable are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method. Long-term debt Long-term debt... -

Page 198

... when payment is due within 12 months from the balance sheet date. Long-term debt is removed from the statement of financial position when it is extinguished, i.e. when the obligation specified in the contract is discharged, canceled or expires. current and deferred taxes The tax expense for... -

Page 199

...or provided for. Share-based payments The Company operates a number of equity-settled, share-based compensation plans, under which the entity receives services from employees as consideration for equity instruments (options). The fair value of the employee services received in exchange for the grant... -

Page 200

... in accordance with IAS 18 - Revenue. Revenue includes sales of merchandise (both wholesale and retail), insurance and administrative fees associated with the Group's managed vision care business, eye exams and related professional services, and sales of merchandise to franchisees along with other... -

Page 201

... the year. Free frames given to customers as part of a promotional offer are recorded in cost of sales at the time they are delivered to the customer. Discounts and coupons tendered by customers are recorded as a reduction of revenue at the date of sale. Use of accounting estimates The preparation... -

Page 202

...issued after the applicable effective date. There are no new IFRSs or IFRICs (International Financial Reporting Interpretations Committee) that are effective for the first time starting from January 1, 2012 and that had a significant impact on the consolidated financial statements of the Group as of... -

Page 203

...that should be effective starting from January, 1 2013, has been suspended. The Group is assessing the full impact of adopting IFRS 9. IFRS 10 - Consolidated Financial Statements, issued in May 2011. The new model replaces the current duality of IAS 27 and SIC12. The standard states that an investor... -

Page 204

> 118 | ANNUAL REPORT 2012 Disclosures relating to separate accounts are addressed in the revised IAS 27 Separate Financial Statements. IFRS 12 also provides a new set of disclosures related to unconsolidated structured entities. The new disclosures should enable users to understand the nature and... -

Page 205

... entity reduces significantly the number of employees. Curtailment gains/losses are accounted for as past-service costs. Annual expense for a funded benefit plan will include net interest expense or income, calculated by applying the discount rate to the net defined benefit asset or liability. There... -

Page 206

... within the Treasury department which identifies, evaluates and implements financial risk hedging activities, in compliance with the Financial Risk Management Policy guidelines approved by the Board of Directors, and in accordance with the Group operational units. The Policy defines the guidelines... -

Page 207

... as the exchange rate risk, the interest rate risk, credit risk and the utilization of derivative and non-derivative instruments. The Policy also specifies the management activities, the permitted instruments, the limits and proxies for responsibilities. (a) Exchange rate risk The Group operates at... -

Page 208

... with an insurance company in order to cover the credit risk associated with customers of Luxottica Trading and Finance Ltd. in those countries where the Group does not have a direct presence. c2) With regard to credit risk related to the management of financial resources and cash availabilities... -

Page 209

CONSOLIDATED FINANCIAL STATEMENTS - NOTES | 123 > Usually, the bank counterparties are selected by the Group Treasury Department and cash availabilities can be deposited, over a certain limit, only with counterparties with elevated credit ratings, as defined in the policy. Operations with ... -

Page 210

...relating to liabilities. With regard to interest rate swaps, the cash flows include the settlement of the interest spread, both positive and negative, which expire during different periods. The various maturity date categories represent the period of time between the date of the financial statements... -

Page 211

... million (Euro 4.0 million as of december 31, 2011), net of tax effect, and lower by Euro 4.1 million as of december 31, 2011 (not applicable to 2012), net of tax effect, in connection with the increase/decrease of the fair value of the derivatives used for the cash flow hedges. As of december 31... -

Page 212

...,702 Note (*) 6 7 9 13 15 16 17 20 21 24 The numbers reported above refer to the paragraphs within these notes to the consolidated financial statements in which the financial assets and liabilities are further explained. december 31, 2011 Financial assets at fair value through profit and loss 668... -

Page 213

...would result in default. g) Fair value In order to determine the fair value of financial instruments, the Group utilizes valuation techniques which are based on observable market prices (Mark to Model). These techniques therefore fall within Level 2 of the hierarchy of Fair Values identified by IFRS... -

Page 214

... consolidated statement of Financial Position Other current assets Other non-current liabilities Other current liabilities december 31, 2011 668 8,550 16,058 Fair Value measurements at Reporting date Using: Level 1 Level 2 668 8,550 16,058 Level 3 - As of december 31, 2012 and 2011, the Group did... -

Page 215

... million. The acquisition furthers the Group's strategy of continued expansion of its wholesale business and acquiring a manufacturing facility in south America. The goodwill of Euro 88.8 million from the acquisition mainly reflects (i) a reduction in custom duties and transportation costs and more... -

Page 216

... include a contingent liability for approximately Euro 17.5 million related to tax risks which arose prior to the acquisition date. The acquisition related costs of Euro 1.2 million were expensed as incurred. The consideration paid net of the cash acquired (Euro 6.1 million) was Euro 66.4 million. -

Page 217

... FINANCIAL STATEMENTS - NOTES | 131 > On July 31, 2012, the Group successfully completed the acquisition of more than 120 Sun Planet branded sun specialty stores in Spain and Portugal from Multiopticas Internacional. In 2011, Luxottica acquired the Sun Planet retail chain in Latin America... -

Page 218

> 132 | ANNUAL REPORT 2012 Net sales included in the consolidated financial statements relating to Sun Planet (Spain and Portugal) starting from the acquisition date are Euro 5.5 million. sun Planet's impact on the Group's 2012 consolidated net income was a net loss of Euro 3.5 million. Had sun ... -

Page 219

... reported to the highest authority in the Group's decision making process. (1) (2) Inter segment transactions and corporate adjustments (c) (thousands of Euro) 2012 Net sales (a) Income from operations Interest income Interest expense Other-net Income before provision for income taxes Provision... -

Page 220

> 134 | ANNUAL REPORT 2012 Information by geographical area The geographic segments include Europe, North America (which includes the United States of America, Canada and Caribbean islands), Asia-Pacific (which includes Australia, New Zealand, China, Hong Kong and Japan) and Other (which includes ... -

Page 221

... and post office checks cash and cash equivalents on hand Total As of december 31 2012 779,683 7,506 2,904 790,093 2011 891,406 9,401 4,293 905,100 iNfoRMATioN oN ThE coNSoLidATEd STATEMENT of fiNANciAL poSiTioN CURRENT ASSETS 6. cASh ANd cASh EQuiVALENTS Accounts receivable consist exclusively... -

Page 222

> 136 | ANNUAL REPORT 2012 Write-downs of accounts receivable are determined in accordance with the Group credit policy described in note 3 "Financial Risks". Accruals and reversals of the allowance for doubtful accounts are recorded within selling expenses in the consolidated statement of income.... -

Page 223

... (64,953) (43,938) Other assets comprise the following items: (thousands of Euro) sales taxes receivable short-term borrowings Prepaid expenses Other assets Total financial assets As of december 31 2012 15,476 835 2,569 35,545 54,425 2011 18,785 1,186 1,573 38,429 59,973 9. oThER ASSETS income... -

Page 224

... royalties totaling Euro 18.2 million as of december 31, 2012 (Euro 29.7 million as of december 31, 2011). Prepaid expenses mainly relate to the timing of payments of monthly rental expenses incurred by the Group's North America and Asia-Pacific retail divisions. The net book value of financial... -

Page 225

... 2,549,696 (1,320,566) 1,086,574 Increases Decreases Business Combinations Translation difference and other Depreciation expense Balance as of December 31, 2011 Of which: Historical cost Accumulated depreciation Total as of December 31, 2011 64,466 (6,812) 6,124 19,158 (55,420) 488,422 893,948... -

Page 226

...in cost of sales, Euro 114.8 million (Euro 108.5 million in 2011) in selling expenses; Euro 3.9 million (Euro 4.4 million in 2011) in advertising expenses; and Euro 24.8 million (Euro 22.5 million in 2011) in general and administrative expenses. capital expenditures in 2012 and 2011 mainly relate to... -

Page 227

... FINANCIAL STATEMENTS - NOTES | 141 > Changes in goodwill and intangible assets as of December 31, 2011 and 2012 were as follows: Customer relations, contracts and lists 225,364 (51,967) 173,397 11. GoodWiLL ANd iNTANGibLE ASSETS (thousands of Euro) Historical cost Accumulated amortization Total... -

Page 228

..., considering the rates of return on long-term government bonds and the average capital structure of a group of comparable companies. The recoverable amount of cash-generating units has been determined by utilizing post-tax cash flow forecasts based on the Group's 2013-2015 three-year plan, on the... -

Page 229

... in order to reflect the transfer prices at market conditions. This adjustment was made since the cash-generating units belonging to this segment generate distinct and independent cash flows whose products are sold within an active market. The impairment test performed as of the balance sheet date... -

Page 230

... ANNUAL REPORT 2012 The carrying value of financial assets approximates their fair value and this value also corresponds to the Group's maximum exposure to credit risk. The Group does not have guarantees or other instruments for managing credit risk. Other assets primarily include advance payments... -

Page 231

CONSOLIDATED FINANCIAL STATEMENTS - NOTES | 145 > The gross movement in the deferred income tax accounts is as follows: As of January 1, 2012 Exchange rate difference and other movements Business combinations Income statements Tax charge/(credit) directly to equity At December 31, 2012 78,636 16,... -

Page 232

... subsequent years Total 14,547 22,426 17,930 17,827 21,767 18,964 113,462 The company does not provide for an accrual for income taxes on undistributed earnings of its non-italian operations to the related italian parent company, of Euro 2.0 billion and Euro 1.8 billion in 2012 and 2011 that are... -

Page 233

... short-term lines of credits with different financial institutions. The interest rates on these credit lines are floating. The credit lines may be used, if necessary, to obtain letters of credit. As of December 31, 2012 and 2011, the Company had unused short-term lines of credit of approximately... -

Page 234

> 148 | ANNUAL REPORT 2012 19. ShoRT-TERM pRoViSioNS foR RiSkS ANd oThER chARGES (thousands of Euro) Balance as of December 31, 2011 Increases Decreases Business combinations The balance is detailed below: Legal risk 4,899 1,647 (5,981) 14 578 Self-insurance 5,620 7,395 (8,186) (60) 4,769 Tax ... -

Page 235

...rental Insurance Sales taxes payable Salaries payable Due to social security authorities Sales commissions payable Royalties payable Derivative financial liabilities Other liabilities Total financial liabilities 2012 4,363 683 24,608 9,494 28,550 245,583 36,997 8,569 2,795 1,196 172,704 535,541 2011... -

Page 236

...146 1,923 30,571 Total 2,632,636 274,576 (230,447) 5,146 3,975 56,989 2,742,878 The Group uses debt financing to raise financial resources for long-term business operations and to finance acquisitions. during 2004 the Group financed the cole National corporation acquisition and in 2007 the Oakley... -

Page 237

CONSOLIDATED FINANCIAL STATEMENTS - NOTES | 151 > The table below summarizes the main terms of the Group's long-term debt. Outstanding amount at the reporting date 60,411,904 70,000,000 20,000,000 230,919,721 300,000,000 127,000,000 500,000,000 50,000,000 50,... -

Page 238

... by utilizing the market rate currently available for similar debt and adjusted in order to take into account the Group's current credit rating. On december 31, 2012 the Group has unused uncommitted lines (revolving) of Euro 500 million. Long-term debt, including capital lease obligations, as... -

Page 239

... in the notes Hedging instruments on foreign exchange rates Hedging instruments on interest rates - sT Hedging instruments on foreign exchange rates Hedging instruments on interest rates - LT Net Financial Position 2012 1,657,441 6,048 (438) (681) 1,662,370 2011 2,051,896 668 (12,168) (234) (8,550... -

Page 240

> 154 | ANNUAL REPORT 2012 Our net financial position with respect to related parties is not material. Long-term debt includes finance leases liabilities for Euro 29.2 million (Euro 27.0 million as of december 31, 2012). (thousands of Euro) Gross finance lease liabilities: - no later than 1 year -... -

Page 241

... 31, 2006 was based on the Projected Unit credit cost method. The main assumptions utilized are reported below: Economic assumptions discount rate Annual TFR increase rate death probability: 3.25% 3.00% Those determined by the General Accounting department of the italian Government, named RG48... -

Page 242

> 156 | ANNUAL REPORT 2012 pension funds Qualified Pension Plans - US Holdings sponsors a qualified noncontributory defined benefit pension plan, the Luxottica Group Pension Plan ("Lux Pension Plan"), which provides for the payment of benefits to eligible past and present employees of US Holdings ... -

Page 243

... 12,344 Pension Plan 2012 2011 SERPs 2012 2011 Pension Plan (thousands of Euro) Change in plan assets: Fair value of plan assets - beginning of period Expected return on plan assets Actuarial gain/(loss) on plan assets Employer contribution Direct benefit payments made by the Company Benefits paid... -

Page 244

...ANNUAL REPORT 2012 Amounts to be recognized in the statement of financial position and statement of income along with actual return on assets were as follows: Pension Plan (thousands of Euro) Amounts recognized in the statement of financial position Liabilities: Present value of the obligation Fair... -

Page 245

... 2011 SERPs 2012 2011 Pension Plan 2012 Weighted average assumptions used to determine net periodic benefit cost: Discount rate Expected long-term return on plan assets Rate of compensation increase Mortality table 4.30% 7.50% 5%-3%-2% 2013 Static 5.10% 8.00% 5%-3%-2% 2012 Static 2011 SERPs 2012... -

Page 246

... periods of time. Additionally, the Group considered input from its third party pension asset managers, investment consultants and plan actuaries, including their review of asset class return expectations and long-term inflation assumptions. Plan Assets - The Lux Pension Plan's investment policy is... -

Page 247

... Luxottica Group Employee Retirement Income Security Act of 1974 ("ERISA") Plans Compliance and Investment Committee with the advice of investment managers and/or investment consultants, taking into account current market conditions. During 2011, the Committee reviewed the Lux Pension Plan's asset... -

Page 248

... salary credits on the effective date of the cole acquisition in 2004. The plan liability was Euro 0.7 million and Euro 0.7 million at december 31, 2012 and 2011, respectively. Us Holdings sponsors certain defined contribution plans for its United states and Puerto Rico employees. The cost of... -

Page 249

... The weighted average discount rate used in determining the net periodic benefit cost for 2012 and 2011 was 5.1 percent and 5.5 percent, respectively. The balance is detailed below: 23. LoNG-TERM pRoViSioNS foR RiSkS ANd oThER chARGES Legal risk 8,598 2,824 (2,812) 132 8,741 Self- insurance 23,763... -

Page 250

...| ANNUAL REPORT 2012 25. LuxoTTicA GRoup STockhoLdERS' EQuiTy cApITAL STOcK The share capital of Luxottica Group S.p.A., as of December 31, 2012, amounts to Euro 28,394,291.82 and is comprised of 473,238,197 ordinary shares with a par value of Euro 0.06 each. The share capital of Luxottica Group... -

Page 251

CONSOLIDATED FINANCIAL STATEMENTS - NOTES | 165 > achieved the financial targets identified by the Board of Directors under the 2009 PSP. As a result of these equity grants, the number of Group treasury shares was reduced from 6,186,425 as of December 31, 2011 to 4,681,025 as of December 31, 2012.... -

Page 252

... tax inspection on Luxottica S.r.l. (fiscal year 2007) Aggregate other effects Effective rate 31.4% 3.3% 1.2% 0.4% 36.3% 2011 31.4% 2.4% 0.3% 34.1% For the analysis of the main changes in the 2012 Income statement items versus 2011, refer to paragraph 3. Financial results of the Management report... -

Page 253

... sales volume. The Group also operates departments in various host stores, paying occupancy costs solely as a percentage of sales. Certain agreements which provide for operations of departments in a major retail chain in the United States contain short-term cancellation clauses. Total rental expense... -

Page 254

... ending December 31 (thousands of Euro) 2013 2014 2015 2016 2017 Subsequent years Total GUARANTEES The United States Shoe Corporation, a wholly owned subsidiary within the Group, has guaranteed the lease payments for five stores in the United Kingdom. These lease agreements have varying termination... -

Page 255

...On November 7, 2011, the company acquired a building next to its registered office in milan for a purchase price of Euro 21.4 million from Partimmo s.r.l., a company indirectly controlled by the company's chairman of the board of directors. The purchase price is in line with the fair market value of... -

Page 256

...871 46,464 Consolidated Statement of Financial Position Assets 1,600 8,553 727 10,880 Liabilities 155 2,465 17,793 159 20,572 Total remuneration due to key managers amounted to approximately Euro 43.2 million and Euro 48.9 million in 2012 and 2011, respectively. 30. EARNiNGS pER ShARE basic and... -

Page 257

CONSOLIDATED FINANCIAL STATEMENTS - NOTES | 171 > The table reported below provides the reconciliation between the average weighted number of shares utilized to calculate basic and diluted earnings per share: Weighted average shares outstanding - basic Effect of dilutive stock options 2012 464,... -

Page 258

... 24, 2012 the board of directors of Luxottica approved the reorganization of the retail business in Australia. As a result of this reorganization the Group has closed approximately 10 percent of its Australian and New Zealand stores, redirecting resources into its market leading OPsm brand. As... -

Page 259

... the board of directors to effectively execute, in one or more installments, the stock capital increases and to grant options to employees. The board can also: • establish the terms and conditions for the underwriting of the new shares; • request the full payment of the shares at the time of... -

Page 260

... performance plans to US domiciled beneficiaries 2010 Ordinary Plan 2011 Ordinary Plan 2012 Ordinary Plan Total (*) The plan was reassigned in 2009. On May 13, 2008, a Performance Shares Plan for senior managers within the Company as identified by the Board of Directors of the Company (the "Board... -

Page 261

...-year period from 2011 through 2013. Management expects that the targets will be met. As of December 31, 2011, 11,500 of the 764,750 units granted had been forfeited. Pursuant to the PSP plan adopted in 2008, on May 7, 2012, the Board of Directors granted certain of our key employees 601,000 rights... -

Page 262

> 176 | ANNUAL REPORT 2012 The fair value of the stock options was estimated on the grant date using the binomial model and following weighted average assumptions: 2012 Ordinary Plan for citizens resident in the U.S. Share price at the grant date (in Euro) Expected option life Volatility Dividend ... -

Page 263

CONSOLIDATED FINANCIAL STATEMENTS - NOTES | 177 > Movements reported in the various stock option plans in 2012 are reported below: Number of options outstanding as of December 31, 2011 146,100 555,500 100,000 666,256 70,000 1,100,000 20,000 1,401,000 336,000 523,000 1,845,000 645,000 Number of ... -

Page 264

... | ANNUAL REPORT 2012 Options exercisable on December 31, 2012 are summarized in the following table: Number of options exercisable as of December 31, 2012 2004 Plan 2005 Plan 2006 Extraordinary Plan 2007 Plan 2008 Plan 2009 Ordinary Plan - for citizens non resident in the U.S. 2009 Ordinary Plan... -

Page 265

... structure to reduce the cost of capital. consistent with others in the industry the Group monitors capital also on the basis of the gearing ratio which is calculated as net financial position divided by total capital. Net financial position is calculated as total borrowings (including short-term... -

Page 266

... this financial statements were authorized for issue. in accordance with iFRs 3, the fair value of the net assets and liabilities assumed will be defined within 12 months from the acquisition date. * milan, February 28, 2013 On behalf of the board of directors Andrea Guerra chief Executive Officer... -

Page 267

CONSOLIDATED FINANCIAL STATEMENTS - ATTACHMENT | 181 > Attachment ExchANGE RATES uSEd To TRANSLATE fiNANciAL STATEMENTS pREpAREd iN cuRRENciES oThER ThAN EuRo Average exchange rate for the year ended December 31, 2012 1.28479 1.20528 0.81087 2.50844 102.49188 1.28421 16.90293 8.70407 1.24071 5.... -

Page 268

... included within the scope of consolidation; a description of the primary risks and uncertainties to which the Group is exposed is also included. Milano, February 28, 2013 Andrea Guerra (Chief Executive Officer) Enrico Cavatorta (Manager in charge with preparing the Company's financial reports) -

Page 269

...recommended by Consob, the Italian Commis mission for listed Companies and the Stock Exchang nge. Those standards require that we plan and perform pe the audit to obtain the necessary assuranc nce about whether the consolidated financ ancial statements are free of material misstatement nt and, taken... -

Page 270

... No. 58/98 8p presented in the report on corporate governance nce a and ownership structure are consistent with ith the consolidated financial statements of Luxottica ottica Group as of 31 December 2012. Milan, 5 April 2013 PricewaterhouseCoopers s SpA Sp Signed by Stefano Bravo (Partner) This... -

Page 271

... from the profit for the year for the distribution of the dividend, assuming that the number of the treasury shares of the company remains unchanged, would amount to approximately Euro 276 million. Milan, February 28, 2013 On behalf of the Board of Directors Andrea Guerra Chief Executive Officer -

Page 272

..., 2012, the Board of Directors of Luxottica Group S.p.A. approved the reorganization of the retail business in Australia. As a result of the reorganization, the Company closed approximately 10 percent of its Australian and New Zealand stores, redirecting resources into its market leading OPSM brand. -

Page 273

... FINANCIAL STATEMENTS - BOARD OF STATUTORY AUDITORS REPORT | 187 > 3) On March 19, 2012, the Company closed an offering in Europe to institutional investors of Euro 500 million of senior unsecured guaranteed notes due on March 19, 2019. The notes are listed on the Luxembourg Stock Exchange... -

Page 274

... managers and from meetings with the Audit Company, according to a reciprocal exchange of the significant facts and figures. No significant issues concerning the main subsidiaries emerged from the assessment of the annual reports, annexed to the financial statements and issued by the Boards... -

Page 275

...attention to the services provided outside the auditing process. It has to be noted, for what concerns financial information, that the Company also adopted the international accounting principles (IAS/IFRS) in preparing its reports for the Security Exchange Commission of the United States since 2010... -

Page 276

...financial statement and review of the regular keeping of company accounts during the fiscal year): Other audit services PricewaterhouseCoopers S.p.A. Luxottica Group S.p.A. Italian subsidiaries Foreign subsidiaries (thousands of Euro) 420 0 788 Taking in consideration the nature of these activities... -

Page 277

CONSOLIDATED FINANCIAL STATEMENTS - BOARD OF STATUTORY AUDITORS REPORT -

Page 278

... ANNUAL REPORT 2012 Corporate information LuxoTTicA GRoup S.p.A. REGISTERED OFFIcE AND HEADQUARTERS Via C. Cantù, 2 - 20123 Milan - Italy Tel. +39 02 86334.1 - Fax +39 02 8633 4636 E-mail: [email protected] Fiscal code and milan company register no. 00891030272 VAT no.10182640150 MEDIA RELATIONS... -

Page 279

WWW.LUXOTTICA.COM