LensCrafters 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|77 >

REPORT ON

CORPORATE

GOVERNANCE

AND OWNERSHIP

STRUCTURE

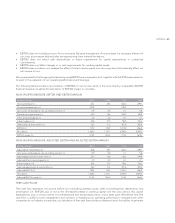

advance repayment of the loan in the event that a third party not linked to the Del Vecchio family gains control of the

Company and at the same time, the majority of lenders believe, reasonably and in good faith, that such third party is not

able to repay the debt.

On June 30, 2008, the subsidiary company U.S. Holdings made a private placement of debt notes on the U.S. market for a

total amount of US$ 275 million with the following expiry dates: US$ 20 million on July 1, 2013; US$ 127 million on July 1,

2015; and US$ 128 million on July 1, 2018. The agreement with institutional investors provides for the advance repayment

of the loan in the event that a third party not linked to the Del Vecchio family gains control of at least 50 percent of the

Company’s shares.

On June 16, 2009, Luxottica Group S.p.A. amended the loan agreement entered into with Banca Nazionale del Lavoro on

April 8, 2008 for the total amount of Euro 150 million. The amendment extended the expiry of the agreement to July 13,

2011. The agreement provides for the advance repayment of the loan in the event that a third party not linked to the Del

Vecchio family gains control of the Company and at the same time, the lender believes, reasonably and in good faith, that

this third party is not able to repay the debt.

On November 11, 2009 Luxottica Group S.p.A. entered into a loan agreement, which was amended on November 30,

2010, for the total amount of Euro 300 million expiring on November 30, 2014, with Mediobanca, Calyon, UniCredit and

Deutsche Bank. The agreement provides for the advance repayment of the loan in the event that a third party not linked

to the Del Vecchio family gains control of the Company and at the same time, the majority of lenders believe, reasonably

and in good faith, that this third party is not able to repay the debt.

On January 29, 2010, the subsidiary company U.S. Holdings made a private placement of debt notes on the U.S. market

for a total amount of US$ 175 million with the following expiry dates: US$ 50 million on January 29, 2017; US$ 50 million

on January 29, 2020; and US$ 75 million on January 29, 2019. The Note Purchase Agreement provides for the advance

repayment of the loan in the event that a third party not linked to the Del Vecchio family gains control of at least 50 percent

of the Company shares.

On September 30, 2010, Luxottica Group S.p.A. made a private placement of debt notes on the U.S. market for a total

amount of Euro 100 million with the following expiry dates: Euro 50 million on September 15, 2017; and Euro 50 million on

September 15, 2020. The Note Purchase Agreement provides for the advance payment of the loan in the event that a third

party not linked to the Del Vecchio family gains control of at least 50% of the Company shares.

On November 10, 2010, the Company issued a bond listed on the Luxembourg Stock Exchange (code ISIN XS0557635777)

for a total amount of Euro 500 million, expiring on November 15, 2015. The offering prospectus contains a clause concerning

the change of control which provides for the possibility of the holders of the bonds to exercise a redemption option of

100% of the value of the notes in the event that a third party not linked to the Del Vecchio family gains control of the

Company. This clause is not applied in the event that the Company obtains an investment grade credit rating.

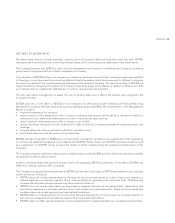

With regard to the agreements between the Company and the directors on the indemnity to be paid in the event of

resignation or termination of employment without just cause or in the event of termination of the employment relationship

following a take–over bid, please refer to Section II (see Remuneration of Directors).

The appointment and the removal of directors and auditors are respectively governed by article 17 and by article 27 of

the Company’s by–laws, which are available for review on the company website www.luxottica.com in the Governance/

By–laws section. With regard to any matters not expressly provided for by the by–laws, the current legal and regulatory

provisions shall apply.

The Company’s by–laws can be modified by the extraordinary shareholders’ meeting, which convenes and passes

resolutions based on a majority vote according to the provisions of law and, as provided for by article 23 of the by–laws,

by the Board of Directors within certain limits in modifying the by–laws to adapt to legal provisions.