LensCrafters 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010> 156 |

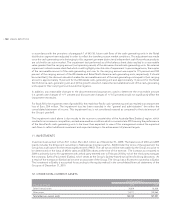

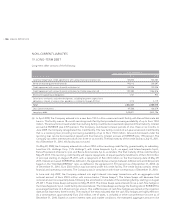

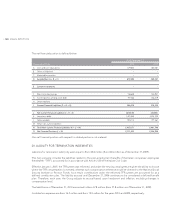

NON–CURRENT LIABILITIES

19. LONG–TERM DEBT

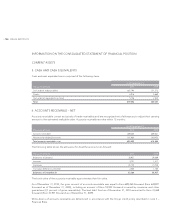

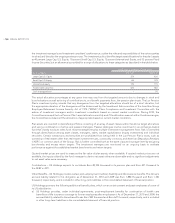

Long–term debt consists of the following:

(thousands of Euro)

As of December 31,

2010 2009

Luxottica Group S.p.A. credit agreements with various financial institutions (a) 545,552 544,585

Senior unsecured guaranteed notes (b) 943,112 205,297

Credit agreement with various financial institutions (c) 242,236 750,228

Credit agreement with various financial institutions for Oakley acquisition (d) 897,484 1,062,816

Short–term capital lease obligations 1,141 970

Other loans with banks and other third parties, including long–term capital lease

obligations, interest at various rates, payable in installments through 2014 (e) 3,112 4,179

Total 2,632,637 2,568,075

Less: Current maturities 197,566 166,279

Long–term debt 2,435,071 2,401,796

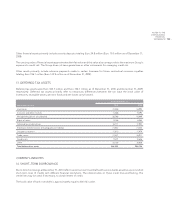

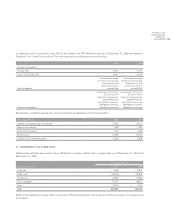

(a) In April 2008, the Company entered into a new Euro 150.0 million unsecured credit facility with Banca Nazionale del

Lavoro. This facility was an 18–month revolving credit facility that provided borrowing availability of up to Euro 150.0

million. The amounts borrowed under the revolving facility could be borrowed and repaid until final maturity. Interest

accrued at EURIBOR plus 0.375 percent. The Company could select interest periods of one, three or six months. In

June 2009, the Company renegotiated this credit facility. The new facility consists of a 2–year unsecured credit facility

that is a revolving loan providing borrowing availability of up to Euro 150.0 million. Amounts borrowed under the

revolving loan can be borrowed and repaid until final maturity. Interest accrues at EURIBOR plus 1.90 percent. The

Company can select interest periods of one, three or six months. The final maturity of the credit facility is July 13, 2011.

As of December 31, 2010, this facility was not used.

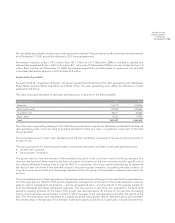

On May 29, 2008, the Company entered into a Euro 250.0 million revolving credit facility, guaranteed by its subsidiary,

Luxottica U.S. Holdings Corp. (“US Holdings”), with Intesa Sanpaolo S.p.A., as agent, and Intesa Sanpaolo S.p.A.,

Banca Popolare di Vicenza S.c.p.A. and Banca Antonveneta S.p.A., as lenders. The final maturity of the credit facility is

May 29, 2013. This revolving credit facility will require repayments of equal quarterly installments of Euro 30.0 million

of principal starting on August 29, 2011, with a repayment of Euro 40.0 million on the final maturity date of May 29,

2013. Interest accrues at EURIBOR (as defined in the agreement) plus a margin between 0.40 percent and 0.60 percent

based on the “Net Debt/EBITDA” ratio, as defined in the agreement (1.531 percent as of December 31, 2010). As

of December 31, 2010, Euro 250.0 million was borrowed under this credit facility. The credit facility contains certain

financial and operating covenants. The Company was in compliance with those covenants as of December 31, 2010.

In June and July 2009, the Company entered into eight interest rate swap transactions with an aggregate initial

notional amount of Euro 250.0 million with various banks (“Intesa Swaps”). The Intesa Swaps will decrease their

notional amount on a quarterly basis, following the amortization schedule of the underlying facility, starting on August

29, 2011. These Intesa Swaps will expire on May 29, 2013. The Intesa Swaps were entered into as a cash flow hedge on

the Intesa Sanpaolo S.p.A. credit facility discussed above. The Intesa Swaps exchange the floating rate of EURIBOR for

an average fixed rate of 2.25 percent per annum. The ineffectiveness of cash flow hedges was tested at the inception

date and at least every three months. The results of the tests indicated that the cash flow hedges are highly effective.

As a consequence, approximately Euro (2.6) million, net of taxes, is included in other comprehensive income as of

December 31, 2010. Based on current interest rates and market conditions, the estimated aggregate amount to be