LensCrafters 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

|153 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

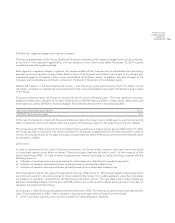

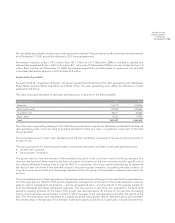

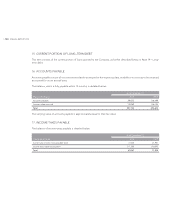

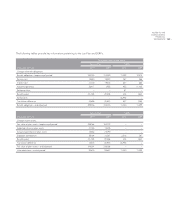

Other financial assets primarily include security deposits totaling Euro 24.8 million (Euro 10.5 million as of December 31,

2009).

The carrying value of financial assets approximates their fair value and this value also corresponds to the maximum Group’s

exposure to credit risk. The Group does not have guarantees or other instruments for managing credit risk.

Other assets primarily include advance payments made to certain licensees for future contractual minimum royalties

totaling Euro 106.1 million (Euro 122.9 million as of December 31, 2009).

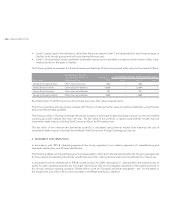

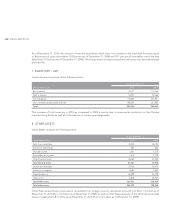

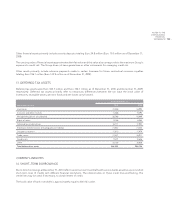

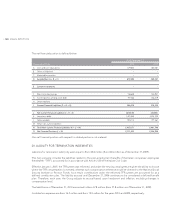

13. DEFERRED TAX ASSETS

Deferred tax assets were Euro 364.3 million and Euro 356.7 million as of December 31, 2010 and December 31, 2009,

respectively. Deferred tax assets primarily refer to temporary differences between the tax base the book value of

inventories, intangible assets, pension funds and net losses carry forward.

(thousands of Euro)

As of December 31,

2010 2009

Inventories 72,448 54,992

Insurance and other reserves 11,666 14,393

Net operating losses carry forward 26,546 43,499

Rights of return 9,148 8,085

Deferred tax on derivatives 18,711 17,903

Employee related reserves (Including pension liability) 73,837 73,432

Occupancy reserves 17,875 17,979

Trade names 72,831 76,971

Fixed assets 9,201 10,626

Other 52,038 38,826

Total deferred tax assets 364,300 356,706

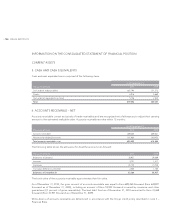

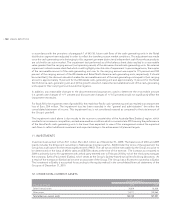

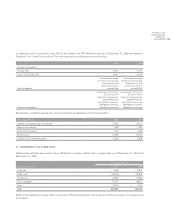

CURRENT LIABILITIES

14. SHORT–TERM BORROWINGS

Short–term borrowings at December 31, 2010 reflect current account overdrafts with various banks as well as uncommitted

short–term lines of credits with different financial institutions. The interest rates on these credit lines are floating. The

credit lines may be used, if necessary, to obtain letters of credit.

The book value of bank overdrafts is approximately equal to their fair value.