LensCrafters 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|137 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

IFRS 3 – • Business Combinations: The amendment, applicable for annual periods beginning on or after July 1, 2010,

clarifies that contingent consideration balances arising from business combinations whose acquisition date preceded

the date when an entity first applied IFRS 3 as issued in 2008, do not have to be adjusted upon application of this

IFRS. The amendment also clarifies the measurement of non–controlling interests in the acquiree that are present

ownership interests and entitle the holder to a proportionate share in the entity’s net assets in the event of liquidation.

The amendment also specifies that an acquirer must measure a liability or an equity instrument related to share–based

payment transactions of the acquiree or the replacement of an acquiree’s share–based payment transactions with

share–based payment transactions of the acquirer in accordance with the method set forth in IFRS 2 at the acquisition

date.

IFRS 7 – • Financial Instruments: Disclosures: The amendment emphasizes the interaction between qualitative and

quantitative disclosures about the nature and extent of risks arising from financial liabilities. The amendment eliminates

the requirement to disclose the carrying amount of financial assets that would otherwise be past due or impaired

where their terms were renegotiated. The amendment also eliminates the requirement to disclose the fair value of

collateral and other credit enhancements, which can be potentially misleading, although an entity is still required to

disclose a description of the collateral and its financial effects.

IAS 1 – • Presentation of Financial Statements: The amendment requires, either in the statement of changes in equity

or in the notes, an analysis of other comprehensive income by item.

IAS 27 – • Consolidated and separate financial statements: The amendment clarifies the transition requirements for

amendments arising as a result of IAS 27.

IAS 34 – • Interim Financial Reporting: The amendment clarifies that the information included in the interim financial

reporting on significant transactions and events should update the relevant information presented in the most recent

annual report.

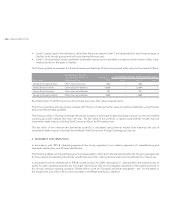

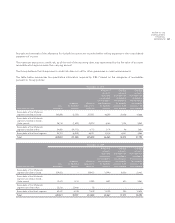

3. FINANCIAL RISKS

The assets of the Group are exposed to different types of financial risk: market risk (which includes exchange rate risks,

interest rate risk relative to fair value variability and cash flow uncertainty), credit risk and liquidity risk. The risk management

strategy of the Group aims to stabilize the results of the Group by minimizing the potential effects due to volatility in

financial markets. The Group uses derivative financial instruments, principally interest rate and currency swap agreements,

as part of its risk management strategy.

Financial risk management is centralized within the Treasury department which identifies, evaluates and implements

financial risk hedging activities, in compliance with the Financial Risk Management Policy guidelines approved by the

Board of Directors, and in accordance with the Group operational units. The Policy defines the guidelines for any kind of

risk, such as the exchange rate risk, the interest rate risk, credit risk and the utilization of derivative and non–derivative

instruments. The Policy also specifies the management activities, the permitted instruments, the limits and proxies for

responsibilities.

a) Exchange rate risk

The Group operates at the international level and is therefore exposed to exchange rate risk related to the various currencies

with which the Group operates. The Group only manages transaction risk. The transaction exchange rate risk derives from

commercial and financial transactions in currencies other than the functional currency of the Group, i.e. the Euro.

The primary exchange rate to which the Group is exposed is the Euro/US$ exchange rate.

The exchange rate risk management policy defined by the Group’s management states that transaction exchange rate risk

must be hedged for a percentage between 50 percent and 100 percent by trading forward currency contracts or permitted

option structures with third parties.