LensCrafters 2010 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

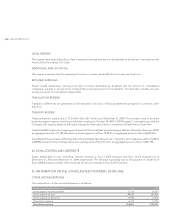

ANNUAL REPORT 2010> 164 |

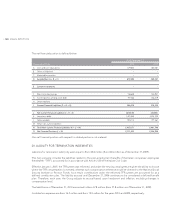

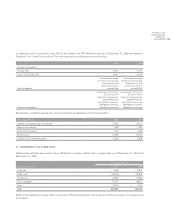

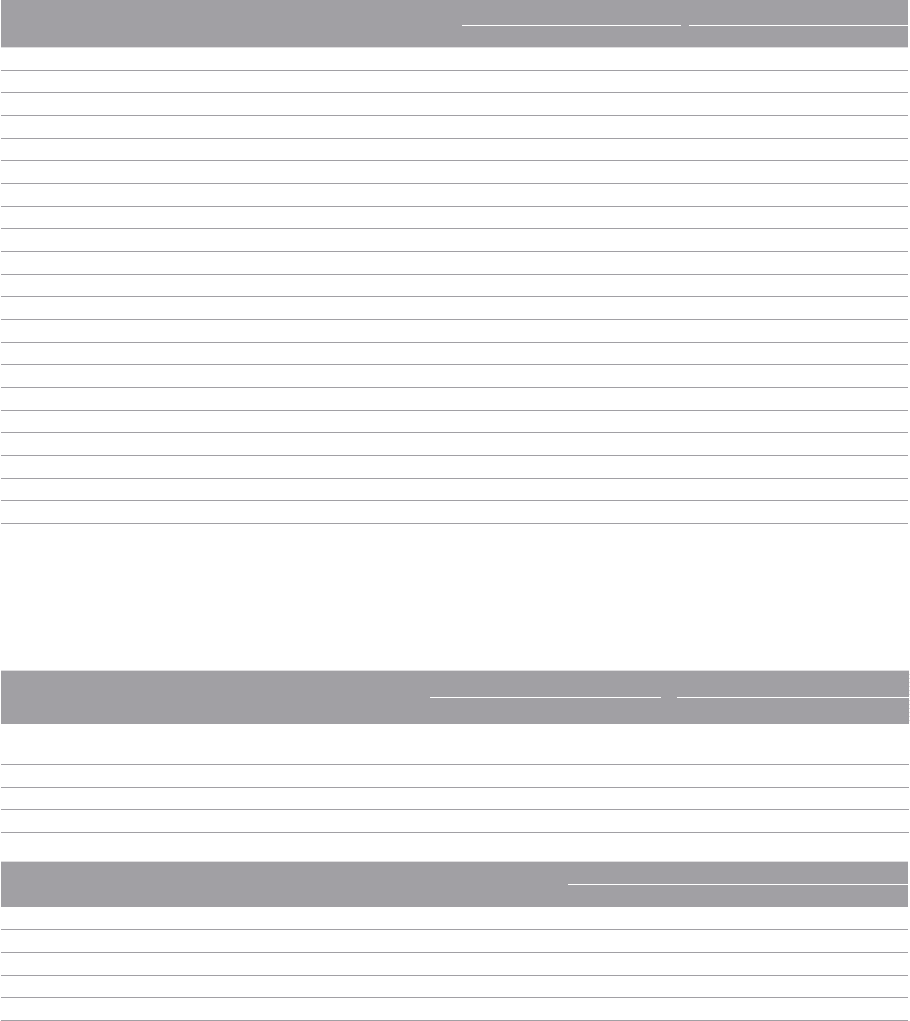

Amounts to be recognized in the statement of financial position and profit or loss along with actual return on assets were

as follows:

(thousands of Euro)

Pension Plan SERPs

2010 2009 2010 2009

Amounts recognized in the statement of financial position:

Liabilities:

Present value of the obligation 409,316 334,015 11,340 11,299

Fair value of plan assets 314,501 238,168 – –

Liability recognized in statement of financial position 94,815 95,847 11,340 11,299

Accumulated other comprehensive income:

Net gain/(loss), beginning of year (63,659) (87,429) (2,627) (3,849)

Asset gain/(loss) 14,462 23,790 – –

Liability experience gain/(loss) 1,744 (1,761) 421 1,228

Liability assumption change gain/(loss) (28,161) (191) (875) (86)

Translation difference (4,527) 1,932 (187) 80

Accumulated other comprehensive income, end of year (80,141) (63,659) (3,268) (2,627)

Service cost 18,640 18,443 367 466

Interest cost 21,700 19,476 628 633

Expected return on plan assets (21,185) (15,204) – –

Settlement loss – – 81 –

Expense recognized in profit or loss 19,156 22,715 1,076 1,129

Actual return on assets:

Expected return on assets 21,185 15,205 – –

Actuarial gain/(loss) on plan assets 14,462 23,790 – –

Actual return on assets 35,646 38,995 – –

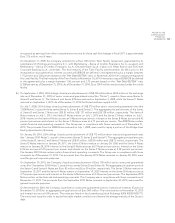

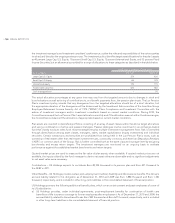

During 2010, the Lux SERP plan settled a portion of its benefit obligations through lump sum cash payments to certain

plan participants. As a result of this action, the projected benefit obligation was re–measured as of July 1, 2010. US

Holdings recognized an actuarial loss of Euro 81 thousand in earnings at the time of re–measurement.

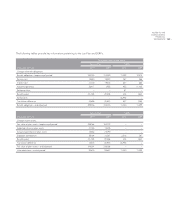

The following tables show the main assumptions used to determine the period benefit cost and the benefit obligation.

Lux Plan SERPs

2010 2009 2010 2009

Weighted–average assumptions used to determine benefit

obligations:

Discount Rate 5,50% 6,15% 5,50% 6,15%

Rate of compensation increase 5% – 3% – 2% 4% – 3% – 1% 5% – 3% – 2% 4% – 3% – 1%

Expected long–term return on plan assets 8,00% 8,00% n.a. n.a.

Pension Plan

2010 2009

Weighted–average assumptions used to determine net periodic benefit cost:

Discount rate 5.50% 6.15%

Expected long–term return on plan assets 8.00% 8.00%

Rate of compensation increase 5% – 3% – 2% 4% – 3% – 1%

Mortality table RP–2000 RP–2000