LensCrafters 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|141 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

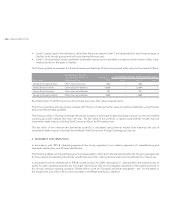

Floating–rate debt exposes the Group to a risk which originates from the volatility of the interest rates (cash flow risk). In

relation to this risk, and for the purposes of the related hedging, the Group utilizes derivate contracts, specifically Interest

Rate Swap (IRS) agreements, which exchange the floating rate for a fixed rate, thereby reducing the risk from interest rate

volatility.

The risk policy of the Group requires the maintenance of a percentage of fixed–rate debts that is greater than 25 percent

and less than 75 percent of total debts. This percentage is obtained by utilizing Interest Rate Swap agreements, where

required.

On the basis of various scenarios, the Group calculates the impact of rate changes on the consolidated statement of

income. For each scenario, the same interest rate change is utilized for all currencies. The various scenarios only include

those liabilities at floating rates that are not hedged with fixed interest rate swaps. On the basis of these scenarios, the

impact, as of December 31, 2010 and net of tax effect, of an increase/decrease of 100 bps on net income, in a situation with

all other variables unchanged, would have been a maximum decrease of Euro 4.4 million (Euro 9.4 million as of December

31, 2009) or a maximum increase of Euro 4.4 million (Euro 9.4 million as of December 31, 2009).

With reference to Interest Rate Swap agreements utilized to hedge against cash flow risk as of December 31, 2010, and in

the event that interest rates increased/decreased by 100 bps, with all other variables unchanged, the stockholders’ equity

reserves would have been, respectively, greater by Euro 12.7 million (Euro 20.7 million as of December 31, 2009), net of tax

effect, and lower by Euro 12.9 million (Euro 21.3 million as of December 31, 2009), net of tax effect, in connection with the

increase/decrease of the fair value of the derivatives used for the cash flow hedges.

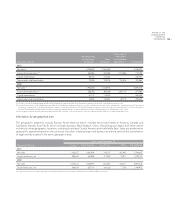

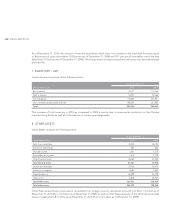

(millions of Euro)

As of December 31, 2010

Plus 100 bps Minus 100 bps

Net income Reserve Net income Reserve

Liabilities (4.4) – 4.4 –

Hedging derivatives (Cash Flow Hedges) – 12.7 – (12.9)

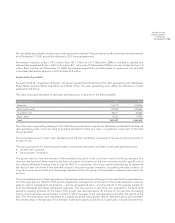

(millions of Euro)

As of December 31, 2009

Plus 100 bps Minus 100 bps

Net income Reserve Net income Reserve

Liabilities (9.4) – 9.4 –

Hedging derivatives (Cash Flow Hedges) – 20.7 – (21.3)