LensCrafters 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|151 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

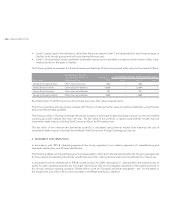

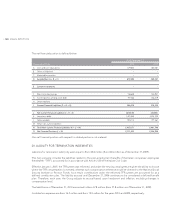

No intangibles associated to the business combinations were realized. The purchase price allocation has not been finalized

as of December 31, 2010 and will be reflected in 2011 financial statements.

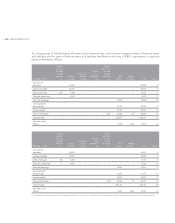

Amortization expense of Euro 107.2 million (Euro 83.1 million as of 31 December 2009) is included in general and

administrative expenses for Euro 106.2 million (Euro 83.1 million as of 31 December 2009) and in cost of sales for Euro 1.0

million (Euro 0 million as of December 31, 2009). Amortization expense for goodwill relates to impairment loss recorded

in the Retail distribution segment in 2010 for Euro 20.4 million

Impairment of goodwill

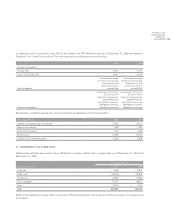

Pursuant to IAS 36 – Impairment of Assets – the Group has identified the following four cash–generating units: Wholesale,

Retail North America,Retail Asia–Pacific and Retail Other. The cash–generating units reflect the distribution model

adopted by the Group.

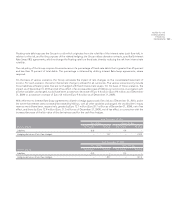

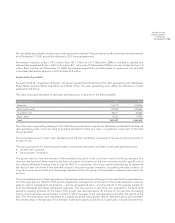

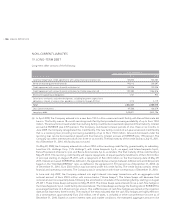

The value of goodwill allocated to each cash–generating unit is reported in the following table:

(thousands of Euro) 2010 2009

Wholesale 1,116,119 1,054,956

North America retail 1,372,638 1,292,685

Asia–Pacific retail 358,317 303,262

Retail – other 43,323 37,932

Total 2,890,397 2,688,835

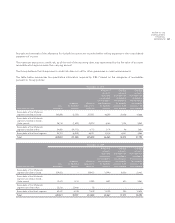

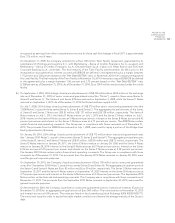

The information required by paragraph 134 of IAS 36 is provided below only for the Wholesale and Retail North America

cash–generating units, since the value of goodwill allocated to these two units is a significant component of the total

Group goodwill.

The recoverable amount of each cash–generating unit has been verified by comparing its net assets carrying amounts to

its value in use.

The main assumptions for determining the value in use are reported below and refer to both cash generating units:

Growth rate: 2 percent•

Discount rate: 7.6 percent•

This growth rate is in line with the rate of the manufacturing sector of the countries in which the Group operates. The

discount rate has been determined on the basis of market information on the cost of money and the specific risk of

the industry (Weighed Average Cost of Capital, WACC). In particular, the Group used a methodology to determine

the discount rate which was in line with that utilized in the previous year, therefore, considering the rates of return on

long–term government bonds and the average capital structure of a group of comparable companies were taken into

account.

The recoverable amount of cash–generating units has been determined by utilizing post–tax cash flow forecasts based on

the three–year plan for the 2011–2013 period, prepared by management on the basis of the results attained in previous

years as well as management expectations – split by geographical area – on future trends in the eyewear market for

both the Wholesale and Retail distribution segments. The time period of cash flows was extended to the 2014–2015

period by creating forecasts on the basis of the growth rate reported above. At the end of the cash flow forecasting

period, a terminal value was estimated in order to reflect the value of the cash–generating unit after the period of the

plan. The terminal values were calculated as a perpetuity at the same growth rate as described above and represent

the present value, in the last year of the forecast, of all future perpetual cash flows. In particular, it should be noted that,