LensCrafters 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

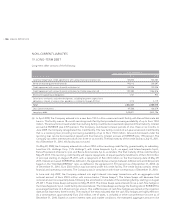

ANNUAL REPORT 2010> 166 |

the investment manager’s and investment consultant’s performance, outline the roles and responsibilities of the various parties

involved, and describe the ongoing review process. The investment policy identifies target asset allocations for the plan’s assets

at 40 percent Large Cap U.S. Equity, 10 percent Small Cap U.S. Equity, 15 percent International Equity, and 35 percent Fixed

Income Securities, but an allowance is provided for a range of allocations to these categories as described in the table below.

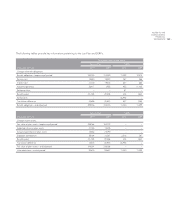

Asset category

Asset class as a percent of total assets

Minimum Maximum

Large Cap U.S. Equity 37% 43%

Small Cap U.S. Equity 8% 12%

International equity 13% 17%

Fixed income securities 32% 38%

Cash and equivalents –5%

The actual allocation percentages at any given time may vary from the targeted amounts due to changes in stock and

bond valuations as well as timing of contributions to, and benefit payments from, the pension plan trusts. The Lux Pension

Plan’s investment policy intends that any divergence from the targeted allocations should be of a short duration, but

the appropriate duration of the divergence will be determined by the Investment Subcommittee of the Luxottica Group

Employee Retirement Income Security Act of 1974 (“ERISA”) Plans Compliance and Investment Committee with the

advice of investment managers and/or investment consultants based on current market conditions. During 2010, the

Committee reviewed the Lux Pension Plan’s asset allocation monthly and if the allocation was not within the above ranges,

the Committee re–balanced the allocations if appropriate based on current market conditions.

Plan assets are invested in diversified portfolios consisting of an array of asset classes within the above target allocations

and using a combination of active and passive strategies. Passive strategies involve investment in an exchange–traded

fund that closely tracks an index fund. Active strategies employ multiple investment management firms. Risk is controlled

through diversification among asset classes, managers, styles, market capitalization (equity investments) and individual

securities. Certain transactions and securities are prohibited from being held in the Lux Pension Plan’s trusts, such as

ownership of real estate other than real estate investment trusts, commodity contracts, and American Depositary Receipts

(“ADR”) or common stock of the Group. Risk is further controlled both at the asset class and manager level by assigning

benchmarks and excess return targets. The investment managers are monitored on an ongoing basis to evaluate

performance against the established market benchmarks and return targets.

Quoted market prices are used to measure the fair value of plan assets, when available. If quoted market prices are not

available, the inputs utilized by the fund manager to derive net asset value are observable and no significant adjustments

to net asset value were necessary.

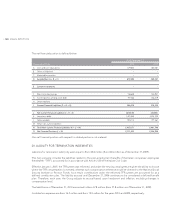

Contributions – US Holdings expects to contribute Euro 48,104 thousand to its pension plan and Euro 421 thousand to

the SERP in 2011.

Other Benefits – US Holdings provides certain post–employment medical, disability and life insurance benefits. The Group’s

accrued liability related to this obligation as of December 31, 2010 and 2009 was Euro 1,880 thousand and Euro 1,360

thousand, respectively, and is included in other long–term liabilities in the consolidated statement of financial position.

US Holdings sponsors the following additional benefit plans, which cover certain present and past employees of some of

its US subsidiaries:

US Holdings provides, under individual agreements, post–employment benefits for continuation of health care a)

benefits and life insurance coverage to former employees after employment. As of December 31, 2010 and 2009, the

accrued liability related to these benefits was Euro 582 thousand and Euro 627 thousand, respectively, and is included

in other long–term liabilities in the consolidated statement of financial position.