LensCrafters 2010 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010> 162 |

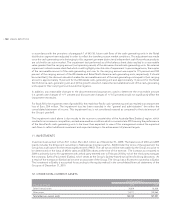

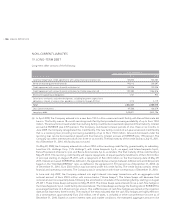

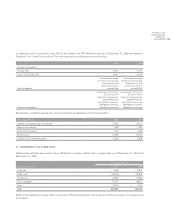

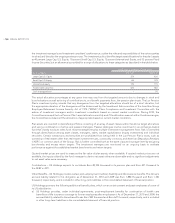

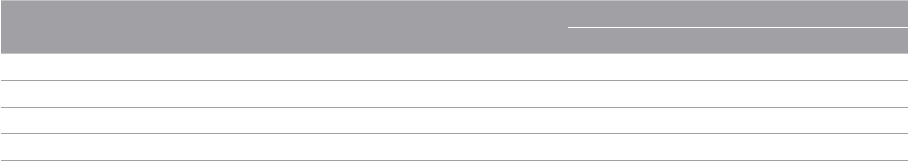

22. OTHER NON–CURRENT LIABILITIES

(thousands of Euro)

As of December 31,

2010 2009

Provision for risk 82,855 99,050

Other liabilities 113,077 113,517

Other financial liabilities 114,658 137,461

Total other non–current liabilities 310,590 350,028

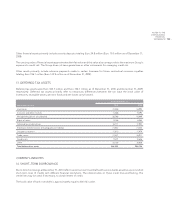

The provision for risks primarily includes:

accruals for “self–insurance” covering specific risks, amounting to Euro 26.9 million (Euro 25.2 million as of December 1.

31, 2009);

accruals for various legal disputes arising from normal business activities, totaling Euro 6.0 million (Euro 3.0 million as 2.

of December 31, 2009);

accruals for tax liabilities of Euro 37.5 million (Euro 51.3 million as of December 31, 2009). The decrease is primarily 3.

related to certain contingent tax liabilities for Euro 19.9 million originally recorded as part of the 2006 sale of our

Things Remembered retail business which either settled or expired. The release of the provision has been recorded

in the discontinued operation line within the consolidated statement of income as of 31 December 2010. The entire

discontinued operation relates to release of the tax reserve noted above.

Other liabilities primarily include the liabilities for U.S. pension funds.

The decrease of other financial liabilities as of December 31, 2010 as compared to December 31, 2009 was mainly due to

the payment of the financial liabilities relating to the purchase the remaining non–controlling interests in our subsidiary

SGH UK Ltd , which occurred on July 30, 2010 (the financial liabilities were Euro 31.2 million at December 31, 2009).

Information regarding post–employment employee benefits is provided below.

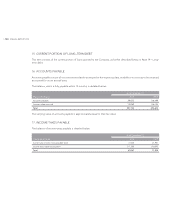

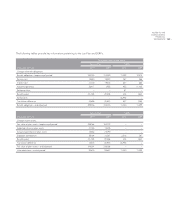

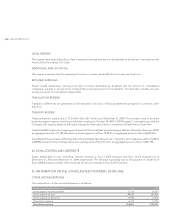

Pension funds

Qualified Pension Plans – US Holdings sponsors a qualified noncontributory defined benefit pension plan, the Luxottica

Group Pension Plan (“Lux Pension Plan”), which provides for the payment of benefits to eligible past and present

employees of US Holdings upon retirement. Pension benefits are gradually accrued based on length of service and annual

compensation under a cash balance formula. Participants become vested in the Lux Pension Plan after three years of

vesting service as defined by the Lux Pension Plan.

Nonqualified Pension Plans and Agreements – US Holdings also maintains a nonqualified, unfunded supplemental

executive retirement plan (“Lux SERP”) for participants of its qualified pension plan to provide benefits in excess of

amounts permitted under the provisions of prevailing tax law. The pension liability and expense associated with this plan

are accrued using the same actuarial methods and assumptions as those used for the qualified pension plan. This plan’s

benefit provisions mirror those of the Lux Pension Plan.

US Holdings also sponsors the Cole National Group, Inc. Supplemental Pension Plan. This plan is a nonqualified unfunded

SERP for certain participants of the former Cole pension plan who were designated by the Board of Directors of Cole

on the recommendation of Cole’s chief executive officer at such time. This plan provides benefits in excess of amounts

permitted under the provisions of the prevailing tax law. The pension liability and expense associated with this plan are

accrued using the same actuarial methods and assumptions as those used for the qualified pension plan.