LensCrafters 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ANNUAL REPORT 2010> 136 |

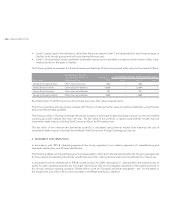

IFRS 9 – Financial instruments, issued in November 2009. This standard is the first step in the process to replace IAS 39 –

Financial instruments: recognition and measurement. IFRS 9 introduces new requirements for classifying and measuring

financial assets. The new standard reduces the number of categories of financial assets pursuant to IAS 39 and requires

that all financial assets be: (i) classified on the basis of the model which the company has adopted in order to manage its

financial activities and on the basis of the cash flows from financing activities; (ii) initially measured at fair value plus any

transaction costs in the case of financial assets not measured at fair value through profit and loss; and (iii) subsequently

measured at their fair value or at the amortized cost. IFRS 9 also provides that embedded derivatives which fall within the

scope of IFRS 9 must no longer be separated from the primary contract which contains them and states that the company

may decide to directly record – within the consolidated statement of comprehensive income any changes in the fair value

of investments which fall within the scope of IFRS 9. The standard is not applicable until 1 January 2013, but is available for

early adoption. The Group has not early adopted and has not yet assessed IFRS 9’s full impact.

IAS 24 (revised) – Related party disclosures issued in November 2009. It supersedes IAS 24, Related party disclosures,

issued in 2003. IAS 24 (revised) is mandatory for periods beginning on or after 1 January 2011 and earlier application, in

whole or in part, is permitted. The revised standard clarifies and simplifies the definition of a related party and removes

the requirement for government–related entities to disclose details of all transactions with the government and other

government–related entities.

IAS 32 amendment – Classification of rights issues issued in October 2009. The amendment applies to annual periods

beginning on or after 1 February 2010. Earlier application is permitted. The amendment addresses the accounting for rights

issues that are denominated in a currency other than the functional currency of the issuer. Provided certain conditions are

met, such rights issues are now classified as equity regardless of the currency in which the exercise price is denominated.

The amendment applies retrospectively in accordance with IAS 8 Accounting policies, changes in accounting estimates

and errors.

IFRIC 19 – Extinguishing financial liabilities with equity instruments, issued in November 2009, is effective from July 1,

2010. The interpretation clarifies the accounting by an entity when the terms of a financial liability are renegotiated and

result in the entity issuing equity instruments to a creditor of the entity to extinguish all or part of the financial liability. It

requires a gain or loss to be recognized in profit or loss, which is measured as the difference between the carrying amount

of the financial liability and the fair value of the equity instruments issued. If the fair value of the equity instruments issued

cannot be reliably measured, the equity instruments should be measured to reflect the fair value of the financial liability

extinguished.

IFRIC 14 amendments – Prepayments of a minimum funding requirement, issued in November 2009. The amendments

correct an unintended consequence of IFRIC 14, IAS 19 – The limit on a defined benefit asset, minimum funding

requirements and their interactions. Without the amendments, entities are not permitted to recognize as an asset certain

voluntary prepayments for minimum funding contributions. The amendments are effective for annual periods beginning

January 1, 2011. Earlier application is permitted.

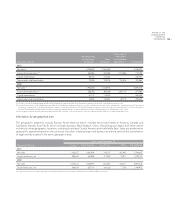

In May 2010, the IASB issued a series of amendments to IFRS (Improvements to IFRSs). Details are provided in the

following paragraphs for those identified by the IASB as resulting in accounting changes for presentation, recognition and

measurement purposes, excluding any amendments regarding changes in terminology or editorial changes.

IFRS 1 – • First–time Adoption of International Financial Reporting Standards: The improvement (i) extends the scope

for the use of the deemed cost exemption to allow an entity to recognize an event–driven fair value measurement as

deemed cost when the event occurs, provided that it is during the periods covered by its first IFRS financial statements,

(ii) permits entities with operations subject to rate regulation to use as deemed cost at the date of the transition to

IFRS the carrying amount of the items of property, plant and equipment or intangible assets determined under the

entity’s previous GAAP, and (iii) exempts a first–time adopters from all the requirements of IAS 8 for the interim

reports presented in accordance with IAS 34 for part of the period covered by its first IFRS financial statements and

for its first IFRS financial statements.