LensCrafters 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|139 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

The Group’s commercial exposure is regularly monitored through automated control instruments.

Moreover, the Group has entered into an agreement with the insurance company Euler Hermes Siac in order to

cover the credit risk associated with customers of Luxottica Extra Ltd. in those countries where the Group is not

present.

C2) With regards to credit risk related to the management of financial resources and cash availabilities, the risk is managed

and monitored by the Group Treasury Department through financial guidelines to ensure that all the Group subsidiaries

maintain relations with primary bank counterparties. Credit limits with respect to the primary financial counterparties

are based on evaluations and analyses that are implemented by the Group Treasury Department.

Within the Group there are various shared guidelines governing the relations with the bank counterparties, and all the

companies of the Group comply with the “Financial Risk Policy” directives.

Usually, the bank counterparties are selected by the Group Treasury Department and cash availabilities can be

deposited, over a certain limit, only with counterparties with elevated credit ratings, as defined in the policy.

Operations with derivatives are limited to counterparties with solid and proven experience in the trading and

execution of derivatives and with elevated credit ratings, as defined in the policy, in addition to being subordinate

to the undersigning of an ISDA Master Agreement. In particular, counterparty risk of derivatives is mitigated

through the diversification of the counterparty banks with which the Group deals. In this way, the exposure with

respect to each bank is never greater than 25 percent of the total amount of the derivatives portfolio of the

Group.

During the course of the year, there were no situations in which credit limits were exceeded. Based on the information

available to the Group, there were no potential losses deriving from the inability of the abovementioned counterparties

to meet their contractual obligations.

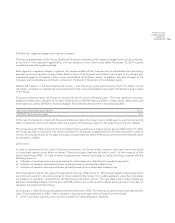

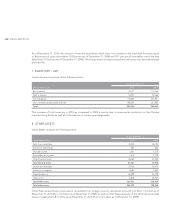

d) Liquidity risk

The management of the liquidity risk which originates from the normal operations of the Group involves the maintenance

of an adequate level of cash availabilities as well as financial availabilities through an adequate amount of committed

credit lines.

With regards to the policies and actions that are used to mitigate liquidity risks, the Group takes adequate actions in order

to meet its obligations. In particular, the Group:

utilizes debt instruments or other credit lines in order to meet liquidity requirements;•

utilizes different sources of financing and, as of December 31, 2010, had unused lines of credit of approximately Euro •

1,434.8 million (of which Euro 875 million are committed lines);

is not subject to significant concentrations of liquidity risk, both from the perspective of financial assets as well as in •

terms of financing sources;

utilizes different sources of bank financing but also a liquidity reserve in order to promptly meet any cash •

requirements;

implements systems to concentrate and manage the cash liquidity (Cash Pooling) in order to more efficiently manage •

the Group financial flows, thereby avoiding the dispersal of liquid funds and minimizing financial charges;

monitors, through the Treasury Department, forecasts on the utilization of liquidity reserves of the Group based on •

expected cash flows.

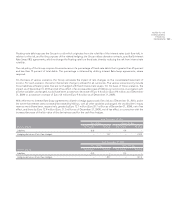

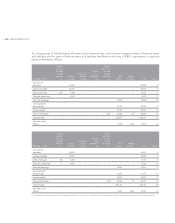

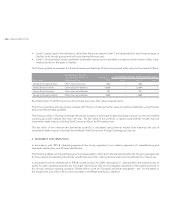

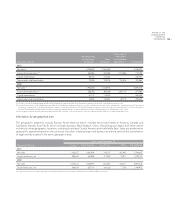

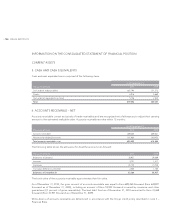

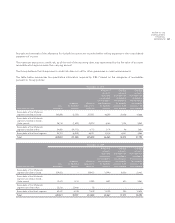

The following tables include a summary, by maturity date, of assets and liabilities at December 31, 2010 and December 31,

2009. The reported balances are contractual and undiscounted figures. With regards to forward foreign currency contracts,