LensCrafters 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|143 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

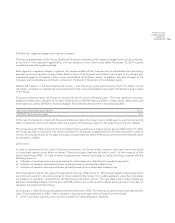

f) Default risk: negative pledges and financial covenants

The financing agreements of the Group (See Note 19) require compliance with negative pledges and financial covenants,

as set forth in the respective agreements, with the exception of our Bond issue dated November 15, 2015 requires

compliance only with negative pledge.

With regards to negative pledges, in general, the clauses prohibit of the Company and its subsidiaries from permitting

any liens or security interests on any of their assets in favor of third parties and without the consent of the lenders over

a threshold equal to 30 percent of the Group consolidated stockholders’ equity. In addition, the sale of assets of the

Company and its subsidiaries is limited to a maximum threshold of 30 percent of consolidated assets.

Default with respect to the abovementioned clauses – and following a grace period during which the default can be

remedied – would be considered with a material breach of the contractual obligations pursuant to the financing agreement

of the Group.

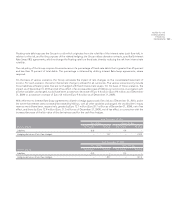

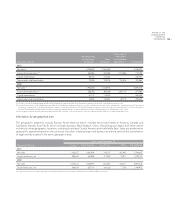

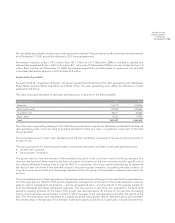

Financial covenants require the Group to comply with specific levels of financial ratios. The most significant covenants

establish a threshold for the ratio of net debt of the Group to EBITDA (Earnings before interest, taxes, depreciation and

amortization) as well as EBITDA to financial charges. The covenants are reported in the following table:

Net Financial Position/Pro forma EBITDA < 3.5 x

EBITDA/Pro forma financial charges > 5 x

In the case of a failure to comply with the abovementioned ratios, the Group may be called upon to pay the outstanding

debt if it does not correct such default within the a period of 15 business days from the date of reporting such default.

The compliance with these covenants is monitored by the Group at the end of each quarter and, as of December 31, 2010,

the Group was fully in compliance with these covenants. The Group also analyzes the trend of these covenants in order to

monitor its compliance and, as of today, the analysis indicates that the ratios of the Group are below the thresholds which

would result in default.

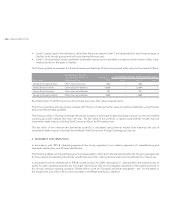

g) Fair value

In order to determine the fair value of financial instruments, the Group utilizes valuation techniques which are based

on observable market prices (Mark to Model). These techniques therefore fall within Level 2 of the hierarchy of Fair

Values identified by IFRS 7. In order to select the appropriate valuation techniques to utilize, the Group complies with the

following hierarchy:

Utilization of quoted prices in an active market for identical assets or liabilities (Comparable Approach);a)

utilization of valuation techniques that are primarily based on observable market prices;b)

utilization of valuation techniques that are primarily based on non–observable market prices.c)

The Group determined the fair value of the derivatives existing on December 31, 2010 through valuation techniques which

are commonly used for instruments similar to those traded by the Group. The models applied to value the instruments

are based on a calculation obtained from the Bloomberg information service. The input data used in these models are

based on observable market prices (the Euro and US$ interest rate curves as well as official exchange rates on the date of

valuation) obtained from Bloomberg.

As of January 1, 2009, the Group had adopted the amendments to IFRS 7 for financial instruments which are valued at fair

value. The amendments to IFRS 7 refer to valuation hierarchy techniques which are based on three levels:

Level 1: Inputs are quoted prices in an active market for identical assets or liabilities;•