LensCrafters 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|135 >

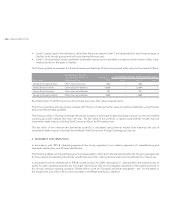

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

the loan contract and, accordingly, should not be recognized separately. Lastly, the amendment clarifies that gains or

losses on hedging instruments should be reclassified from equity to profit or loss in the period in which the hedged cash

flows affect profit or loss. IAS 39 was also amended to clarify how existing principles to determine whether a hedged risk

or portion of cash flows is eligible for designation should be applied in particular situations.

IFRIC 9 – Reassessment of Embedded Derivatives: This amendment excludes derivatives from the scope of application

of IFRIC 9 if they are embedded in contracts acquired through business combinations when jointly–controlled entities or

joint ventures are formed.

IFRS 2 – Share–based Payment: This amendment clarifies that IFRS 2 does not apply to transactions in which a company

acquires assets as part of (i) a business combination, as defined by IFRS 3 (revised), (ii) the contribution of a business unit

to form a joint venture or (iii) the combination of businesses or business units in jointly–controlled entities.

IFRS 5 – Non–current Assets Held for Sale and Discontinued Operations: This amendment clarifies that IFRS 5 and the

other IAS/IFRS standards, that make specific reference to non–current assets (or disposal groups) classified as held for

sale or discontinued operations set forth all required disclosures for these types of assets or operations. The standard was

also amended to require an entity that is committed to a sale plan involving loss of control of a subsidiary to classify all the

assets and liabilities of that subsidiary as held for sale, regardless of whether the entity retains a non–controlling interest

in its former subsidiary after the sale.

IAS 1 – Presentation of Financial Statements: This amendment updates the previous definition of current liabilities under

IAS 1. The previous definition required the classification of liabilities as current if they could be settled at any time through

the issuance of equity instruments. Following the change, the option of converting a liability into an equity instrument is

irrelevant for the purposes of its classification as current/non–current.

IAS 7 – Statement of Cash Flows: This amendment clarifies that only those cash flows that lead to the creation of an asset

can be classified as arising from investing activities in the statement of cash flows.

IAS 17 – Leasing: This amendment extends the general conditions of IAS 17, which allow for the classification of a lease

as finance or operating regardless of whether ownership is acquired at the end of the lease, to land under lease as

well. Previously, under IAS 17, land leases in which ownership was not acquired at the end of the lease were classified

as operating leases. At the adoption date, all land under current leases that have not yet expired should be measured

separately, with the retroactive recognition of a new lease accounted for as a finance lease, where applicable.

IAS 18 – Revenue: This revision specifies the criteria to consider when determining whether, within a transaction that

generates revenue, an entity is principal or agent. The identification of an entity as principal or agent determines how

revenue is recognized. If it acts as agent, revenue may be recognized solely from commissions.

IAS 38 – Intangible Assets: The amendment clarifies guidance in measuring the fair value of an intangible asset acquired

in a business combination and permits the grouping of intangible assets as a single asset if each asset has similar useful

economic lives.

IFRIC 16 – Hedges of a net investment in a foreign operation: The amendment states that, in a hedge of a net investment

in a foreign operation, qualifying hedging instruments may be held by any entity or entities within the group, including the

foreign operation itself, as long as the designation, documentation and effectiveness requirements of IAS 39 that relate

to a net investment hedge are satisfied. In particular, the group should clearly document its hedging strategy because of

the possibility of different designations at different levels of the group.

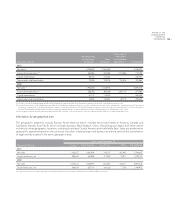

Amendments and interpretations of existing principles which are effective for reporting periods beginning after

January 1, 2010 and not early adopted.