LensCrafters 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ANNUAL REPORT 2010> 40 |

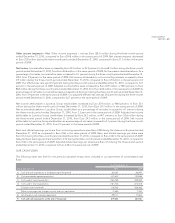

July

On July 30, 2010, we completed the acquisition of the 34.0 percent interest held by minority stockholders in Sunglass Hut

(UK) Limited, one of our English subsidiaries, for approximately GBP 27.8 million, bringing our ownership in this subsidiary

to 100 percent.

September

On September 30, 2010, the Company closed a private placement of Euro 100 million senior unsecured guaranteed

notes, issued in two series (Series G and Series H). The aggregate principal amounts of the Series G and Series H Notes

are Euro 50 million and Euro 50 million, respectively. The Series G Notes mature on September 15, 2017 and the Series H

Notes mature on September 15, 2020. Interest on the Series G Notes accrues at 3.75 percent per annum and interest on

the Series H Notes accrues at 4.25 percent per annum. The Notes contain certain financial and operating covenants. The

Company was in compliance with those covenants as of December 31, 2010. The proceeds from the Notes, were used for

general corporate purposes.

October

On October 5, 2010, Luxottica Group S.p.A. announced the signing of a license agreement with Coach Inc. for the design,

manufacturing and global distribution of sun and prescription eyewear under the Coach, Coach Poppy and Reed Krakoff

brands. Distribution of Coach eyewear collections will be through Coach stores across the world, through select department

stores primarily in North America, Japan, China and other countries in East Asia as well as through select travel retail

locations, independent optical locations and Luxottica’s retail chains. The agreement, which includes a renewal option,

will begin on January 2012 and the first collection will be presented during 2012.

November

On November 10, 2010, the Company issued senior long–term notes to institutional investors (Eurobond dated November

10, 2015) for an aggregate principal amount of Euro 500 million. The notes mature on November 10, 2015 and the fixed

gross coupon is equal to 4.00 percent. The notes are listed on the Luxembourg Stock Exchange (ISIN XS0557635777). The

notes were issued in order to exploit favorable market conditions and extend the average maturity of the Group’s debt.

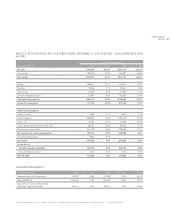

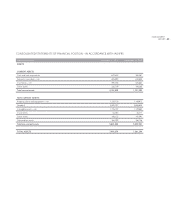

3. FINANCIAL RESULTS

We are a global leader in the design, manufacture and distribution of fashion, luxury and sport eyewear, with net sales

reaching Euro 5.8 billion in 2010, approximately 62,000 employees and a strong global presence. We operate in two

industry segments: (i) manufacturing and wholesale distribution; and (ii) retail distribution. See Note 4 to the Notes to

the Consolidated financial statements as of December 31, 2010 for additional disclosures about our operating segments.

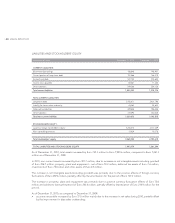

Through our manufacturing and wholesale distribution segment, we are engaged in the design, manufacture, wholesale

distribution and marketing of house and designer lines of mid– to premium–priced prescription frames and sunglasses. We

operate our retail distribution segment principally through our retail brands, which include, among others, LensCrafters,

Sunglass Hut, Pearle Vision, OPSM, Laubman & Pank, Budget Eyewear, Bright Eyes, Oakley “O” Stores and Vaults, David

Clulow and our Licensed Brands (Sears Optical and Target Optical).

As a result of our numerous acquisitions and the subsequent expansion of our business activities in the United States

through these acquisitions, our results of operations, which are reported in Euro, are susceptible to currency rate fluctuations

between the Euro and the U.S. dollar. The Euro/U.S. dollar exchange rate has fluctuated from an average exchange rate

of Euro 1.00 = US$ 1.3947 in 2009 to Euro 1.00 = US$ 1.3257 in 2010. Additionally, with the acquisition of OPSM and Bright

Eyes (acquired through Oakley), our results of operations are susceptible to currency fluctuations between the Euro and

the Australian dollar. Although we engage in certain foreign currency hedging activities to mitigate the impact of these

fluctuations, they have impacted our reported revenues and expenses during the periods discussed herein.