LensCrafters 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

|161 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

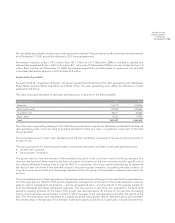

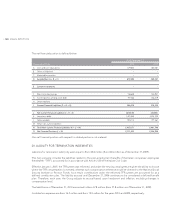

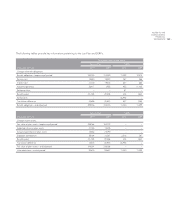

In application of Accounting Principle IAS 19, the valuation of TFR liability accrued as of December 31, 2006 was based on

Projected Unit Credit Cost method. The main assumptions utilized are reported below:

2010 2009

Economic assumptions

Discount rate 4.60% 5.10%

Annual TFR increase rate 3.00% 3.00%

Death probability:

Those determined by

the General Accounting

Department of the

Italian Government,

named RG48

Those determined by

the General Accounting

Department of the

Italian Government,

named RG48

Retirement probability:

assuming the attainment

of the first of the

retirement requirements

applicable for the

Assicurazione Generale

Obbligatoria (General

Mandatory Insurance)

assuming the attainment

of the first of the

retirement requirements

applicable for the

Assicurazione Generale

Obbligatoria (General

Mandatory Insurance)

Movements in liabilities during the course of the year are detailed in the following table:

(thousands of Euro) 2010 2009

Liabilities at the beginning of the period 37,829 39,712

Expenses for interests 1,929 2,090

Actuarial loss (income) 1,575 (819)

Benefits paid (3,495) (3,154)

Liabilities at the end of the period 37,838 37,829

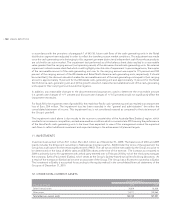

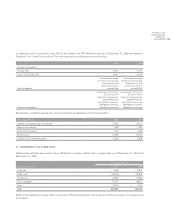

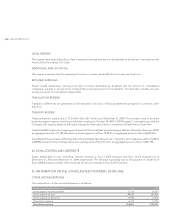

21. DEFERRED TAX LIABILITIES

Deferred tax liabilities amounted to Euro 429.8 million and Euro 396.0 million, respectively, as of December 31, 2010 and

December 31, 2009.

(thousands of Euro)

As of December 31,

2010 2009

Dividends 5,689 10,813

Trade name 236,346 225,678

Fixed assets 76,940 51,642

Other intangibles 91,357 98,811

Other 19,516 9,105

Total 429,848 396,048

Deferred tax liabilities primarily refer to temporary differences between the tax base and the book value of intangible and

fixed assets.