LensCrafters 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|123 >

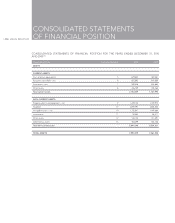

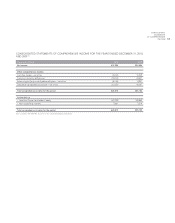

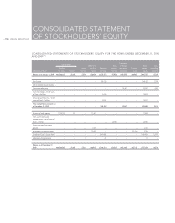

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

The presentation of certain prior year information has been reclassified to conform to the current presentation. In

particular, the Group reclassified Euro 8,604 thousand from selling expenses to general and administrative expenses in

the consolidated statement of income.

The Company’s reporting currency for the presentation of the consolidated financial statements is the Euro. Unless

otherwise specified, the figures in the statements and within these notes to the consolidated financial statements are

expressed in thousands of Euro.

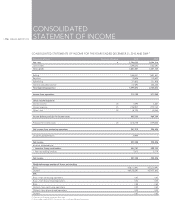

The Company presents its consolidated statement of income using the function of expense method. The Company

presents current and non–current assets and current and non–current liabilities as separate classifications in its consolidated

statements of financial position. This presentation of the consolidated statement of income and of the statement of

financial position is believed to provide the most relevant information. The statement of the consolidated cash flows was

prepared and presented utilizing the indirect method.

The financial statements were prepared using the historical cost convention, with the exception of certain financial assets

and liabilities for which measurement at fair value is required.

The consolidated financial statements have been prepared on a going concern basis. Management believes that, there

are no material uncertainties that may cast significant doubt upon the Group’s ability to continue as a going concern.

1. CONSOLIDATION PRINCIPLES, CONSOLIDATION AREA AND SIGNIFICANT ACCOUNTING

POLICIES

CONSOLIDATION PRINCIPLES

Subsidiaries

Subsidiaries are any entities over which the Group has the power to govern the financial and operating policies

(as defined by IAS 27 – Consolidated and Separate Financial Statements), generally with an ownership of more

than one half of the voting rights. The existence and effect of potential voting rights that are currently exercisable

or convertible are considered when assessing whether the Group controls another entity. Subsidiaries are fully

consolidated from the date on which control is transferred to the Group. They are deconsolidated from the date

that control ceases.

The Group uses the acquisition method of accounting to account for business combinations. The consideration

transferred for the acquisition of a subsidiary is measured as the fair value of the assets transferred, the liabilities

incurred and the equity interests issued by the Group. The consideration transferred includes the fair value of any asset

or liability resulting from a contingent consideration arrangement. Acquisition–related costs are expensed as incurred.

Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date. On an acquisition–by–acquisition basis, the Group recognizes any

non–controlling interest in the acquiree either at fair value or at the non–controlling interest’s proportionate share of

the acquiree’s net assets.

The excess of the consideration transferred, the amount of any non–controlling interest in the acquiree and the acquisition

date fair value of any previous equity interest in the acquiree over the fair value of the Group’s share of the identifiable net

assets acquired is recorded as goodwill. If this is less than the fair value of the net assets of the subsidiary acquired in the

case of a bargain purchase, the difference is recognized directly in the consolidated statement of income.

In business combinations achieved in stages, the Group remeasures its previously held equity interest in the acquiree at

its acquisition date fair value and recognizes the resulting gain or loss, if any, in profit and loss.