LensCrafters 2010 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

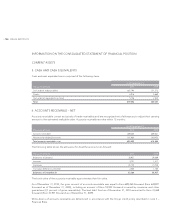

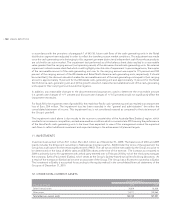

ANNUAL REPORT 2010> 152 |

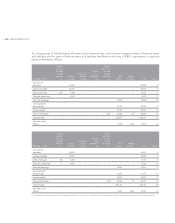

in accordance with the provisions of paragraph 7 of IAS 36, future cash flows of the cash–generating units in the Retail

distribution segment were adjusted in order to reflect the transfer prices at market conditions. This adjustment was made

since the cash generating units belonging to this segment generate distinct and independent cash flows whose products

are sold within an active market. The impairment test performed as of the balance sheet date resulted in a recoverable

value greater than the carrying amount (net operating assets) of the abovementioned cash–generating units. No external

impairment indicators were identified which could highlight potential risks of impairment. In percentage terms, the surplus

of the recoverable amount of the cash–generating unit over its the carrying amount was equal to 115 percent and 182

percent of the carrying amount of the Wholesale and Retail North America cash–generating units, respectively: It should

be noted that (i) the discount rate which makes the recoverable amount of the cash generating units equal to their carrying

amount is approximately 13 percent for the Wholesale cash–generating unit and approximately 17 percent for the Retail

North America cash–generating unit, and (ii) the growth rate which makes the recoverable amount of the cash–generating

units equal to their carrying amounts would be negative.

In addition, any reasonable changes to the abovementioned assumptions used to determine the recoverable amount

(i.e. growth rate changes of +/–1 percent and discount rate changes of +/–0.5 percent) would not significantly affect the

impairment test results.

For fiscal 2010, the impairment test of goodwill for the retail Asia–Pacific cash–generating unit has resulted in an impairment

loss of Euro 20.4 million. The impairment loss has been recorded in the “general and administrative” line within the

consolidated statement of income. This impairment loss is not considered material as compared to the total amount of

the Group’s goodwill.

The impairment noted above is due mostly to the economic uncertainties of the Australia–New Zealand, region, which

resulted in an increase in competition, and adverse weather conditions which occurred in late 2010 causing the performance

of the Asia–Pacific cash–generating units to be lower than expected. In view of this management revised the expected

cash flows to reflect additional investment and expected delays in the achievement of planned targets.

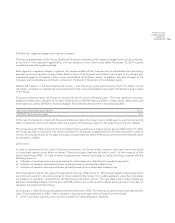

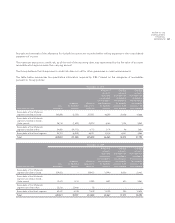

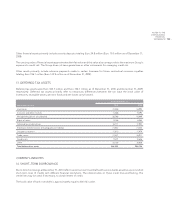

11. INVESTMENTS

Investments amounted to Euro 54.1 million (Euro 46.3 million as of December 31, 2009). The balance as of 2010 and 2009

mainly includes the 40 percent ownership in Multiopticas Internacional S.L. (MOI) Under the terms of the agreement the

Group has a call option for the remaining 60 percent of MOI. The call option will be exercisable by the Group at a price to

be determined on the basis of MOI’s sales and EBITDA values at the time of the exercise. .The increase as compared to

2009 is primarily due to the agreement with a third party entered into in February 2010 by which the third party manages

the company, Eyebiz Pty Limited (Eyebiz), which serves as the Group’s Sydney–based optical lens finishing laboratory. .As

a result of the transaction Eyebiz has become an associate of the Group. The Group has a 30 percent ownership in Eyebiz

The investment in Eyebiz is accounted for according to the equity method in the consolidated financial statements of the

Group as of December 31, 2010.

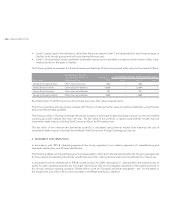

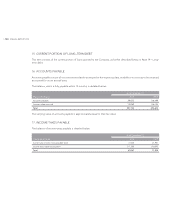

12. OTHER NON–CURRENT ASSETS

(thousands of Euro)

As of December 31,

2010 2009

Other financial assets 34,014 18,026

Other assets 114,111 129,565

Total other non–current assets 148,125 147,591