LensCrafters 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|177 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

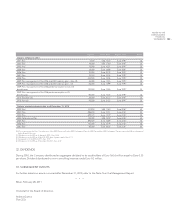

Interest rate swaps

The notional amount of the existing interest rate swap instruments still effective as of December 31, 2009 is reported in

the following table:

Notional amount Currency

1,525,000,000 US$

250,000,000 Euro

31. SHARE–BASED PAYMENTS

Beginning in April 1998, certain officers and other key employees of the Company and its subsidiaries were granted

stock options of Luxottica Group S.p.A. under the Company’s stock option plans (the “plans”). In order to strengthen the

loyalty of some key employees – with respect to individual targets, and in order to enhance the overall capitalization of the

Company – the Company’s stockholders meetings approved three stock capital increases on March 10, 1998, September

20, 2001 and June 14, 2006, respectively, through the issuance of new common shares to be offered for subscription to

employees. On the basis of these stock capital increases, the authorized share capital was equal to Euro 29,537,918.57.

These options become exercisable in either three equal annual installments, two equal annual installments in the second

and third years of the three–year vesting period or 100 percent vesting on the third anniversary of the date of grant.

Certain options may contain accelerated vesting terms if there is a change in ownership (as defined in the plans).

The stockholders’ meeting has delegated the Board of Directors to effectively execute, in one or more installments, the

stock capital increases and to grant options to employees. The Board can also:

establish the terms and conditions for the underwriting of the new shares;•

request the full payment of the shares at the time of their underwriting;•

identify the employees to grant the options based on appropriate criteria;•

regulate the effect of the termination of the employment relationships with the Company or its subsidiaries and the •

effects of the employee death on the options granted by specific provision included in the agreements entered into

with the employees.

Upon execution of the proxy received from the Stockholders’ meeting, the Board of Directors has granted a total of

51,794,300 options of which, as of December 31, 2010, 15,577.210 have been exercised.

On April 29 2010, the Board of Directors granted 703,500 options to employees domiciled in the United States with a fair

value of Euro 5.41 per option as well as 1,221,000 options to employees domiciled outside the United States with a fair

value of Euro 5.59.

On May 7, 2009, the Board of Directors authorized the reassignment of new options to employees who were then

beneficiaries of the Company’s 2006 and 2007 ordinary plans and the Company’s 2006 performance plan, which,

considering market conditions and the financial crisis, had an exercise price that was undermining the performance

incentives that typically form the foundation of these plans. The new options’ exercise price was consistent with the

market values of Luxottica shares being equal to the greater of the stock price on the grant date of the new options

or the previous 30–day average. In connection with the reassignment of options related to the Company’s 2006 and

2007 ordinary plans, the employees who surrendered their options received the right to purchase the same number

of Luxottica Group ordinary shares that were subject to the options he or she previously held for a total amount

of 2,885,000 options. For the new options assigned to the U.S. citizen beneficiaries of the 2006 and 2007 plans, the

Company recognized an incremental fair value per share of Euro 2.16 and Euro 2.20, respectively. For the new options

assigned to the non U.S. citizen beneficiaries of the 2006 and 2007 plans, the Company recognized an incremental fair

value per share of Euro 2.68 and Euro 2.77, respectively.