LensCrafters 2010 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|167 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

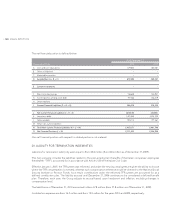

US Holdings established and maintains the Cole National Group, Inc. Supplemental Retirement Benefit Plan, which b)

provides supplemental retirement benefits for certain highly compensated and management employees who were

previously designated by the former Board of Directors of Cole as participants. This is an unfunded noncontributory

defined contribution plan. Each participant’s account is credited with interest earned on the average balance during

the year. This plan was frozen as to future salary credits on the effective date of the Cole acquisition in 2004. The plan

liability of Euro 848 thousand and Euro 869 thousand at December 31, 2010 and 2009, respectively, is included in other

long–term liabilities in the consolidated statement of financial position.

The Group continues to participate in superannuation plans in Australia and Hong Kong. The plans provide benefits on a

defined contribution basis for employees upon retirement, resignation, disablement or death. Contributions to defined

contribution superannuation plans are recognized as an expense as the contributions are paid or become payable to the

fund. Contributions are accrued based on legislated rates and annual compensation. The Group’s accrued liability related

to this obligation as of December 31, 2010 and 2009 was Euro 3,642 thousand and Euro 3,045 thousand, respectively, and

is included in other long–term liabilities in the consolidated statement of financial position.

Health Benefit Plans – US Holdings partially subsidizes health care benefits for eligible retirees. Employees generally

become eligible for retiree health care benefits when they retire from active service between the ages of 55 and 65.

Benefits are discontinued at age 65. During 2009, US Holdings provided for a one–time special election of early retirement

to certain associates age 50 or older with 5 or more years of service. Benefits for this group are also discontinued at age

65 and the resulting special termination benefit is immaterial.

The plan liability of Euro 3,277 thousand and Euro 3,482 thousand at December 31, 2010 and 2009, respectively, is included

in other long–term liabilities on the consolidated statement of financial position.

The cost of this plan in 2010 and 2009 as well as the 2011 expected contributions are immaterial.

For 2011, a 9.5 percent (10.0 percent for 2010) increase in the cost of covered health care benefits was assumed. This

rate was assumed to decrease gradually to 5 percent for 2020 and remain at that level thereafter. The health care cost

trend rate assumption could have a significant effect on the amounts reported. A 1.0 percent increase or decrease in the

health care trend rate would not have a material impact on the consolidated financial statements. The weighted–average

discount rate used in determining the accumulated postretirement benefit obligation was 5.5 percent at December 31,

2010 and 6.15 percent at December 31, 2009.

The weighted–average discount rate used in determining the net periodic benefit cost for 2010, 2009 and 2008 was 6.15

percent and 6.3 percent, respectively.

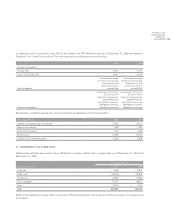

23. LUXOTTICA GROUP STOCKHOLDERS’ EQUITY

CAPITAL STOCK

The share capital of Luxottica Group S.p.A., as of December 31, 2010, amounts to Euro 27,964,632.60 and is comprised of

466,077,210 ordinary shares with a par value of Euro 0.06 each.

As of January 1, 2010, the share capital amounted to Euro 27,863,182.98 and was comprised of 464,386,383 ordinary shares

with a par value of Euro 0.06 each.

Following the exercise of 1,690,827 options to purchase ordinary shares granted to employees under existing stock option

plans, the share capital grew by Euro 101,449.62 during 2010.

The total options exercised in 2010 were 1,690,827, of which 164,400 refer to the 2001 Plan, 482,350 refer to the 2002 Plan,

221,200 refer to the 2003 Plan, 368,877 refer to the 2004 Plan, 235,000 refer to the Extraordinary 2004 Plan, and 219,000

refer to the 2005 Plan.