LensCrafters 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2010> 144 |

Level 2: Inputs used in the valuations, other than the prices listed in Level 1, are observable for each financial asset or •

liability, both directly (prices) and indirectly (derived from prices);

Level 3: Unobservable inputs used when observable inputs are not available in situations where there is little, if any, •

market activity for the asset or liability.

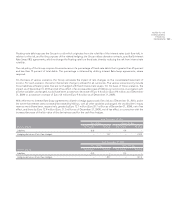

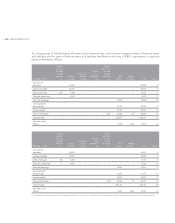

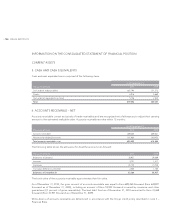

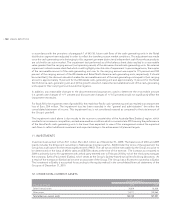

The following table summarizes the financial assets and liabilities of the Group valued at fair value (in thousands of Euro):

Description

Classification within the

consolidated statement of

financial position

December 31,

2010

Fair value measurements at reporting date using:

Level 1 Level 2 Level 3

Foreign Exchange Contracts Other short–term assets 1,484 – 1,484 –

Interest Rate Derivatives Other long–term liabilities 52,964 – 52,964 –

Interest Rate Derivatives Other short–term liabilities 901 – 901 –

Foreign Exchange Contracts Other short–term liabilities 4,689 – 4,689 –

As of December 31, 2010, the Group did not have any Level 3 fair value measurements.

The Group maintains policies and procedures with the aim of valuing the fair value of assets and liabilities using the best

and most relevant data available.

The Group portfolio of foreign exchange derivatives includes only forward foreign exchange contracts on the most traded

currency pairs with maturity less than one year. The fair value of the portfolio is valued using internal models that use

observable market inputs including Yield Curves and Spot and Forward prices.

The fair value of the interest rate derivatives portfolio is calculated using internal models that maximize the use of

observable market inputs including Interest Rates, Yield Curves and Foreign Exchange Spot prices.

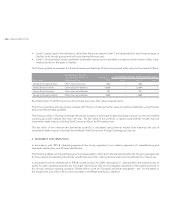

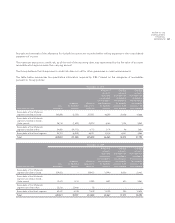

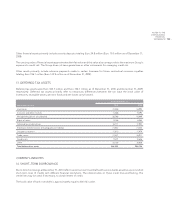

4. SEGMENT INFORMATION

In accordance with IFRS 8, Operating segments the Group operates in two industry segments: (1) manufacturing and

wholesale distribution, and (2) retail distribution.

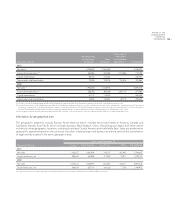

The following tables summarize the segment and geographic information deemed essential by the Group’s management

for the purpose of evaluating the Group’s performance and for making decisions about future allocations of resources.

In accordance with an amendment to IFRS 8, issued on April 16, 2009, starting from 1, January 2010, the total amounts of

assets for each reporting segment are no longer disclosed as they are not regularly reported to the highest authority in

the Group’s decision–making operation. Please refer to note 10 “Goodwill and other intangibles – net” for the detail on

the impairment loss of Euro 20.4 million recorded in the Retail distribution segment.