LensCrafters 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

ANNUAL REPORT 2010> 140 |

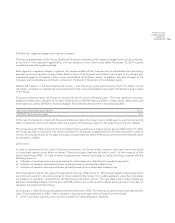

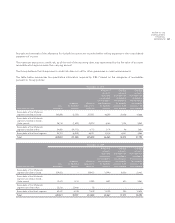

the tables relating to assets report the flows relative to only receivables. These amounts will be counterbalanced by the

payables, as reported in the tables relating to liabilities. With regards to interest rate swaps, the cash flows include the

settlement of the interest spread, both positive and negative, which expire during different periods. The various maturity

date categories represent the period of time between the date of the financial statements and the contractual maturity

date of the obligations, whether receivable or payable.

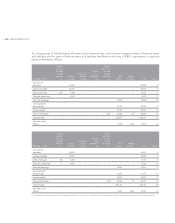

As of December 31, 2010 (thousands of Euro)

Less than

1 year

From

1 to 3 years

From

3 to 5 years

Beyond

5 years

Cash and cash equivalents 679,852 – – –

Derivatives receivable 2,183 – – –

Accounts receivable 655,892 – – –

Other current assets 63,327 – – –

As of December 31, 2009 (thousands of Euro)

Less than

1 year

From

1 to 3 years

From

3 to 5 years

Beyond

5 years

Cash and cash equivalents 380,081 – – –

Derivatives receivable 733 – 262 –

Accounts receivable 618,884 – – –

Other current assets 73,956 – – –

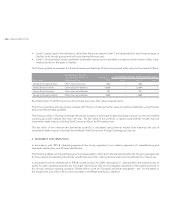

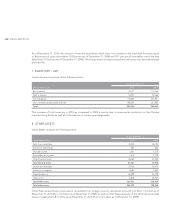

As of December 31, 2010 (thousands of Euro)

Less than

1 year

From

1 to 3 years

From

3 to 5 years

Beyond

5 years

Debt owed to banks and other financial institutions 428,385 1,321,627 959,664 374,975

Derivatives payable 44,951 20,505 – –

Accounts payable 537,742 – – –

Other current liabilities 440,590 – – –

As of December 31, 2009 (thousands of Euro)

Less than

1 year

From

1 to 3 years

From

3 to 5 years

Beyond

5 years

Debt owed to banks and other financial institutions 882,229 1,112,841 676,271 207,798

Derivatives payables 38,729 19,423 – –

Accounts payable 434,604 – – –

Other current liabilities 461,709 – – –

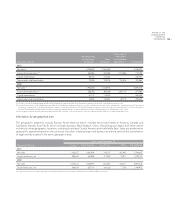

e) Interest rate risk

The interest rate risk to which the Group is exposed primarily originates from long–term debt. Such debt accrues interest

at both fixed and floating rates.

With regards to the risk arising from fixed–rate debt, the Group does not apply specific hedging policies since it does not

deem the risk to be material.