LensCrafters 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.|61 >

MANAGEMENT

REPORT

R) WE ARE EXPOSED TO CREDIT RISK ON OUR ACCOUNTS RECEIVABLE. THIS RISK IS HEIGHTENED DURING

PERIODS WHEN ECONOMIC CONDITIONS WORSEN

A substantial majority of our outstanding trade receivables are not covered by collateral or credit insurance. While we have

procedures to monitor and limit exposure to credit risk on our trade and non–trade receivables, there can be no assurance

such procedures will effectively limit our credit risk and avoid losses, which could have a material adverse effect on our

results of operations.

S) UNFORESEEN OR CATASTROPHIC LOSSES NOT COVERED BY INSURANCE COULD MATERIALLY ADVERSELY

AFFECT OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION

For certain risks, we do not maintain insurance coverage because of cost and/or availability. Because we retain some

portion of our insurable risks, and in some cases self–insure completely, unforeseen or catastrophic losses in excess of

insured limits could materially adversely affect our results of operations and financial condition.

T) CHANGES IN OUR TAX RATES OR EXPOSURE TO ADDITIONAL TAX LIABILITIES COULD AFFECT OUR FUTURE

RESULTS

We are subject to taxes in Italy, the United States and numerous other foreign jurisdictions. Our future effective tax rates

could be affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation

of deferred tax assets and liabilities, or changes in tax laws or their interpretation. Any of these changes could have a

material adverse effect on our profitability. We also are regularly subject to the examination of our income tax returns by

the U.S. Internal Revenue Service as well as the governing tax authorities in other countries where we operate. We routinely

assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our provision

for taxes. Currently, some of our companies are under examination by the tax authorities in the United States, Italy and

other jurisdictions. There can be no assurance that the outcomes of the current ongoing examinations and possible future

examinations will not materially adversely affect our business, results of operations, financial condition and prospects.

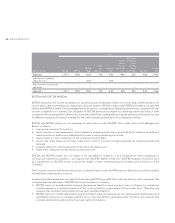

11. 2011 OUTLOOK

The results achieved in 2010 and the strength of Luxottica’s business model and of its brands put the Group in an ideal position

to continue throughout 2011 with solid, stable growth in net sales and a more than proportionate increase in profitability.

In addition to the growth trends enjoyed worldwide by the premium and luxury brands, which are expected to continue in

2011 at double–digit rates, there will be four main engines behind Luxottica’s growth for this year: further development in

emerging markets, the global expansion of Sunglass Hut, growth in the United States and the potential of Oakley.

• Development in emerging markets

In 2011, emerging markets will represent a formidable driving force for both Luxottica Segments. These countries, which

already today account for approximately 15 percent of the net sales of the Wholesale segment and 7 percent of the

Group’s consolidated sales, have recorded excellent results over the last 6 years, with a 220 percent increase in sales. It

is expected that in 2011 Luxottica will continue this trend of sustained development: net sales of the Wholesale segment

in these countries are expected to increase by about 20 percent. Luxottica has highlighted three geographic areas within

emerging markets: the Big markets (including China, India, Brazil and Mexico), the Mature markets (including Singapore,

Hong Kong, Taiwan and Chile) and the New markets (including Thailand, Vietnam, Indonesia, Colombia and Peru). For

each area, a specific strategy has been developed over time, including the introduction of special initiatives and collections,

with the aim of stimulating demand and increasing penetration of Luxottica’s brands. In Asia in particular, volumes sold in

the Big emerging markets are expected to grow by 120 percent over the next three years, in the Mature emerging markets

by approximately 30 percent and in the New emerging markets by 60 percent. The volumes sold in the New emerging

markets in Latin America over the next three years are expected to increase by approximately 60 percent.