LensCrafters 2010 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2010 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|179 >

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

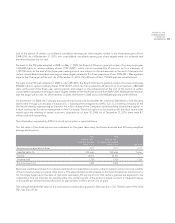

end of the period of certain consolidated cumulative earnings per share targets related to the three–year period from

2008–2010. As of December 31, 2010, the consolidated cumulative earning per share targets were not achieved and

therefore the plan did not vest.

Pursuant to the PSP plan adopted in 2008, on May 7, 2009, the Board of Directors granted certain of our key employees

1,435,000 rights to receive ordinary shares (“PSP 2009”), which can be increased by 25 percent up to a maximum of

1,793,750 units, at the end of the three–year vesting period, and subject to the achievement at the end of the period of

certain consolidated cumulative earning per share targets related to the three–year period from 2009–2011. Management

expects that the target will be met. As of December 31, 2010, 181,250 units of the 1,793,500 granted were forfeited.

Pursuant to the PSP plan adopted in 2008, on April 29, 2010, the Board of Directors granted certain of our key employees

692,000 rights to receive ordinary shares (“PSP 2010”), which can be increased by 25 percent up to a maximum of 865,000

units, at the end of the three–year vesting period, and subject to the achievement at the end of the period of certain

consolidated cumulative earning per share targets related to the three–year period from 2010–2012. Management expects

that the target will be met. As of December 31, 2010, there were 12,500 units of the 865,000 granted were forfeited.

On September 14, 2004, the Company announced that its majority stockholder, Mr. Leonardo Del Vecchio, had allocated

shares held through La Leonardo Finanziaria S.r.l. (subsequently merged into Delfin S.à r.l.), a holding company of the

Del Vecchio family, representing at that time 9.6 million shares of the Company’s authorized and issued share capital, to

a stock option plan for senior management of the Company. The stock options to be issued under the stock option plan

vested upon the meeting of certain economic objectives as of June 30, 2006. As of December 31, 2010, there were 8.1

million units still outstanding.

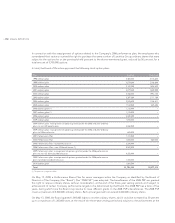

The information requested by IFRS 2 on stock option plans is reported below.

The fair value of the stock options was estimated on the grant date using the binomial model and following weighted

average assumptions:

2010

Ordinary Plan –

for citizens resident

in the U.S.A.

2010

Ordinary Plan –

for citizens not resident

in the U.S.A. PSP 2010

Share price at the grant date (in Euro) 21.17 21.17 21.17

Expected option life 5.48 years 5.48 years 3 years

Volatility 30.35% 30.35% –

Dividend yield 1.75% 1.75% 1.75%

Risk–free interest rate 2.26% 2.26% –

Expected volatilities are based on implied volatilities from traded share options on the Company’s stock, historical volatility

of the Company’s share price and other factors. The expected option life is based on the historical exercise experience for

the Company based upon the date of grant and represents the period of time that options granted are expected to be

outstanding. The risk–free rate for periods within the contractual life of the option is based on the U.S. Federal Treasury

or European government bond yield curve, as appropriate, in effect at the time of grant.

The average weighted fair value of the stock options under plans granted in 2010 was Euro 5.52. The fair value of the 2010

PSP, was Euro 20.10.