Kroger 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

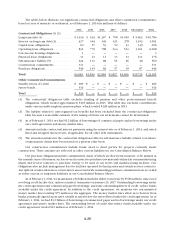

A-24

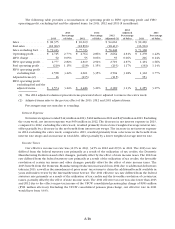

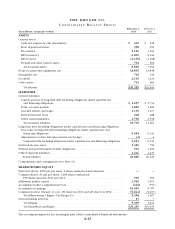

Net cash used by investing activities

Cash used by investing activities was $4.8 billion in 2013, compared to $2.2 billion in 2012 and

$1.9 billion in 2011. The amount of cash used by investing activities increased in 2013, compared to 2012, due

to increased payments for capital investments and acquisitions. The amount of cash used by investing activities

increased in 2012, compared to 2011, due to increased payments for capital investments and acquisitions.

Capital investments, including changes in construction-in-progress payables and excluding acquisitions, were

$2.4 billion in 2013, $2.1 billion in 2012 and $2.0 billion in 2011. Acquisitions were $2.3 billion in 2013,

$122 million in 2012 and $51 million in 2011. The increase in payments for acquisitions in 2013, compared

to 2012 was primarily due to our merger with Harris Teeter. Refer to the “Capital Investments” section for an

overview of our supermarket storing activity during the last three years.

Net cash used by financing activities

Financing activities provided (used) cash of $1.6 billion in 2013, ($600) million in 2012 and ($1.4) billion

in 2011. The increase in cash provided by financing activities in 2013, compared to 2012, was primarily related

to increased proceeds from the issuance of long-term debt, primarily to finance our merger with Harris Teeter,

and a reduction in payments on long-term debt and treasury stock purchases, offset partially by net payments

on our commercial paper program. The decrease in the amount of cash used for financing activities in 2012,

compared to 2011, was primarily related to increased proceeds from the issuance of long-term debt and net

borrowings from our commercial paper program, offset partially by payments on long-term debt. Proceeds

from the issuance of long-term debt were $3.5 billion in 2013, $863 million in 2012 and $453 million in 2011.

Proceeds (payments) provided from our commercial paper program were ($395) million in 2013, $1.3 billion

in 2012 and $370 million in 2011. Please refer to the “Debt Management” section for additional information. We

repurchased $609 million of Kroger common shares in 2013, compared to $1.3 billion in 2012 and $1.5 billion

in 2011. We paid dividends totaling $319 million in 2013, $267 million in 2012 and $257 million in 2011.

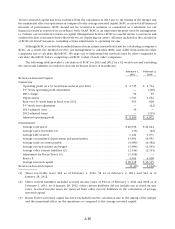

Debt Management

Total debt, including both the current and long-term portions of capital lease and lease-financing

obligations increased $2.4 billion to $11.3 billion as of year-end 2013, compared to 2012. The increase in

2013, compared to 2012, resulted from the issuance of (i) $600 million of senior notes bearing an interest

rate of 3.85%, (ii) $400 million of senior notes bearing an interest rate of 5.15%, (iii) $500 million of senior

notes bearing an interest rate of 3-month London Inter-Bank Offering Rate (“LIBOR”) plus 53 basis points,

(iv) $300 million of senior notes bearing an interest rate of 1.2%, (v) $500 million of senior notes bearing an

interest rate of 2.3%, (vi) $700 million of senior notes bearing an interest rate of 3.3%, and (vii) $500 million of

senior notes bearing an interest rate of 4.0%, offset partially by a reduction in commercial paper of $395 million

and payments at maturity of $400 million of senior notes bearing an interest rate of 5.0% and $600 million

of senior notes bearing an interest rate of 7.5%. This increase in financing obligations was due to partially

funding our merger with Harris Teeter, refinancing our debt maturities in 2013 and replacing the senior notes

that matured in fourth quarter of 2012, offset partially by the payment at maturity of our $400 million of

senior notes bearing an interest rate of 5.0%, $600 million of senior notes bearing an interest rate of 7.5% and

a reduction in commercial paper of $395 million.

Total debt, including both the current and long-term portions of capital leases and lease-financing

obligations increased $714 million to $8.9 billion as of year-end 2012, compared to 2011. The increase in

2012, compared to 2011, resulted from increased borrowings of $1.3 billion of commercial paper supported

by our credit facility and the issuance of (i) $500 million of senior notes bearing an interest rate of 3.4% and

(ii) $350 million of senior notes bearing an interest rate of 5.0%, offset partially by payments at maturity of

(i) $491 million of senior notes bearing an interest rate of 6.75%, (ii) $346 million of senior notes bearing an

interest rate of 6.2% and (iii) $500 million of senior notes bearing an interest rate of 5.5%. This increase in

financing obligations was primarily to fund our $258 million UFCW consolidated pension plan contribution

in the fourth quarter of 2012, prefunding $250 million of employee benefit costs at the end of 2012, to

repurchase common shares, pay at maturity $500 million of senior notes bearing an interest rate of 5.5% and

purchase of a specialty pharmacy.