Kroger 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-3

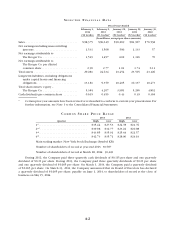

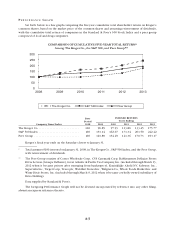

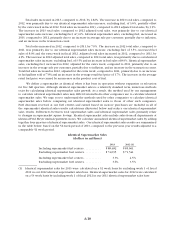

PE R F O R M A N C E G R A P H

Set forth below is a line graph comparing the five-year cumulative total shareholder return on Kroger’s

common shares, based on the market price of the common shares and assuming reinvestment of dividends,

with the cumulative total return of companies in the Standard & Poor’s 500 Stock Index and a peer group

composed of food and drug companies.

2008 2009 2010 2011 2012 2013

The Kroger Co. S&P 500 Index Peer Group

COMPARISON OF CUMULATIVE FIVE-YEAR TOTAL RETURN*

Among The Kroger Co., the S&P 500, and Peer Group**

0

50

100

150

200

250

300

Company Name/Index

Base

Period

2008

INDEXED RETURNS

Years Ending

2009 2010 2011 2012 2013

The Kroger Co. . . . . . . . . . . . . . . . . . . . . . . . . . . 100 96.85 97.93 113.86 133.45 175.77

S&P 500 Index . . . . . . . . . . . . . . . . . . . . . . . . . . 100 133.14 162.67 171.34 201.50 242.42

Peer Group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100 123.89 134.49 141.36 170.73 193.17

Kroger’s fiscal year ends on the Saturday closest to January 31.

* Total assumes $100 invested on January 31, 2009, in The Kroger Co., S&P 500 Index, and the Peer Group,

with reinvestment of dividends.

** The Peer Group consists of Costco Wholesale Corp., CVS Caremark Corp, Etablissments Delhaize Freres

Et Cie Le Lion (Groupe Delhaize), Great Atlantic & Pacific Tea Company, Inc. (included through March 13,

2012 when it became private after emerging from bankruptcy), Koninklijke Ahold NV, Safeway, Inc.,

Supervalu Inc., Target Corp., Tesco plc, Wal-Mart Stores Inc., Walgreen Co., Whole Foods Market Inc. and

Winn-Dixie Stores, Inc. (included through March 9, 2012 when it became a wholly-owned subsidiary of

Bi-Lo Holding).

Data supplied by Standard & Poor’s.

The foregoing Performance Graph will not be deemed incorporated by reference into any other filing,

absent an express reference thereto.