Kroger 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-54

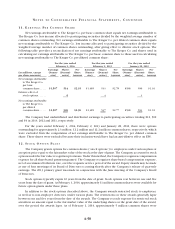

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

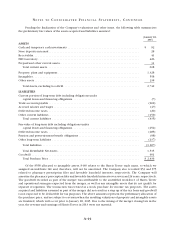

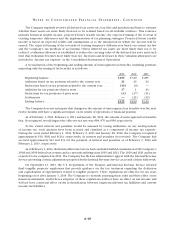

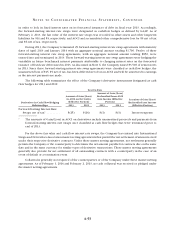

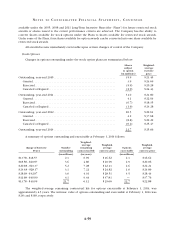

The effect of the net settlement provisions of these master netting agreements on the Company’s

derivative balances upon an event of default or termination event is as follows as of February 1, 2014 and

February 2, 2013:

February 1, 2014

Gross

Amount

Recognized

Gross

Amounts

Offset in

the Balance

Sheet

Net

Amount

Presented in

the Balance

Sheet

Gross Amounts Not Offset

in the Balance Sheet

Financial

Instruments

Cash

Collateral

Net

Amount

Liabilities

Fair Value Interest Rate Swaps . . . $2 $— $2 $— $— $2

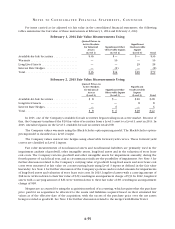

February 2, 2013

Gross

Amount

Recognized

Gross

Amounts

Offset in

the Balance

Sheet

Net

Amount

Presented in

the Balance

Sheet

Gross Amounts Not Offset

in the Balance Sheet

Net

Amount

Financial

Instruments

Cash

Collateral

Assets

Cash Flow Forward-Starting

Interest Rate Swaps . . . . . . . . . $16 $ (2) $14 $— $— $14

Fair Value Interest Rate Swaps . . . 1 — 1 — — 1

Total. . . . . . . . . . . . . . . . . . . . . . . . $17 $ (2) $15 $— $— $15

Liabilities

Cash Flow Forward-Starting

Interest Rate Swaps . . . . . . . . . $11 $ (2) $ 9 $— $— $ 9

Commodity Price Protection

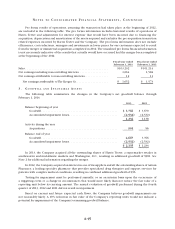

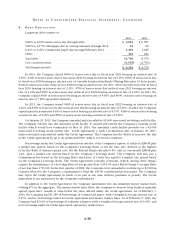

The Company enters into purchase commitments for various resources, including raw materials utilized

in its manufacturing facilities and energy to be used in its stores, warehouses, manufacturing facilities and

administrative offices. The Company enters into commitments expecting to take delivery of and to utilize

those resources in the conduct of normal business. Those commitments for which the Company expects to

utilize or take delivery in a reasonable amount of time in the normal course of business qualify as normal

purchases and normal sales.

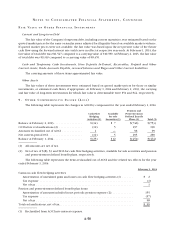

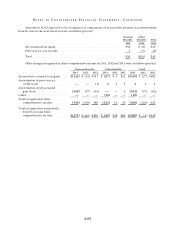

8 . F A I R VA L U E M E A S U R E M E N T S

GAAP establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The three

levels of the fair value hierarchy defined in the standards are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities;

Level 2 – Pricing inputs are other than quoted prices in active markets included in Level 1, which are

either directly or indirectly observable;

Level 3 – Unobservable pricing inputs in which little or no market activity exists, therefore requiring an

entity to develop its own assumptions about the assumptions that market participants would use in pricing

an asset or liability.