Kroger 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

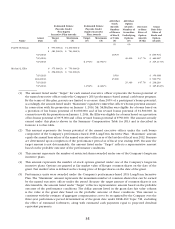

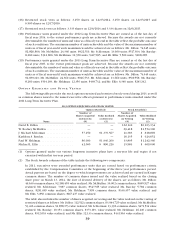

Although participants generally receivecreditedservicebeginning at age 21, thoseparticipantswho

commencedemploymentpriorto1986,includingtheabovelistednamedexecutiveofficers,begantoaccrue

creditedserviceafterattainingage25.Intheeventofaterminationofemployment,Mr.Schlotmancurrentlyis

eligibleforareducedearlyretirementbenefit,ashehasattainedage55.Mr.Ellis,asacashbalanceparticipant

intheConsolidatedPlan,willreceivebenefitsasanannualpaycreditequalto5%ofeligibleearningswith

interestaccruingdailyatarateequaltothe30-yearTreasuryrate.

Mr.DillonalsoparticipatesintheDillonEmployees’ProfitSharingPlan(the“DillonPlan”).TheDillonPlan

isaqualifieddefinedcontributionplanunderwhichDillonCompanies,Inc.anditsparticipatingsubsidiaries

maychoosetomakediscretionarycontributionseachyearthatarethenallocatedtoeachparticipant’saccount.

ParticipationintheDillonPlanwasfrozeneffectiveJanuary1,2001.BenefitsundertheDillonPlandonot

continuetoaccrueforMr.Dillon.ParticipantsintheDillonPlanelectfromamonganumberofinvestment

options and the amounts in their accounts are invested and credited with investment earnings in accordance

withtheirelections.PriortoJuly1,2000,participantscouldelecttomakevoluntarycontributionsunderthe

DillonPlan,butthatoptionwasdiscontinuedeffectiveasofJuly1,2000.Participantscanelecttoreceivetheir

DillonPlanbenefitintheformofeitheralumpsumpaymentorinstallmentpayments.

Due to offset formulas contained in the Consolidated Plan and the Dillon Excess Plan, Mr. Dillon’s

accruedbenefitsundertheDillonPlanoffsetaportionofthebenefitthatwouldotherwiseaccrueforthem

underthoseplansfortheirservicewithDillonCompanies,Inc.Althoughbenefitsthataccrueunderdefined

contributionplansarenotreportableundertheaccompanyingtable,wehaveaddednarrativedisclosureof

theDillonPlanbecauseoftheoffsettingeffectthatbenefitsunderthatplanhasonbenefitsaccruingunder

the Consolidated Plan and the Dillon Excess Plan.

The assumptions used in calculating the present values are set forth in Note 15 to the consolidated

financialstatementsinKroger’sForm10-Kforfiscalyear2013endedFebruary1,2014.Thediscountrateused

todeterminethepresentvaluesis4.99%,whichisthesamerateusedatthemeasurementdateforfinancial

reporting purposes.

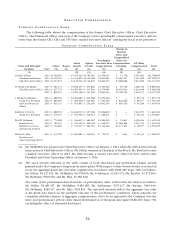

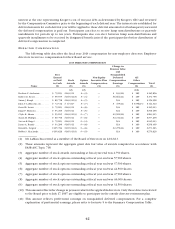

NO N Q U A L I F I E D D E F E R R E D C O M P E N S A T I O N

The following table provides information on nonqualified deferred compensation for the named

executive officers for 2013.

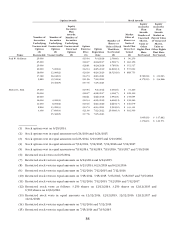

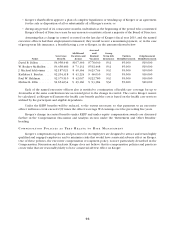

2013 NONQUALIFIED DEFERRED COMPENSATION

Executive

Contributions

in Last FY

Registrant

Contributions

in Last FY

Aggregate

Earnings

in Last FY

Aggregate

Withdrawals/

Distributions

Aggregate

Balance at

Last FYE

Name ($) ($) ($) ($) ($)

DavidB.Dillon .................... $60,000(1) $0 $76,367 $0 $1,173,732

W.RodneyMcMullen ............... $215,817(2) $0 $452,389 $0 $6,998,182

J.MichaelSchlotman ............... $ 0 $0 $ 0 $0 $ 0

PaulW.Heldman ................... $ 0 $0 $80,713 $0 $1,449,413

KathleenS.Barclay ................. $ 0 $0 $ 0 $0 $ 0

MichaelL.Ellis .................... $ 0 $0 $ 33,804 $0 $584,760

(1) Thisamountrepresentsthedeferralofperformance-basedannualbonusearnedinfiscalyear2012and

paidinMarch2013.ThisamountisincludedintheSummaryCompensationTablefor2012infootnote4.

(2) Thisamountrepresentsthedeferralofperformance-basedannualbonusearnedinfiscalyear2012and

paid in March 2013 in the amount of $171,762 and deferral of long-term cash bonus earned during

the2010through2012performanceperiodandpaidinMarch2013intheamountof$44,055.These

amountsareincludedintheSummaryCompensationTablefor2012infootnote4.

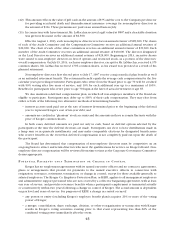

Eligibleparticipantsmayelecttodeferupto100%oftheamountoftheirsalarythatexceedsthesumof

theFICAwagebaseandpre-taxinsuranceandotherInternalRevenueCodeSection125plandeductions,as

wellas100%oftheirannualandlong-termbonuscompensation.Deferralaccountamountsarecreditedwith