Kroger 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-44

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

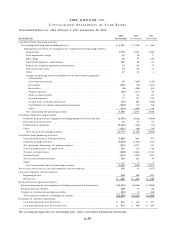

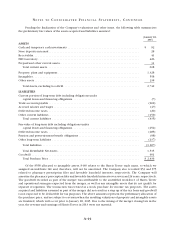

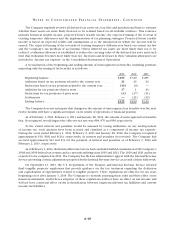

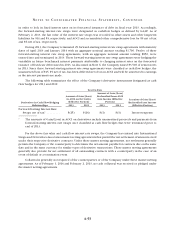

Pending the finalization of the Company’s valuations and other items, the following table summarizes

the preliminary fair values of the assets acquired and liabilities assumed:

January 28,

2014

ASSETS

Cash and temporary cash investments .............................................. $ 92

Store deposits in-transit .......................................................... 28

Receivables.................................................................... 41

FIFO inventory................................................................. 426

Prepaid and other current assets................................................... 31

Total current assets ........................................................... 618

Property, plant and equipment .................................................... 1,328

Intangibles .................................................................... 558

Other assets ................................................................... 238

Total Assets, excluding Goodwill................................................. 2,742

LIABILITIES

Current portion of long-term debt including obligations under

capital leases and financing obligations........................................... (7)

Trade accounts payable .......................................................... (202)

Accrued salaries and wages ....................................................... (47)

Deferred income taxes........................................................... (20)

Other current liabilities .......................................................... (159)

Total current liabilities ........................................................ (435)

Fair-value of long-term debt including obligations under

capital leases and financing obligations........................................... (252)

Deferred income taxes........................................................... (285)

Pension and postretirement benefit obligations ....................................... (98)

Other long-term liabilities ........................................................ (137)

Total Liabilities .............................................................. (1,207)

Total Identifiable Net Assets .................................................... 1,535

Goodwill ..................................................................... 901

Total Purchase Price .......................................................... $ 2,436

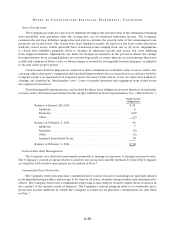

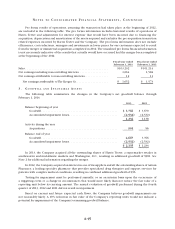

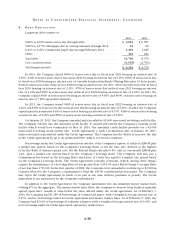

Of the $558 allocated to intangible assets, $430 relates to the Harris Teeter trade name, to which we

assigned an indefinite life and, therefore, will not be amortized. The Company also recorded $53 and $75

related to pharmacy prescription files and favorable leasehold interests, respectively. The Company will

amortize the pharmacy prescription files and favorable leasehold interests over seven and 24 years, respectively.

The goodwill recorded as part of the merger was attributable to the assembled workforce of Harris Teeter

and operational synergies expected from the merger, as well as any intangible assets that do not qualify for

separate recognition. The transaction was treated as a stock purchase for income tax purposes. The assets

acquired and liabilities assumed as part of the merger did not result in a step up of the tax basis and goodwill

is not expected to be deductible for tax purposes. The above amounts represent the preliminary allocation of

the purchase price, and are subject to revision when the resulting valuations of property and intangible assets

are finalized, which will occur prior to January 28, 2015. Due to the timing of the merger closing late in the

year, the revenue and earnings of Harris Teeter in 2013 were not material.