Kroger 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-15

CO M M O N S H A R E R E P U R C H A S E P R O G R A M

We maintain share repurchase programs that comply with Securities Exchange Act Rule 10b5-1 and

allow for the orderly repurchase of our common shares, from time to time. We made open market purchases

of Kroger common shares totaling $338 million in 2013, $1.2 billion in 2012 and $1.4 billion in 2011 under

these repurchase programs. In addition to these repurchase programs, we also repurchase common shares to

reduce dilution resulting from our employee stock option plans. This program is solely funded by proceeds from

stock option exercises, and the tax benefit from these exercises. We repurchased approximately $271 million

in 2013, $96 million in 2012 and $127 million in 2011 of Kroger shares under the stock option program.

The shares reacquired in 2013 were acquired under two separate share repurchase programs. The first is

a $500 million repurchase program that was authorized by Kroger’s Board of Directors on October 16, 2012.

The second is a program that uses the cash proceeds from the exercises of stock options by participants in

Kroger’s stock option and long-term incentive plans as well as the associated tax benefits. As of February 1,

2014, we had $129 million remaining on the October 16, 2012 $500 million share repurchase program. On

March 13, 2014, the Company announced a new $1 billion share repurchase program that was authorized by

the Board of Directors, replacing the $500 million repurchase program that was authorized by the Board of

Directors on October 16, 2012.

CA P I T A L I N V E S T M E N T S

Capital investments, including changes in construction-in-progress payables and excluding acquisitions

and the purchase of leased facilities, totaled $2.3 billion in 2013, $2.0 billion in 2012 and $1.9 billion in 2011.

Capital investments for acquisitions totaled $2.3 billion in 2013, $122 million in 2012 and $51 million in 2011.

Capital investments for acquisitions of $2.3 billion in 2013 relate to our merger with Harris Teeter. Refer to

Note 2 to the Consolidated Financial Statements for more information on the merger with Harris Teeter.

Capital investments for the purchase of leased facilities totaled $108 million in 2013, $73 million in 2012

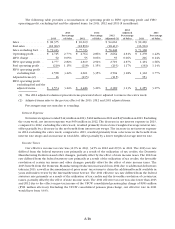

and $60 million in 2011. The table below shows our supermarket storing activity and our total food store

square footage:

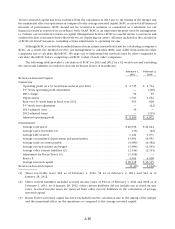

Supermarket Storing Activity

2013 2012 2011

Beginning of year.................................................. 2,424 2,435 2,460

Opened.......................................................... 17 18 10

Opened (relocation)................................................ 7 7 12

Acquired......................................................... 227 — 6

Acquired (relocation)............................................... — — 2

Closed (operational) ............................................... (28) (29) (41)

Closed (relocation)................................................. (7) (7) (14)

End of year ....................................................... 2,640 2,424 2,435

Total food store square footage (in millions) ............................ 161 149 149

RE T U R N O N I N V E S T E D C A P I T A L

We calculate return on invested capital (“ROIC”) by dividing adjusted operating profit for the prior four

quarters by the average invested capital. Adjusted operating profit is calculated by excluding certain items

included in operating profit, and adding our LIFO charge, depreciation and amortization and rent. Average

invested capital is calculated as the sum of (i) the average of our total assets, (ii) the average LIFO reserve,

(iii) the average accumulated depreciation and amortization and (iv) a rent factor equal to total rent for the

last four quarters multiplied by a factor of eight; minus (i) the average taxes receivable, (ii) the average trade

accounts payable, (iii) the average accrued salaries and wages and (iv) the average other current liabilities.

Averages are calculated for return on invested capital by adding the beginning balance of the first quarter

and the ending balance of the fourth quarter, of the last four quarters, and dividing by two. We use a factor

of eight for our total rent as we believe this is a common factor used by our investors and analysts. Harris