Kroger 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

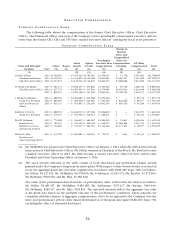

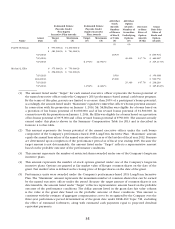

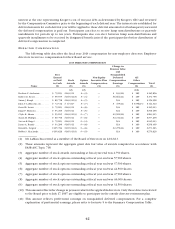

EX E C U T I V E C O M P E N S A T I O N

SU M M A R Y C O M P E N S A T I O N T A B L E

ThefollowingtableshowsthecompensationoftheformerChiefExecutiveOfficer, ChiefExecutive

Officer, Chief Financial Officer and each of the Company’s three most highly compensated executive officers

otherthantheformerCEO,CEOandCFO(the“namedexecutiveofficers”)duringthefiscalyearspresented:

SU M M A R Y C O M P E N S A T I O N T A B L E

Name and Principal

Position Year

Salary

($)

Bonus

($)

Stock

Awards

($)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

(1) (2) (3) (4) (5) (6)

DavidB.Dillon 2013 $1,346,161 — $5,709,429 $2,781,910 $2,456,235 $15,376 $459,584 $12,768,695

Chairman and Former 2012 $1,328,320 — $3,332,852 $1,342,088 $1,600,065 $3,380,527 $301,985 $11,285,837

Chief Executive Officer 2011 $1,273,871 — $3,130,540 $1,716,693 $2,699,153 $3,088,686 $232,820 $12,141,763

W.RodneyMcMullen 2013 $ 962,731 — $5,062,435 $907,862 $1,722,946 $63,518 $166,329 $8,885,821

Chief Executive Officer 2012 $ 937,732 — $1,087,655 $437,983 $1,079,085 $1,415,003 $124,998 $ 5,082,456

2011 $ 899,113 — $1,009,368 $553,506 $1,821,903 $1,768,792 $104,573 $6,157,255

J.MichaelSchlotman 2013 $ 688,599 — $1,564,689 $509,088 $1,004,220 $ — $ 85,176 $3,851,772

SeniorVicePresident 2012 $ 669,787 — $ 609,908 $245,602 $602,146 $822,669 $60,137 $ 3,010,249

and Chief Financial 2011 $ 631,371 — $ 503,801 $276,269 $1,002,310 $ 990,524 $45,269 $3,449,544

Officer

KathleenS.Barclay 2013 $ 686,702 — $1,436,930 $307,838 $1,026,620 $ — $144,953 $3,603,043

SeniorVicePresident 2012 $ 675,972 — $ 491,998 $ 148,512 $628,271 $ — $ 96,054 $2,040,807

PaulW.Heldman 2013 $ 772,298 — $ 944,621 $460,267 $1,084,020 $ 11,645 $156,184 $3,429,035

Executive Vice 2012 $ 761,501 — $ 551,418 $ 222,048 $ 648,071 $1,266,466 $115,715 $3,565,219

President,Secretary 2011 $ 730,682 — $ 479,075 $262,710 $1,110,126 $1,374,309 $96,977 $4,053,879

andGeneralCounsel

MichaelL.Ellis 2013 $ 539,576 — $1,484,681 $236,283 $755,571 $ 1,944 $ 64,332 $3,082,387

President and

Chief Operating Officer

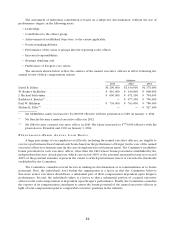

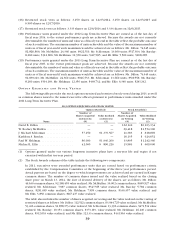

(1) Mr.McMullenwaspromotedtoChiefExecutiveOfficeronJanuary1,2014whenMr.Dillonretiredfrom

hispositionasChiefExecutiveOfficer.Mr.DillonremainsasChairmanoftheBoard.Ms.Barclaybecame

a named executive officer in 2012. Mr. Ellis became a named executive officer in 2013 and became

PresidentandChiefOperatingOfficeronJanuary1,2014.

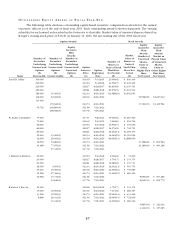

(2) The stock awards reflected in the table consist of both time-based and performance-based awards

grantedundertheCompany’slong-termincentiveplans.Withrespecttotime-basedawards,orrestricted

stock,theaggregategrantdatefairvaluecomputedinaccordancewithFASBASCTopic718isasfollows:

Mr.Dillon:$4,227,912;Mr.McMullen:$4,578,950;Mr.Schlotman:$1,293,572;Ms.Barclay:$1,272,990;

Mr.Heldman:$699,504;andMr.Ellis:$1,358,848.

Thevalueoftheperformance-basedawards,orperformanceunits,reflectedinthetableisasfollows:

Mr. Dillon: $1,481,517; Mr. McMullen: $483,485; Mr. Schlotman: $271,117; Ms. Barclay: $163,940;

Mr.Heldman:$245,117;andMr.Ellis:$125,833.Thereportedamountsreflecttheaggregatefairvalue

atthegrantdatebasedonthe probable outcomeoftheperformanceconditions.Theseamountsare

consistentwiththeestimateofaggregatecompensationcosttoberecognizedbytheCompanyoverthe

three-yearperformanceperiodoftheawarddeterminedasofthegrantdateunderFASBASCTopic718,

excluding the effect of estimated forfeitures.