Kroger 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

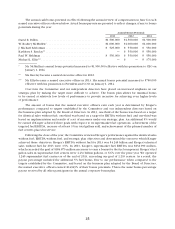

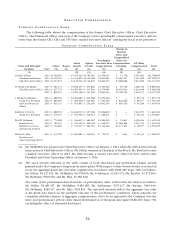

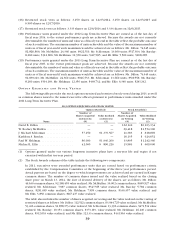

Name

Grant

Date

Estimated Future

Payouts Under

Non-Equity

Incentive Plan Awards

Estimated Future

Payouts Under

Equity Incentive

Plan Awards

All Other

Stock

Awards:

Number

of Shares

of Stock

or Units

(#)

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Grant

Date Fair

Value of

Stock and

Option

Awards

Target

($)

Maximum

($)

Target

(#)

Maximum

(#)

(3) (4)

PaulW.Heldman $ 550,000(1) $1,100,000(1)

$ 381,500(2) $ 763,000(2)

7/15/2013 18,525 $ 699,504

7/15/2013 49,400 $ 37.76 $ 460,267

7/15/2013 6,175(5) 12,350(5) $ 245,117(5)

MichaelL.Ellis $ 375,000(1) $ 750,000(1)

$ 256,000(2) $ 512,000(2)

7/15/2013 9,510 $ 359,098

12/12/2013 25,000 $ 999,750

7/15/2013 25,360 $37.76 $ 236,283

7/15/2013 3,170(5) 6,340(5) $ 125,833(5)

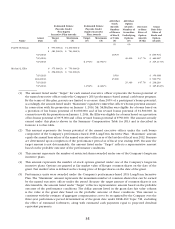

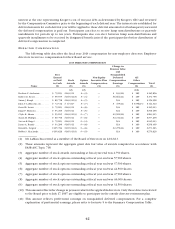

(1) Theamountlistedunder“Target”foreachnamedexecutiveofficerrepresentsthebonuspotentialof

thenamedexecutiveofficerundertheCompany’s2013performance-basedannualcashbonusprogram.

Bythetermsofthisplan,payoutsarelimitedtonomorethan200%ofaparticipant’sbonuspotential;

accordingly,theamountlistedunder“Maximum”equalstwotimesthatofficer’sbonuspotentialamount.

InconnectionwithhispromotiononJanuary1,2014,Mr.McMullenwaseligibleforabonusbasedon

aproration ofhisbonuspotentialof$1,000,000andofhisrevisedbonus potentialof$1,500,000.In

connectionwithhispromotiononJanuary1,2014,Mr.Elliswaseligibleforabonusbasedonaproration

ofhisbonuspotentialof$375,000andofhisrevisedbonuspotentialof$750,000.Theamountactually

earned under this plan is shown in the Summary Compensation Table for 2013 and is described in

footnote4tothattable.

(2) This amount represents the bonus potential of the named executive officer under the cash bonus

componentoftheCompany’sperformance-based2013Long-TermIncentivePlan.“Maximum”amount

equalstheannualbasesalaryofthenamedexecutiveofficersasofthelastdayoffiscalyear2012.Bonuses

aredetermineduponcompletionoftheperformanceperiodasoffiscalyearending2015.Becausethe

targetamountisnotdeterminable,theamountlistedunder“Target”reflectsarepresentativeamount

basedontheprobableoutcomeoftheperformanceconditions.

(3) ThisamountrepresentsthenumberofrestrictedsharesawardedunderoneoftheCompany’slong-term

incentive plans.

(4) Thisamountrepresentsthe numberofstockoptionsgrantedunderoneoftheCompany’slong-term

incentiveplans.OptionsaregrantedatfairmarketvalueofKrogercommonsharesonthedateofthe

grant.FairmarketvalueisdefinedastheclosingpriceofKrogersharesonthedateofthegrant.

(5) PerformanceunitswereawardedundertheCompany’sperformance-based2013Long-TermIncentive

Plan.The“Maximum”amountrepresentsthemaximumnumberofcommonsharesthatcanbeearned

bythenamedexecutiveofficerundertheaward.Becausethetargetamountofcommonsharesisnot

determinable,theamountlistedunder“Target”reflectsarepresentativeamountbasedontheprobable

outcome of the performance conditions. The dollar amount listed in the grant date fair value column

is the value at the grant date based on the probable outcome of these conditions. This amount is

consistentwiththeestimateofaggregatecompensationcosttoberecognizedbytheCompanyoverthe

three-yearperformanceperioddeterminedasofthegrantdateunderFASBASCTopic718,excluding

the effect of estimated forfeitures, along with estimated cash payments equal to projected dividend

equivalentpayments.