Kroger 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-41

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

the Company’s 2008 and 2009 federal tax returns. The Company has filed an administrative appeal with the

Internal Revenue Service protesting certain adjustments proposed by the Internal Revenue Service as a result

of their field work.

The assessment of the Company’s tax position relies on the judgment of management to estimate the

exposures associated with the Company’s various filing positions.

Self-Insurance Costs

The Company is primarily self-insured for costs related to workers’ compensation and general liability

claims. Liabilities are actuarially determined and are recognized based on claims filed and an estimate of

claims incurred but not reported. The liabilities for workers’ compensation claims are accounted for on a

present value basis. The Company has purchased stop-loss coverage to limit its exposure to any significant

exposure on a per claim basis. The Company is insured for covered costs in excess of these per claim limits.

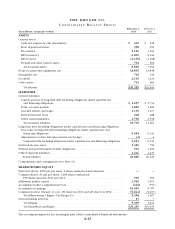

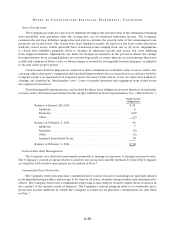

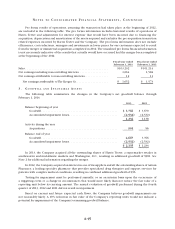

The following table summarizes the changes in the Company’s self-insurance liability through

February 1, 2014.

2013 2012 2011

Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 537 $ 529 $ 514

Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 220 215 215

Claim payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (215) (207) (200)

Assumed from Harris Teeter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 — —

Ending balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 569 537 529

Less: Current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (224) (205) (197)

Long-term portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 345 $ 332 $ 332

The current portion of the self-insured liability is included in “Other current liabilities,” and the long-

term portion is included in “Other long-term liabilities” in the Consolidated Balance Sheets.

The Company maintains surety bonds related to self-insured workers’ compensation claims. These bonds

are required by most states in which the Company is self-insured for workers’ compensation and are placed

with third-party insurance providers to insure payment of our obligations in the event the Company is unable

to meet its claim payment obligations up to its self-insured retention levels. These bonds do not represent

liabilities of the Company, as the Company has recorded reserves for the claim costs.

The Company is similarly self-insured for property-related losses. The Company maintains stop loss

coverage to limit its property loss exposures including coverage for earthquake, wind, flood and other

catastrophic events.

Revenue Recognition

Revenues from the sale of products are recognized at the point of sale. Discounts provided to customers

by the Company at the time of sale, including those provided in connection with loyalty cards, are recognized

as a reduction in sales as the products are sold. Discounts provided by vendors, usually in the form of paper

coupons, are not recognized as a reduction in sales provided the coupons are redeemable at any retailer that

accepts coupons. The Company records a receivable from the vendor for the difference in sales price and

cash received. Pharmacy sales are recorded when provided to the customer. Sales taxes are recorded as other

accrued liabilities and not as a component of sales. The Company does not recognize a sale when it sells its

own gift cards and gift certificates. Rather, it records a deferred liability equal to the amount received. A sale

is then recognized when the gift card or gift certificate is redeemed to purchase the Company’s products.

Gift card and certificate breakage is recognized when redemption is deemed remote and there is no legal

obligation to remit the value of the unredeemed gift card. The amount of breakage has not been material for

2013, 2012 and 2011.