Kroger 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-45

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

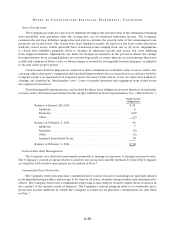

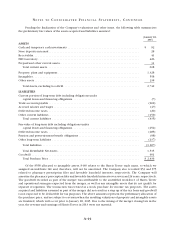

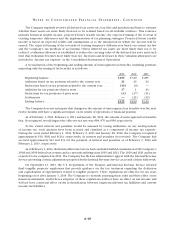

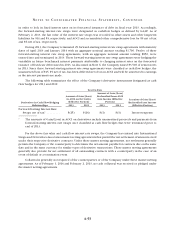

Pro forma results of operations, assuming the transaction had taken place at the beginning of 2012,

are included in the following table. The pro forma information includes historical results of operations of

Harris Teeter and adjustments for interest expense that would have been incurred due to financing the

acquisition, depreciation and amortization of the assets acquired and excludes the pre-acquisition transaction

related expenses incurred by Harris Teeter and the Company. The pro forma information does not include

efficiencies, cost reductions, synergies and investments in lower prices for our customers expected to result

from the merger or immaterial acquisitions completed in 2012. The unaudited pro forma financial information

is not necessarily indicative of the results that actually would have occurred had the merger been completed

at the beginning of the 2012.

Fiscal year ended

February 1, 2014

Fiscal year ended

February 2, 2013

Sales ..................................................... $103,202 $101,214

Net earnings including noncontrolling interests .................. 1,664 1,584

Net earnings attributable to noncontrolling interests............... 12 11

Net earnings attributable to The Kroger Co..................... $ 1,652 $ 1,573

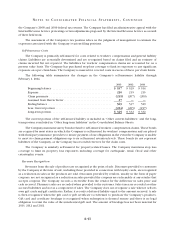

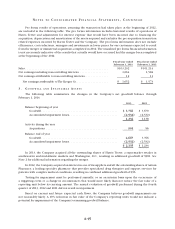

3 . G O O D W I L L A N D I N T A N G I B L E A S S E T S

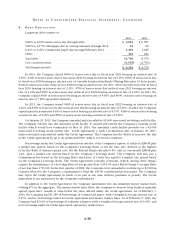

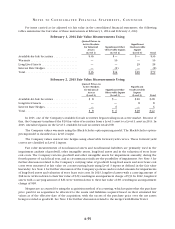

The following table summarizes the changes in the Company’s net goodwill balance through

February 1, 2014.

2013 2012

Balance beginning of year

Goodwill ................................................. $ 3,766 $ 3,670

Accumulated impairment losses ............................... (2,532) (2,532)

1,234 1,138

Activity during the year

Acquisitions............................................... 901 96

Balance end of year

Goodwill ................................................. 4,667 3,766

Accumulated impairment losses ............................... (2,532) (2,532)

$ 2,135 $ 1,234

In 2013, the Company acquired all the outstanding shares of Harris Teeter, a supermarket retailer in

southeastern and mid-Atlantic markets and Washington, D.C., resulting in additional goodwill of $901. See

Note 2 for additional information regarding the merger.

In 2012, the Company acquired an interest in one of its suppliers and all the outstanding shares of Axium

Pharmacy, a leading specialty pharmacy that provides specialized drug therapies and support services for

patients with complex medical conditions, resulting in combined additional goodwill of $96.

Testing for impairment must be performed annually, or on an interim basis upon the occurrence of

a triggering event or a change in circumstances that would more likely than not reduce the fair value of a

reporting unit below its carrying amount. The annual evaluation of goodwill performed during the fourth

quarter of 2013, 2012 and 2011 did not result in impairment.

Based on current and future expected cash flows, the Company believes goodwill impairments are

not reasonably likely. A 10% reduction in fair value of the Company’s reporting units would not indicate a

potential for impairment of the Company’s remaining goodwill balance.