Kroger 2013 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-62

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

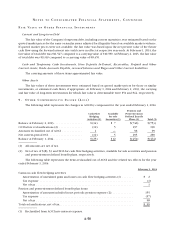

14 . S T O C K

Preferred Shares

The Company has authorized five million shares of voting cumulative preferred shares; two million

shares were available for issuance at February 1, 2014. The shares have a par value of $100 per share and are

issuable in series.

Common Shares

The Company has authorized one billion common shares, $1 par value per share. On May 20, 1999, the

shareholders authorized an amendment to the Amended Articles of Incorporation to increase the number of

authorized common shares from one billion to two billion when the Board of Directors determines it to be in

the best interest of the Company.

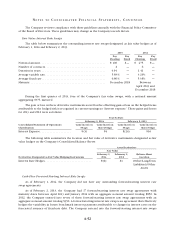

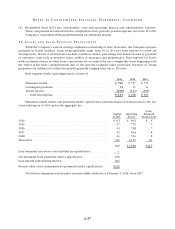

Common Stock Repurchase Program

The Company maintains stock repurchase programs that comply with Securities Exchange Act

Rule 10b5-1 to allow for the orderly repurchase of The Kroger Co. common shares, from time to time. The

Company made open market purchases totaling $338, $1,165 and $1,420 under these repurchase programs in

2013, 2012 and 2011, respectively. In addition to these repurchase programs, in December 1999, the Company

began a program to repurchase common shares to reduce dilution resulting from its employee stock option

plans. This program is solely funded by proceeds from stock option exercises and the related tax benefit. The

Company repurchased approximately $271, $96 and $127 under the stock option program during 2013, 2012

and 2011, respectively.

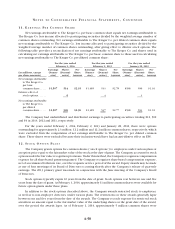

15 . C O M P A N Y - S P O N S O R E D B E N E F I T P L A N S

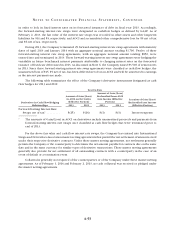

The Company administers non-contributory defined benefit retirement plans for some non-union

employees and union-represented employees as determined by the terms and conditions of collective

bargaining agreements. These include several qualified pension plans (the “Qualified Plans”) and non-qualified

plans (the “Non-Qualified Plans”). The Non-Qualified Plans pay benefits to any employee that earns in excess

of the maximum allowed for the Qualified Plans by Section 415 of the Internal Revenue Code. The Company

only funds obligations under the Qualified Plans. Funding for the pension plans is based on a review of the

specific requirements and on evaluation of the assets and liabilities of each plan.

In addition to providing pension benefits, the Company provides certain health care benefits for retired

employees. The majority of the Company’s employees may become eligible for these benefits if they reach

normal retirement age while employed by the Company. Funding of retiree health care benefits occurs as

claims or premiums are paid.

The Company recognizes the funded status of its retirement plans on the Consolidated Balance Sheet.

Actuarial gains or losses, prior service costs or credits and transition obligations that have not yet been

recognized as part of net periodic benefit cost are required to be recorded as a component of AOCI. All plans

are measured as of the Company’s fiscal year end.

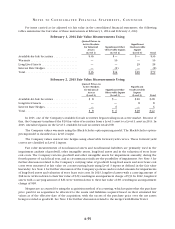

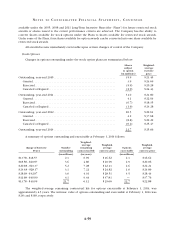

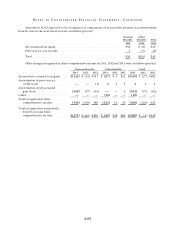

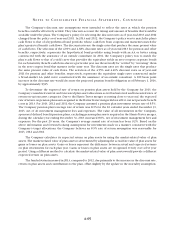

Amounts recognized in AOCI as of February 1, 2014 and February 2, 2013 consist of the following (pre-tax):

Pension Benefits Other Benefits Total

2013 2012 2013 2012 2013 2012

Net actuarial loss (gain) ................ $857 $1,201 $(111) $(15) $746 $1,186

Prior service cost (credit) ............... 23(35) (8) (33) (5)

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $859 $1,204 $(146) $(23) $713 $1,181