Kroger 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-23

In December 2011, the FASB amended its standards related to offsetting assets and liabilities. This

amendment requires entities to disclose both gross and net information about certain instruments and

transactions eligible for offset in the statement of financial position and certain instruments and transactions

subject to an agreement similar to a master netting agreement. This information is intended to enable users

of the financial statements to understand the effect of these arrangements on our financial position. The new

rules became effective for us on February 3, 2013. In January 2013, the FASB further amended this standard

to limit its scope to derivatives, repurchase and reverse repurchase agreements, securities borrowings and

lending transactions. See Note 7 to the Company’s Consolidated Financial Statements for the Company’s new

disclosures related to this amended standard.

RE C E N T L Y I S S U E D A C C O U N T I N G S T A N D A R D S

In July 2013, the FASB amended Accounting Standards Codification (“ASC”) 740, “Income Taxes.” The

amendments provide guidance on the financial statement presentation of an unrecognized tax benefit, as

either a reduction of a deferred tax asset or as a liability, when a net operating loss carryforward, similar tax

loss, or a tax credit carryforward exists. The amendments will be effective for interim and annual periods

beginning after December 15, 2013 and may be applied on a retrospective basis. Early adoption is permitted.

We do not expect the adoption of these amendments to have a significant effect on our consolidated financial

position or results of operations.

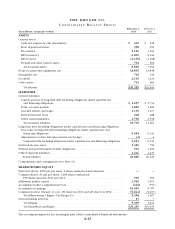

LI Q U I D I T Y A N D C A P I T A L R E S O U R C E S

Cash Flow Information

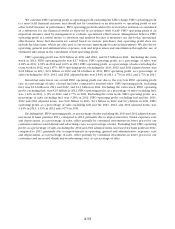

Net cash provided by operating activities

We generated $3.4 billion of cash from operations in 2013, compared to $2.8 billion in 2012 and

$2.7 billion in 2011. The cash provided by operating activities came from net earnings including non-

controlling interests adjusted primarily for non-cash expenses of depreciation and amortization, the LIFO

charge and changes in working capital. The increase in net cash provided by operating activities in 2013,

compared to 2012, resulted primarily due to changes in working capital and long-term liabilities. The increase

in net cash provided by operating activities in 2012, compared to 2011, resulted primarily due to an increase

in net earnings including non-controlling interests, offset by a decline in long-term liabilities and changes in

working capital.

The use of cash for the payment of long-term liabilities decreased in 2013, as compared to 2012, primarily

due to our funding of the remaining UAAL in 2012. The use of cash increased in 2012, as compared to 2011,

primarily due to our funding of the remaining UAAL commitment. Changes in working capital used cash

from operating activities of $130 million in 2013, compared to $332 million in 2012 and $300 million in

2011. The decreased use of cash for changes in working capital in 2013, compared to 2012, was primarily

due to a decrease in deposits in-transit and a reduced use of cash for prepaid expenses and receivables. The

increased use of cash for changes in working capital in 2012, compared to 2011, was primarily due to an

increased use of cash for prepaid expenses and less cash provided by accrued expenses, partially offset by

a reduced use of cash for inventories. Cash used for prepaid expenses increased in 2012, compared to 2011,

due to Kroger prefunding $250 million of employee benefits at the end of 2012. These amounts are also net

of cash contributions to our Company-sponsored defined benefit pension plans totaling $100 million in 2013,

$71 million in 2012 and $52 million in 2011.

The amount of cash paid for income taxes increased in 2013, compared to 2012, primarily due to

additional deductions taken in 2012 related to the funding of our pension contributions and union health

benefits. The amount of cash paid for income taxes increased in 2012, compared to 2011, primarily due to an

increase in net earnings including non-controlling interests.