Kroger 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-38

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

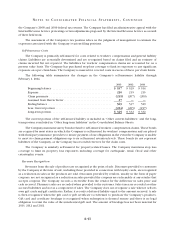

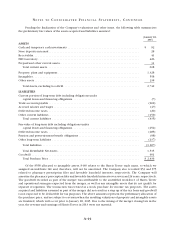

Property, Plant and Equipment

Property, plant and equipment are recorded at cost or, in the case of assets acquired in a business

combination, at fair value. Depreciation expense, which includes the amortization of assets recorded under

capital leases, is computed principally using the straight-line method over the estimated useful lives of individual

assets. Buildings and land improvements are depreciated based on lives varying from 10 to 40 years. All new

purchases of store equipment are assigned lives varying from three to nine years. Leasehold improvements

are amortized over the shorter of the lease term to which they relate, which varies from four to 25 years,

or the useful life of the asset. Manufacturing plant and distribution center equipment is depreciated over

lives varying from three to 15 years. Information technology assets are generally depreciated over five years.

Depreciation expense was $1,703 in 2013, $1,652 in 2012 and $1,638 in 2011.

Interest costs on significant projects constructed for the Company’s own use are capitalized as part

of the costs of the newly constructed facilities. Upon retirement or disposal of assets, the cost and related

accumulated depreciation are removed from the balance sheet and any gain or loss is reflected in net earnings.

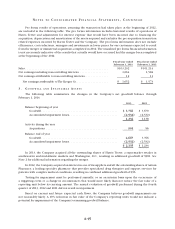

Deferred Rent

The Company recognizes rent holidays, including the time period during which the Company has access

to the property for construction of buildings or improvements and escalating rent provisions on a straight-line

basis over the term of the lease. The deferred amount is included in Other Current Liabilities and Other Long-

Term Liabilities on the Company’s Consolidated Balance Sheets.

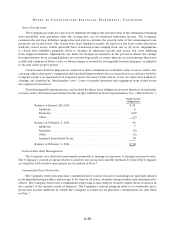

Goodwill

The Company reviews goodwill for impairment during the fourth quarter of each year, and also upon

the occurrence of trigger events. The Company performs reviews of each of its operating divisions and

variable interest entities (collectively, our reporting units) that have goodwill balances. Generally, fair value

is determined using a multiple of earnings, or discounted projected future cash flows, and is compared to the

carrying value of a division for purposes of identifying potential impairment. Projected future cash flows are

based on management’s knowledge of the current operating environment and expectations for the future.

If potential for impairment is identified, the fair value of a division is measured against the fair value of

its underlying assets and liabilities, excluding goodwill, to estimate an implied fair value of the division’s

goodwill. Goodwill impairment is recognized for any excess of the carrying value of the division’s goodwill

over the implied fair value. Results of the goodwill impairment reviews performed during 2013, 2012 and 2011

are summarized in Note 3 to the Consolidated Financial Statements.

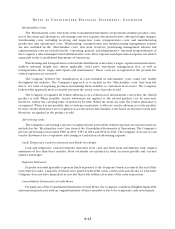

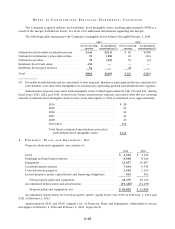

Impairment of Long-Lived Assets

The Company monitors the carrying value of long-lived assets for potential impairment each quarter based

on whether certain trigger events have occurred. These events include current period losses combined with

a history of losses or a projection of continuing losses or a significant decrease in the market value of an asset.

When a trigger event occurs, an impairment calculation is performed, comparing projected undiscounted

future cash flows, utilizing current cash flow information and expected growth rates related to specific stores,

to the carrying value for those stores. If the Company identifies impairment for long-lived assets to be held and

used, the Company compares the assets’ current carrying value to the assets’ fair value. Fair value is based on

current market values or discounted future cash flows. The Company records impairment when the carrying

value exceeds fair market value. With respect to owned property and equipment held for sale, the value of the

property and equipment is adjusted to reflect recoverable values based on previous efforts to dispose of similar

assets and current economic conditions. Impairment is recognized for the excess of the carrying value over

the estimated fair market value, reduced by estimated direct costs of disposal. The Company recorded asset

impairments in the normal course of business totaling $39, $18 and $37 in 2013, 2012 and 2011, respectively.

Costs to reduce the carrying value of long-lived assets for each of the years presented have been included in

the Consolidated Statements of Operations as “Operating, general and administrative” expense.