Kroger 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-60

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

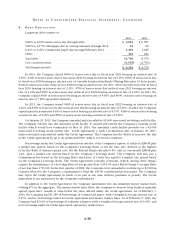

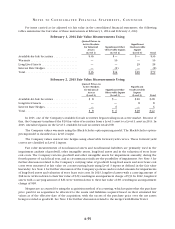

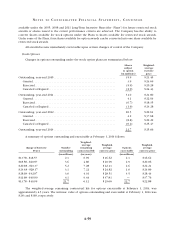

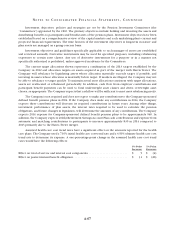

Restricted stock

Changes in restricted stock outstanding under the restricted stock plans are summarized below:

Restricted

shares

outstanding

(in millions)

Weighted-average

grant-date

fair value

Outstanding, year-end 2010...................................... 4.4 $22.39

Granted ................................................... 2.5 $24.63

Lapsed .................................................... (2.5) $21.96

Canceled or Expired ......................................... (0.2) $23.80

Outstanding, year-end 2011 ...................................... 4.2 $23.92

Granted ................................................... 2.6 $22.23

Lapsed .................................................... (2.4) $24.34

Canceled or Expired ......................................... (0.1) $23.28

Outstanding, year-end 2012...................................... 4.3 $22.67

Granted ................................................... 3.2 $37.69

Lapsed .................................................... (2.5) $22.97

Canceled or Expired ......................................... (0.1) $27.31

Outstanding, year-end 2013...................................... 4.8 $32.31

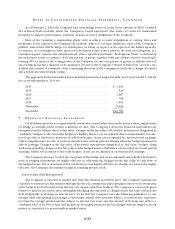

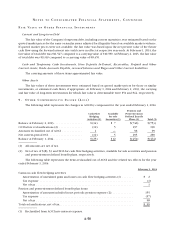

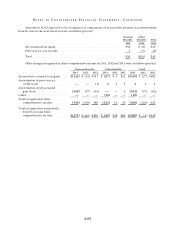

The weighted-average grant date fair value of stock options granted during 2013, 2012 and 2011 was

$8.98, $4.39 and $6.00, respectively. The fair value of each stock option grant was estimated on the date of

grant using the Black-Scholes option-pricing model, based on the assumptions shown in the table below. The

Black-Scholes model utilizes extensive judgment and financial estimates, including the term employees are

expected to retain their stock options before exercising them, the volatility of the Company’s stock price

over that expected term, the dividend yield over the term and the number of awards expected to be forfeited

before they vest. Using alternative assumptions in the calculation of fair value would produce fair values for

stock option grants that could be different than those used to record stock-based compensation expense in

the Consolidated Statements of Operations. The increase in the fair value of the stock options granted during

2013, compared to 2012, resulted primarily from an increase in the Company’s share price, an increase in the

weighted average risk-free interest rate and a decrease in the expected dividend yield. The decrease in the

fair value of the stock options granted during 2012, compared to 2011, resulted primarily from a decrease in

the Company’s share price, a decrease in the weighted average risk-free interest rate and an increase in the

expected dividend yield.

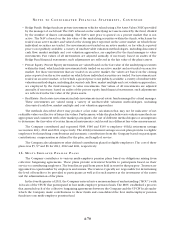

The following table reflects the weighted-average assumptions used for grants awarded to option holders:

2013 2012 2011

Weighted average expected volatility ....................... 26.34% 26.49% 26.31%

Weighted average risk-free interest rate ..................... 1.87% 0.97% 2.16%

Expected dividend yield ................................. 1.82% 2.49% 1.90%

Expected term (based on historical results) ................. 6.8 years 6.9 years 6.9 years

The weighted-average risk-free interest rate was based on the yield of a treasury note as of the grant date,

continuously compounded, which matures at a date that approximates the expected term of the options.

The dividend yield was based on our history and expectation of dividend payouts. Expected volatility was

determined based upon historical stock volatilities; however, implied volatility was also considered. Expected

term was determined based upon a combination of historical exercise and cancellation experience as well as

estimates of expected future exercise and cancellation experience.