Kroger 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-46

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

The Company acquired definite and indefinite lived intangible assets totaling approximately $558 as a

result of the merger with Harris Teeter. See Note 2 for additional information regarding the merger.

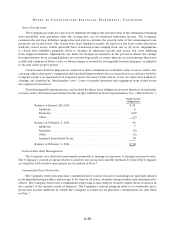

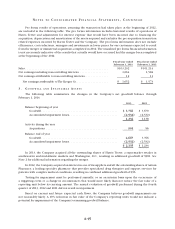

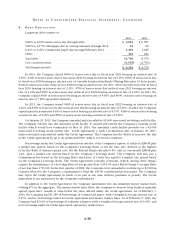

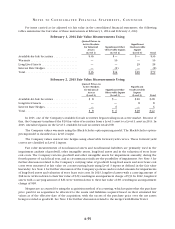

The following table summarizes the Company’s intangible assets balance through February 1, 2014.

2013 2012

Gross carrying

amount

Accumulated

amortization (1)

Gross carrying

amount

Accumulated

amortization (1)

Definite-lived favorable leasehold interests.... $144 $(61) $ 69 $ (58)

Definite-lived pharmacy prescription files .... 95 (28) 45 (26)

Definite-lived other ...................... 78 (10) 54 (2)

Indefinite-lived trade name ................ 430 — — —

Indefinite-lived liquor licenses ............. 54 — 48 —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $801 $(99) $216 $ (86)

(1) Favorable leasehold interests are amortized to rent expense, pharmacy prescription files are amortized to

merchandise costs and other intangibles are amortized to operating, general and administrative expense.

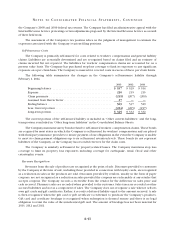

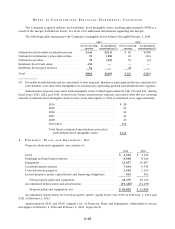

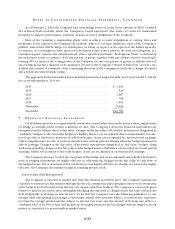

Amortization expense associated with intangible assets totaled approximately $18, $13 and $12, during

fiscal years 2013, 2012 and 2011, respectively. Future amortization expense associated with the net carrying

amount of definite-lived intangible assets for the years subsequent to 2013 is estimated to be approximately:

2014 ...................................... $ 28

2015 ...................................... 25

2016 ...................................... 22

2017 ...................................... 21

2018 ...................................... 20

Thereafter ................................. 102

Total future estimated amortization associated

with definite-lived intangible assets........... $218

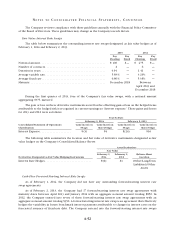

4 . P R O P E R T Y , PL A N T A N D E Q U I P M E N T , NE T

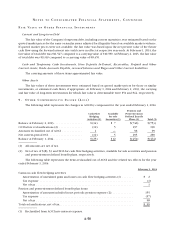

Property, plant and equipment, net consists of:

2013 2012

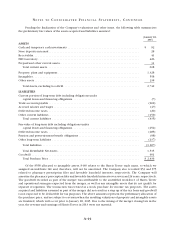

Land ..................................................... $ 2,639 $ 2,450

Buildings and land improvements .............................. 8,848 8,249

Equipment ................................................ 11,037 10,267

Leasehold improvements ..................................... 7,644 6,545

Construction-in-progress ..................................... 1,520 1,239

Leased property under capital leases and financing obligations ...... 691 593

Total property, plant and equipment.......................... 32,379 29,343

Accumulated depreciation and amortization ..................... (15,486) (14,495)

Property, plant and equipment, net........................... $ 16,893 $ 14,848

Accumulated depreciation for leased property under capital leases was $339 at February 1, 2014 and

$321 at February 2, 2013.

Approximately $232 and $236, original cost, of Property, Plant and Equipment collateralized certain

mortgages at February 1, 2014 and February 2, 2013, respectively.