Kroger 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-28

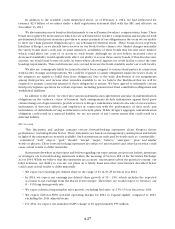

• For2014,weexpectinterestexpensetobeapproximately$490million.

• Weplantousecashflowprimarilyforcapitalinvestments,toimproveourcurrentdebtcoverageratios,

to pay cash dividends and to repurchase stock.

• Weexpecttoobtainsalesgrowthfromnewsquarefootage,aswellasfromincreasedproductivityfrom

existing locations.

• We expect capital investments for 2014 to increase to approximately $2.8 - $3.0 billion, excluding

mergers, acquisitions and purchases of leased facilities. We also expect capital investments to increase

incrementally $200 million each year over the next few years, excluding mergers, acquisitions and

purchases of leased facilities, to accomplish our strategy. We expect total food store square footage for

2014 to grow approximately 1.8% before mergers, acquisitions and operational closings.

• For2014,weexpectoureffectivetaxratetobeapproximately35.0%,excludingtheunexpectedeffect

of the resolution of any tax issues and benefits from certain tax items.

• Wedonotanticipategoodwillimpairmentsin2014.

• For 2014, we expect to contribute approximately $250 million to multi-employer pension funds. We

continue to evaluate our potential exposure to under-funded multi-employer pension plans. Although

these liabilities are not a direct obligation or liability of Kroger, any commitments to fund certain multi-

employer plans will be expensed when our commitment is probable and an estimate can be made.

• In2014,wewillnegotiateagreementswiththeUFCWforstoreassociatesinCincinnati,Atlanta,Southern

California, New Mexico, Richmond/Hampton Roads, West Virginia and Arizona, and an agreement with

the Teamsters covering several distribution and manufacturing facilities. These negotiations will be

challenging, as we must have competitive cost structures in each market while meeting our associates’

needs for good wages and affordable health care. Also, we must address the underfunding of multi-

employer pension plans.

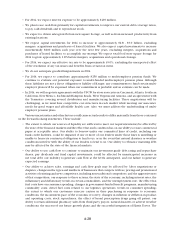

Various uncertainties and other factors could cause actual results to differ materially from those contained

in the forward-looking statements. These include:

• Theextenttowhichoursourcesofliquidityaresufficienttomeetourrequirementsmaybeaffectedby

the state of the financial markets and the effect that such condition has on our ability to issue commercial

paper at acceptable rates. Our ability to borrow under our committed lines of credit, including our

bank credit facilities, could be impaired if one or more of our lenders under those lines is unwilling or

unable to honor its contractual obligation to lend to us, or in the event that natural disasters or weather

conditions interfere with the ability of our lenders to lend to us. Our ability to refinance maturing debt

may be affected by the state of the financial markets.

• Ourabilitytousecashflowtocontinuetomaintainourinvestmentgradedebtratingandrepurchase

shares, pay dividends and fund capital investments, could be affected by unanticipated increases in

net total debt, our inability to generate cash flow at the levels anticipated, and our failure to generate

expected earnings.

• Our ability to achieve sales, earnings and cash flow goals may be affected by: labor negotiations or

disputes; changes in the types and numbers of businesses that compete with us; pricing and promotional

activities of existing and new competitors, including non-traditional competitors, and the aggressiveness

of that competition; our response to these actions; the state of the economy, including interest rates, the

inflationary and deflationary trends in certain commodities, and the unemployment rate; the effect that

fuel costs have on consumer spending; changes in government-funded benefit programs; manufacturing

commodity costs; diesel fuel costs related to our logistics operations; trends in consumer spending;

the extent to which our customers exercise caution in their purchasing in response to economic

conditions; the inconsistent pace of the economic recovery; changes in inflation or deflation in product

and operating costs; stock repurchases; the effect of brand prescription drugs going off patent; our

ability to retain additional pharmacy sales from third party payors; natural disasters or adverse weather

conditions; the success of our future growth plans; and the successful integration of Harris Teeter. The